On Monday, the GBP/USD currency pair also traded relatively calmly, with a bullish bias. The British pound doesn't reach new three-year highs every day, but looking at almost any higher timeframe, it's clear which direction the price moves most of the time. The pound continues to rise steadily and effortlessly. It doesn't need a strong macroeconomic backdrop from the UK or a tightening of monetary policy by the Bank of England to do so. It rises simply because the dollar is falling.

For four months straight, the reasons for the dollar's decline have been discussed. And the list of those reasons isn't getting shorter—it's only growing. That's why it's very hard to predict when the dollar will finally stop its plunge—most likely not anytime soon.

We've also talked many times about the macroeconomic backdrop. Roughly 70–80% of all reports and data releases are ignored. Even if the reports are strong for the dollar, there's no guarantee that the market will buy it. After all, it's the market participants, not the reports, that move currency prices. Even if the Federal Reserve were to hike the key rate to 10% tomorrow, but the market chose not to buy the dollar, the dollar wouldn't rise. While many traders are familiar with the logic "higher rate = stronger currency," a currency only strengthens because a higher rate offers better investment returns, prompting more investors to buy that currency to benefit from the country's economy.

The Bank of England and the Fed will hold policy meetings this week. What could these events potentially signify? In our opinion, they could lead to further challenges for the dollar. Just recall the situation a month and a half ago: the BoE cut its rate by 0.25%, and the Fed once again left its rate unchanged. And what happened? Did the dollar rise? Also note that this year alone, the European Central Bank has already gone through four rounds of monetary easing, cutting its key rate by a total of 1%. All the while, the Fed has remained silent. And yet—which currency has been rising throughout 2025?

So, we believe that regardless of the outcome of the Fed and BoE meetings, they will likely cause more trouble for the dollar. The greenback might see a short-term spike, just like it did on Friday after the escalation of the Israel–Iran conflict—but we all saw what happened afterward.

Especially considering that neither the Fed nor the BoE is expected to cut rates in June. So, any changes would likely come only from Powell's and Bailey's rhetoric. The BoE governor will likely discuss the need for a pause after two rate cuts and strong inflation growth. The Fed Chair will likely stick to his previous stance: wait for the final tariff data, assess the long-term impact on the economy, labor market, and inflation, and only then consider changes in monetary policy. So traders probably shouldn't expect much fresh or important information.

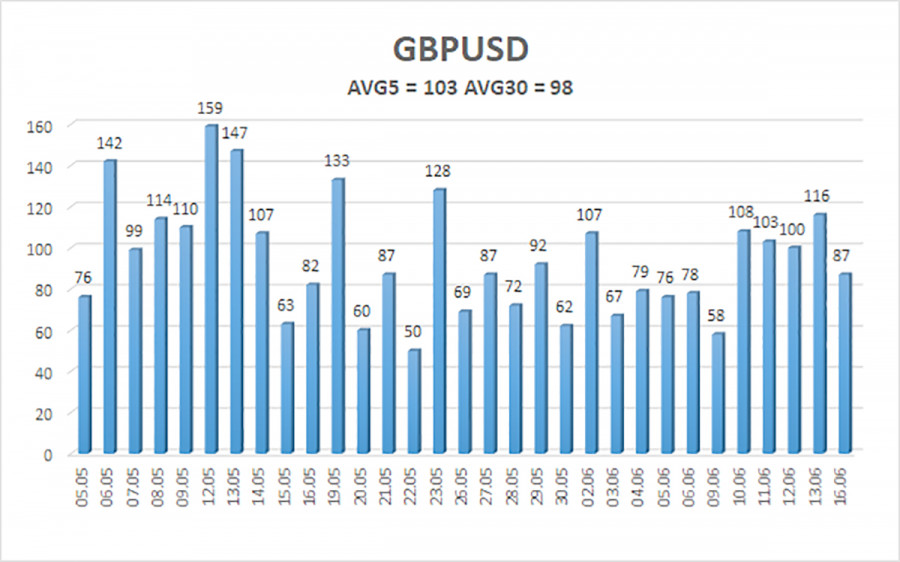

As of June 17, the average volatility of GBP/USD over the past five trading days is 103 pips, which is considered "moderate" for this pair. Therefore, we expect the pair to trade between 1.3487 and 1.3693 on Tuesday. The long-term regression channel points upward, indicating a clear upward trend. The CCI indicator hasn't entered extreme zones recently.

Nearest Support Levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest Resistance Levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading Recommendations:

The GBP/USD pair maintains its upward trend and continues to rise. Plenty of news supports this movement. However, each new decision from Trump is perceived negatively by the market, and positive news from the U.S. is scarce. Therefore, long positions targeting 1.3672 and 1.3693 are much more relevant while the price is above the moving average. If the price consolidates below the moving average, short positions targeting 1.3489 and 1.3428 may be considered, but the probability of growth remains significantly higher than that of a decline. From time to time, the U.S. dollar may show minor corrections, but for further bullish continuation, evident signs of the end of the global trade war are needed.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.