The EUR/USD currency pair continued to trade lower throughout Friday. Did this surprise anyone? Among the interesting events on the last trading day of the previous week, only the Eurozone's first October inflation estimate, which unexpectedly came in at 2.1%, is noteworthy. The previous month recorded a value of 2.2%, and most traders expected a year-on-year decline to 2.1%. Thus, this was precisely one of those cases where expectations completely aligned with reality. Consequently, there was nothing for traders to react to. However, after this report, the European currency once again plummeted, even though this report changes absolutely nothing.

It should be understood that when inflation was at 7% or 5%, any decrease/increase, or conformity/non-conformity with forecasts mattered to the market and influenced the European Central Bank's monetary policy. Now, the ECB itself, along with Christine Lagarde, openly states that inflation has stabilized, that the parameters of monetary policy are satisfactory, and that there is no need to adjust the key rate. Therefore, whether inflation rises or falls makes no difference; it remains close to the target level.

The market has once again used a formal reason to sell the pair. Recall that throughout October, we repeatedly pointed out that there are no grounds for the dollar to rise, and this remains the case over the past month. Of course, any movement can always be explained retrospectively, which is what most experts constantly do. For instance, after the Federal Reserve meeting, where the key rate was lowered for the second consecutive time, the dollar also rose, and experts claimed that the Fed was not "dovish enough," which sounds absurd. The experts probably expected Powell to openly promise a rate cut in December, which the Fed chair has never done.

His rhetoric from meeting to meeting boils down to the same thesis that decisions on rates can only be made based on macroeconomic data. Currently, key macroeconomic indicators on the labor market and unemployment are not being published due to the ongoing shutdown, which has lasted a month (and the market is also ignoring this factor). Thus, Powell could not, in principle, promise a rate cut in December, nor could he even imply it.

We have smoothly approached the essence of the matter. Since the current downward movement may only be another wave of correction on the daily timeframe, it is the right time to pay attention to the weekly timeframe. There, we see a clearly defined descending trend line, from which the price recently bounced for the fourth time (the corresponding illustration is provided in the trading recommendations articles linked below). Since the price has bounced off the global descending trend line and the daily timeframe continues to show a flat trend, the current rise in the American currency is purely technical. Neither the fundamental nor macroeconomic background plays any role here.

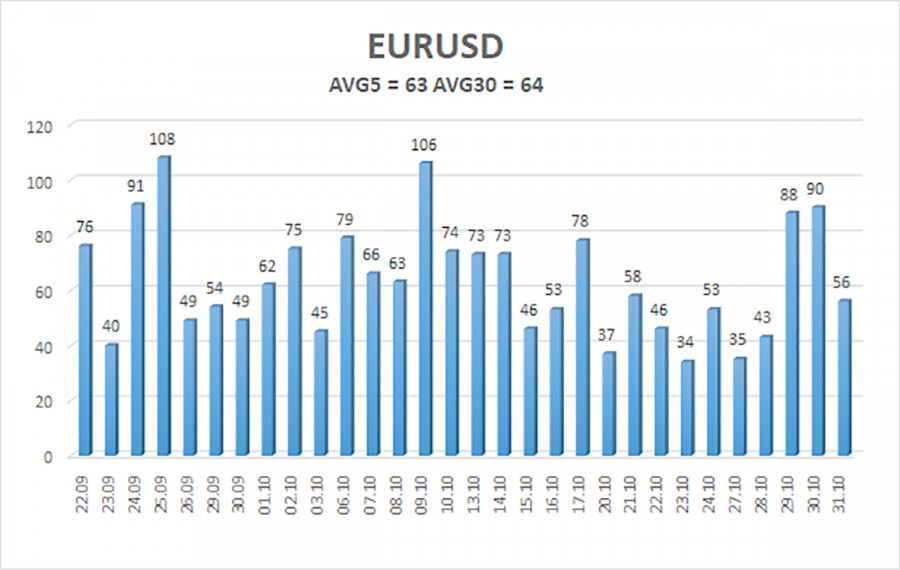

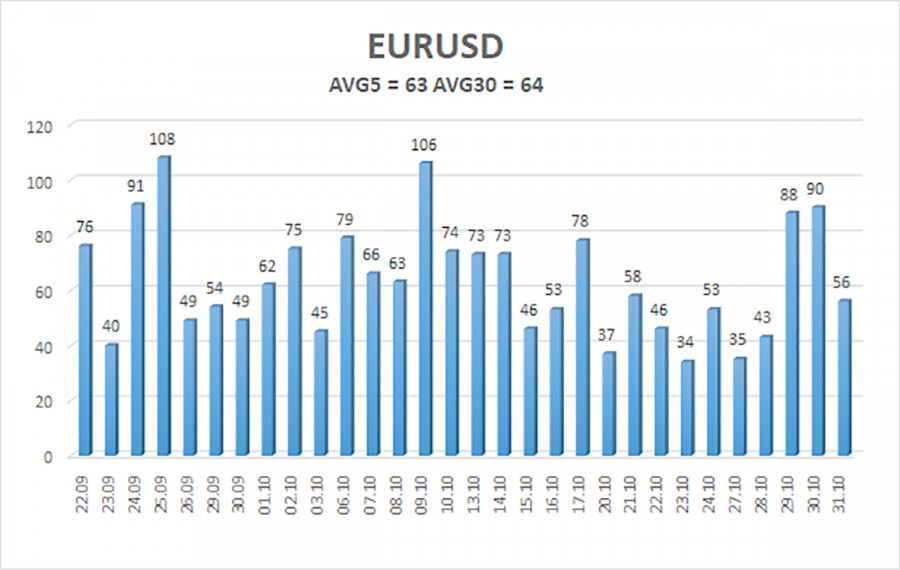

The average volatility of the EUR/USD currency pair over the last five trading days as of November 3 is 63 pips, which is considered "average." We expect the pair to trade between 1.1476 and 1.1601 on Monday. The upper channel of linear regression is directed sideways, signaling a flat movement. The CCI indicator entered the oversold area twice in October (!!!), which may trigger a new wave of upward trend.

Nearest Support Levels:

- S1 – 1.1536

- S2 – 1.1475

- S3 – 1.1414

Nearest Resistance Levels:

- R1 – 1.1597

- R2 – 1.1658

- R3 – 1.1719

Trading Recommendations:

The EUR/USD pair is attempting to begin a new upward trend on the 4-hour timeframe, with an upward trend prevailing on all higher timeframes, though a flat trend has persisted on the daily timeframe for several months. The global fundamental background continues to exert a strong influence on the dollar. Recently, the dollar has been rising, but the local reasons for this are at least ambiguous. Nevertheless, the flat nature of the daily timeframe explains everything.

With the price below the moving average, minor shorts can be considered, with targets of 1.1536 and 1.1475 based solely on technical criteria. Long positions remain relevant above the moving average line, with targets at 1.1841 and 1.1902, as part of the ongoing trend.

Explanations for the Illustrations:

- Linear regression channels help determine the current trend. If both are directed the same way, it indicates a strong trend right now.

- The moving average line (settings of 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the probable price channel the pair will trade in the next day, based on current volatility parameters.

- The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.