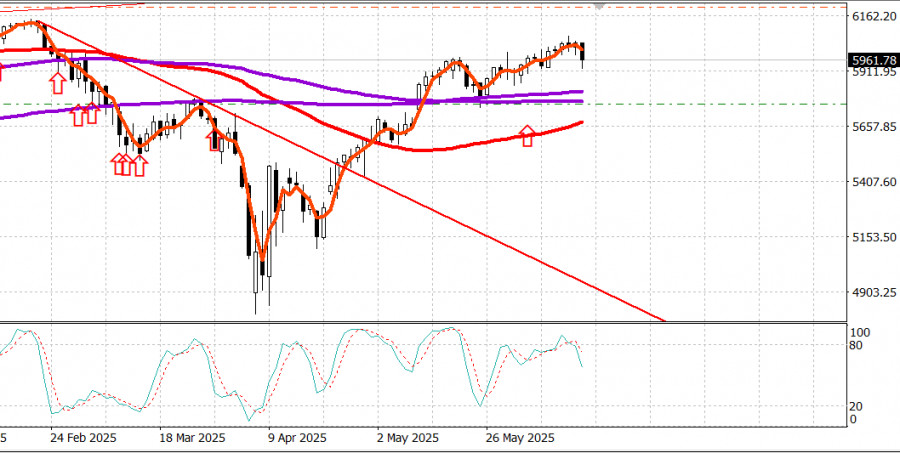

S&P 500

Overview on 13.06

US Market: market declines following Israel's strikes on Iran

Key US indices on Thursday: Dow +0.2%, Nasdaq +0.2%, S&P 500 +0.4%, S&P 500 at 6045, range 5600 – 6200.

As of Friday morning:Overnight, Israel conducted massive airstrikes on Iran, targeting nuclear facilities and individuals involved in Iran's nuclear program leadership.

The S&P 500 dropped in pre-market electronic trading to 5,960, down 1.5%.

Oil surged to $76.90 but then pulled back to $71.50.

Gold climbed to $3,416.

This is the picture as of the morning of June 13. Below is a description of the June 12 trading session.

S&P 500 (+0.4%) closed Thursday with moderate gains, slightly ahead of Nasdaq (+0.2%) and Dow (+0.2%), while small-cap companies lagged, causing the Russell 2000 to fall by 0.4%.

The moderately higher close in large-cap indices reflected continued resilience against selling pressure, as participants remained wary of missing out on further gains following the strong rally from the April lows.

Stocks faced some early pressure triggered by President Trump's toughened stance on trade and renewed geopolitical concerns in the Middle East. However, this was offset by economic data that supported expectations of rate cuts. President Trump stated that letters outlining trade terms would be sent to various countries. These proposals would leave little room for negotiation, as he added that they would include a "take it or leave it" clause.

Further attention was drawn to the escalating tensions in the Middle East after yesterday's report that US embassy staff in Baghdad had been authorized to depart. President Trump confirmed this report last night, while ABC News reported today that Israel is considering military action against Iran with logistical support from the United States.

The published economic data included a cooler-than-expected Producer Price Index (PPI) report for May (+0.1%; consensus +0.2%) and an unemployment claims report that showed a significant jump in continuing claims (+54,000 to 1.956 million), reaching levels not seen since late 2021.

These data reinforced market expectations for a rate cut in September, contributing to a market rebound from the morning lows.

Eight sectors finished the day in positive territory, with the high-yield technology sector (+1.0%) finishing just behind the lower-yielding utilities sector (+1.3%).

The technology sector was supported throughout the day by its fifth-largest component, Oracle (ORCL 199.85, +23.47, +13.3%), which soared to a new record high after beating Q3 expectations and issuing in-line guidance for Q4.

Chipmakers led early in the session, but the PHLX Semiconductor Index (+0.3%) gave back most of its initial gains, underperforming the broader market.

On the downside, the communication services sector (-0.6%) posted the weakest performance, though it remains one of this month's leaders, up 3.2% since late May compared to the S&P 500's 2.3% gain over the same period. Industrials (-0.2%) also underperformed, with Boeing (BA 203.75, -10.25, -4.8%) dragging the group lower after an Air India Boeing 787 crashed shortly after takeoff in Ahmedabad.

Treasuries ended the day solidly higher, with 10-year notes and shorter maturities finishing roughly flat, while long-dated bonds outperformed following a strong $22 billion 30-year bond auction. The 10-year yield fell six basis points to 4.36%, closing just below its 50-day moving average (4.369%).

Economic data overview:

The Producer Price Index rose 0.1% month-over-month in May (consensus +0.2%) following a revised decline of 0.2% (from -0.5%) in April. Core PPI, which excludes food and energy, also increased 0.1% month-over-month (consensus +0.3%), while April's figure was revised from -0.4% to -0.2%.

On a year-over-year basis, the PPI rose 2.6% compared to a revised 2.5% in April (up from 2.4%), while core PPI (excluding food and energy) increased 3.0% compared to a revised 3.2% in April (up from 3.1%).

The key takeaway from the report is that the positive effect of the cooler-than-expected monthly readings was largely offset by upward revisions to the April data.

Nevertheless, the annual core PPI declined from 3.2% to 3.0%, which is a positive development.

Initial jobless claims for the week ending June 7 totaled 248,000 (consensus 250,000), unchanged from the upwardly revised prior week level of 247,000.

Continuing jobless claims for the week ending May 31 rose by 54,000 to 1.956 million, compared to the downwardly revised 1.902 million from the previous week (revised from 1.904 million).

The key takeaway from the report is that continuing claims have reached levels not seen since late 2021, raising some concerns about labor market strength as displaced workers are finding it increasingly difficult to secure new employment quickly.

On Friday, the data will be limited to the release of the preliminary University of Michigan Consumer Sentiment Index for June at 10:00 a.m. ET (consensus 53.0; prior 52.2).

Year-to-date performance:

S&P 500: +2.8%

Nasdaq Composite: +1.8%

Dow Jones Industrial Average: +1.0%

S&P Midcap 400: -2.2%

Russell 2000: -4.1%

Oil as of Friday morning: take a look at the beginning of this report.

Conclusion: A correction of approximately -1.5% in the indices is likely by the end of Friday's session. The Iran-Israel situation remains in focus. Buying at this stage is premature.

Makarov Mikhail, more analytics to follow:

https://www.instaforthtex.com/ru/forex_analysis/?x=mmakarov

https://www.instaprofitone.com/ru/forex_analysis/?x=mmakarov