Trade Review and Tips for Trading the Euro

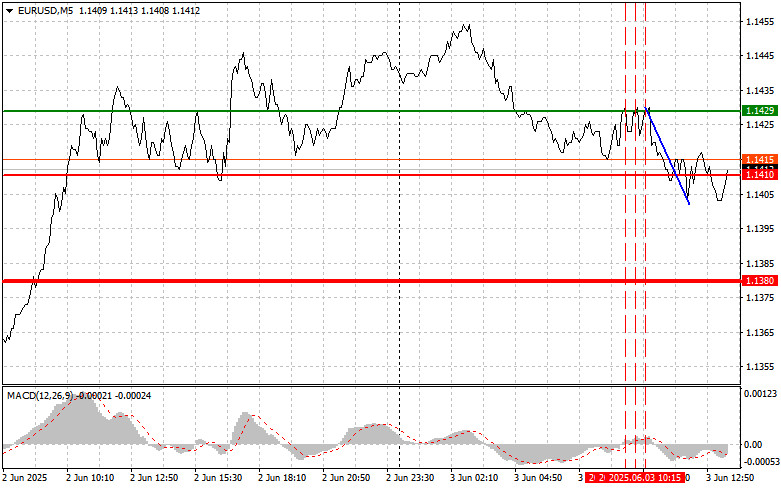

The price test at 1.1429 occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy the euro. The second test of 1.1429 happened while the MACD was in overbought territory, confirming the execution of scenario #2 for a sale. This led to a 25-point drop in the pair.

Pressure on the euro returned after news that inflation in the Eurozone fell to 1.9%, below economists' forecasts of 2.0%. This gives the European Central Bank more flexibility to maintain a dovish policy and possibly lower the interest rate again during the summer. Clearly, the previously adopted ECB measures to tighten monetary policy are still restraining price growth. The ECB's liberal stance, supported by inflation data, contributes to the region's economic activity. A decision on further rate cuts will require a thorough analysis of the economic situation and an assessment of all possible risks and benefits—especially amid the trade uncertainties expected to impact the Eurozone in the near future. The ECB's summer meeting will be crucial in determining the next course of monetary policy in the Eurozone.

Later today, the U.S. Bureau of Labor Statistics will release data on job openings and labor turnover (JOLTS), as well as changes in factory orders. These macroeconomic indicators combined will provide a clearer picture of the U.S. economy's condition and business sentiment.

In particular, the JOLTS index, which shows the number of job openings, hiring, and separations, is an important labor market indicator. A high number of openings signals strong labor demand, typically supporting economic growth. However, too high a number may suggest a shortage of skilled workers and a potential acceleration in wage inflation.

Factory orders data will help assess companies' investment activity and their expectations for future demand. An increase in orders is usually a positive sign of business confidence and readiness to boost production, while a decline could indicate slowing economic growth.

Also significant will be speeches by FOMC members Austan D. Goolsbee and Lorie K. Logan. However, we remember that yesterday's comments by the Fed Chair did not touch on monetary policy, so it's unlikely today's FOMC interviews will be an exception.

As for the intraday strategy, I will rely primarily on the execution of scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro upon reaching the 1.1423 price level (green line on the chart), targeting a rise to 1.1464. At 1.1464, I plan to exit the market and sell the euro in the opposite direction, expecting a 30–35 point move from the entry point. Euro growth today is likely only after weak U.S. data.Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1395 price level when the MACD is in oversold territory. This will limit the pair's downward potential and lead to a market reversal upward. Growth can be expected toward the opposite levels of 1.1423 and 1.1464.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1395 level (red line on the chart). The target will be 1.1363, where I plan to exit and immediately buy in the opposite direction (expecting a 20–25 point move in the opposite direction from the level). Pressure on the pair today may return following strong data.Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1423 price level when the MACD is in overbought territory. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.1395 and 1.1363 can be expected.

What's on the Chart:

- Thin green line – entry price where you can buy the trading instrument;

- Thick green line – projected price where you can set Take Profit or manually lock in profits, as further growth above this level is unlikely;

- Thin red line – entry price where you can sell the trading instrument;

- Thick red line – projected price where you can set Take Profit or manually lock in profits, as further decline below this level is unlikely;

- MACD Indicator – It's important to follow the overbought and oversold areas when entering the market.

Important Notes

Beginner Forex traders should be very cautious when making trading decisions. It's best to stay out of the market before the release of major fundamental reports to avoid sudden price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you don't practice proper money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.