The evening of Sunday brought plenty of reasons for market participants to celebrate (and a slight thrill): US futures are rising again, extending the positive momentum of the previous week. Investors are inspired by hopes of an imminent rate cut and positive signals from US-China trade negotiations.

Indices soar

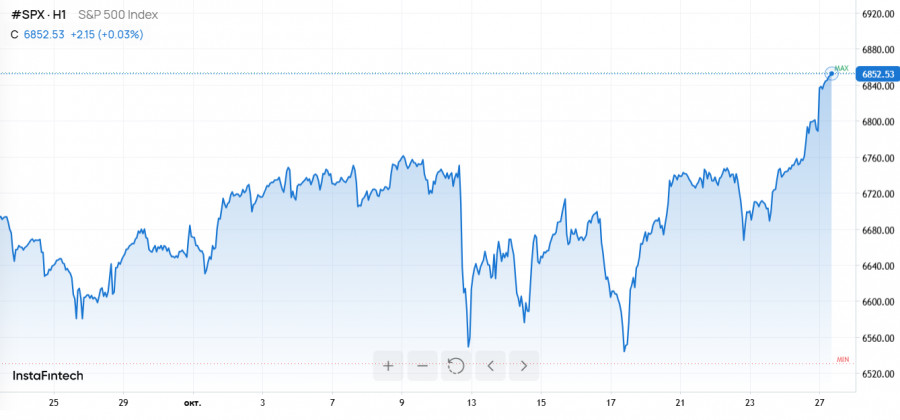

S&P 500 futures climbed by 0.7% late on Sunday, reaching 6,873.75 points.Nasdaq 100 Futures jumped even higher, by 0.9%, settling at 25,726.75 points. Dow Jones Futures kept pace, increasing by 0.6% to hit 47,676.0 points.All major US indices – the Dow Jones Industrial Average, the S&P 500, and the NASDAQ Composite – closed Friday at new all-time highs. The Dow rose by 1%, the S&P gained 0.8%, and the Nasdaq shone with a 1.2% increase. For the markets, this was undoubtedly a day of record achievements.

Inflation data eases concerns

Investor sentiment strengthened after fresh statistical data pleasantly surprised: the rise in US consumer prices for September was more modest than expected. As a result, market participants are almost certain that at the two-day Fed meeting concluding on October 29, 2024, the regulator will cut interest rates by 25 basis points. Markets are nervously looking to the future, anticipating "just a little more" easing, as ING predicts an additional 25-point cut in December, followed by a 50-point reduction in early 2026.

US-China progress in trade war

Over the weekend, markets received another dose of good news: Washington and Beijing announced a "framework understanding" on key issues at the ASEAN summit in Kuala Lumpur.

Treasury Secretary Scott Bessent happily declared that new tariff threats are on hold, and China is not currently imposing restrictions on rare earth element exports. Looming ahead is the pivotal meeting between Donald Trump and Xi Jinping, which could potentially finalize a trade peace agreement.

In his characteristic style, Donald Trump assured reporters, "I think we will have a deal with China." The market's reaction was immediate: investors are envisioning how the months-long tariff drama might finally conclude, and risk assets around the world are poised to celebrate a new era of stability.

Focus on tech giants: Magnificent Seven takes center stage

However, the celebration of macroeconomic life doesn't end there. This week, five of the "Magnificent Seven" American tech giants will announce their earnings: Microsoft, Meta, and Alphabet will reveal their results on Wednesday, followed by Apple and Amazon on Thursday. Topics will include investments in artificial intelligence, demand for cloud services, and certainly trends in consumer behavior and spending.

Nikkei sets new all-time high

While the US is gearing up for another rally, the Japanese exchange is already in full swing: the Nikkei 225 rose by 2.54%, marking another historic high. Leading the charge are shares of Kawasaki Heavy Industries (+9.02%, 12,630.00 points), Fujikura Ltd. (+7.98%, 19,355.00), and SoftBank Group Corp. (+6.66%, 25,470.00). The number of gaining stocks (2755) far exceeds those that declined (881).

Among the negative movements are shares of Shin-Etsu Chemical Co. (-3.67%, 4,725.00), Chugai Pharmaceutical (+2.13%, 6,787.00), and SUMCO Corp. (-1.85%, 1,672.50). The Nikkei Volatility index, meanwhile, reacted without excessive panic, decreasing by 7.22% to 25.44, clearly indicating that traders do not expect turbulence at this time.

WTI, Brent, and gold show their character

The commodity markets are also restless: WTI oil futures for December delivery rose by 0.50% to $61.81 per barrel, while Brent for January added 0.48% to settle at $65.51. However, gold decided to take a small step back, with the December futures dropping by 1.09% to $4,092.55 per troy ounce.

USD/JPY gains slightly

On Forex, the USD/JPY pair is up by a symbolic 0.05% (152.94), and the euro against the yen has also gained 0.05% (177.82). The US dollar index has slipped slightly, down 0.04% to 98.71.

Thus, traders are looking at a very dynamic week ahead. With expectations of Fed rate cuts and a potential trade peace deal between the US and China, it makes sense to pay close attention to futures and stocks of companies sensitive to these events.

Technical signals and fundamental reports from the Magnificent Seven provide numerous interesting entry (and exit) points in the tech sector. Additionally, one might look at the Japanese market: shares of Kawasaki Heavy Industries, Fujikura, and SoftBank Group could continue their positive trend amid historic highs. Don't forget to keep an eye on oil and currency movements as well.