Analysis of Trades and Trading Tips for the Euro

The price test at 1.1395 coincided with the MACD indicator, which had significantly moved downward from the zero mark, limiting the pair's downside potential. For this reason, I did not sell the euro.

The European economy is facing a challenging situation due to the strengthening of the US dollar, which is driven by slowing inflation in the eurozone and the protectionist policies of the Trump administration. While slower price growth is favorable in the long term, it has weakened the euro in the short term. Trump's decision to double tariffs on steel and aluminum imports to 50% also negatively impacted market sentiment, especially in the currency market. Such measures aimed at supporting American manufacturers inevitably lead to retaliatory actions from trading partners, including the European Union, which could provoke trade conflicts and increase instability in currency markets.

Given the circumstances, the European Central Bank must make carefully calibrated decisions tomorrow to stabilize the eurozone economy and maintain the competitiveness of European companies on the international stage. Coordinated measures, including monetary and fiscal tools, are needed to mitigate the negative effects of protectionism and restore investor confidence in the European economy.

Today, service sector PMI and composite PMI data for the eurozone are expected, which could increase pressure on the euro. Investors are closely watching these indicators as they provide valuable information about the current state of the eurozone economy and allow forecasting its future development. If the PMI data comes in below expectations, it could confirm fears of a slowdown in economic growth in the region and trigger further euro sell-offs.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

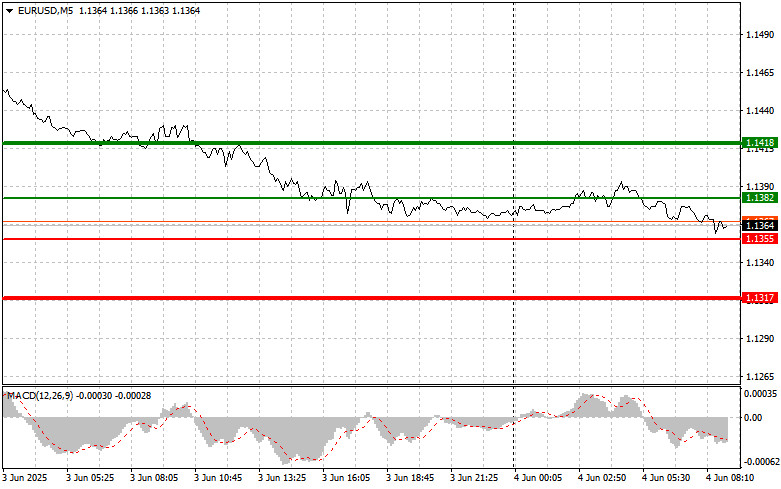

Scenario #1: I plan to buy the euro today if the price reaches the 1.1382 area (green line on the chart) with a target of 1.1418. At 1.1418, I plan to exit the market and sell the euro on a reversal, aiming for a 30–35 pip move from the entry point. Buying the euro should only be considered after good data.

Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1355 level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and trigger a market reversal upwards. Growth toward 1.1382 and 1.1418 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after reaching the 1.1355 level (red line on the chart). The target will be 1.1317, where I plan to exit the market and immediately buy on a reversal (targeting a 20–25 pip move from the level). Selling pressure will likely return if there is a sharp drop in PMI indices.

Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1382 level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and trigger a market reversal downward. A decline toward 1.1355 and 1.1317 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.