Analysis of Wednesday's Trades

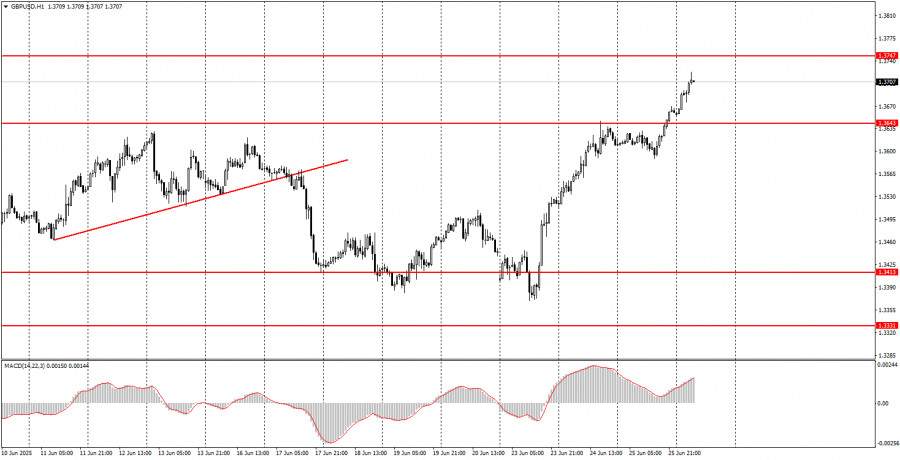

1H Chart of GBP/USD

On Wednesday, the GBP/USD pair continued its upward movement, which had begun on Tuesday. As a reminder, Tuesday brought news of a truce between Israel and Iran, which triggered a sharp decline in demand for the U.S. dollar, still seen by some market participants as a "safe-haven asset." In addition, the July 9 deadline for "preferential tariffs" is approaching. Aside from the agreement with the United Kingdom, the Trump administration has yet to finalize any trade deals. There is virtually no information in the media about negotiations with any other countries, so the market is expecting the worst—namely, a reinstatement of tariffs, which would further accelerate inflation and slow economic growth, both of which are already showing signs of deterioration. Speaking before Congress, Jerome Powell confirmed he expects inflation to rise this summer while monetary policy has seemingly fallen out of focus.

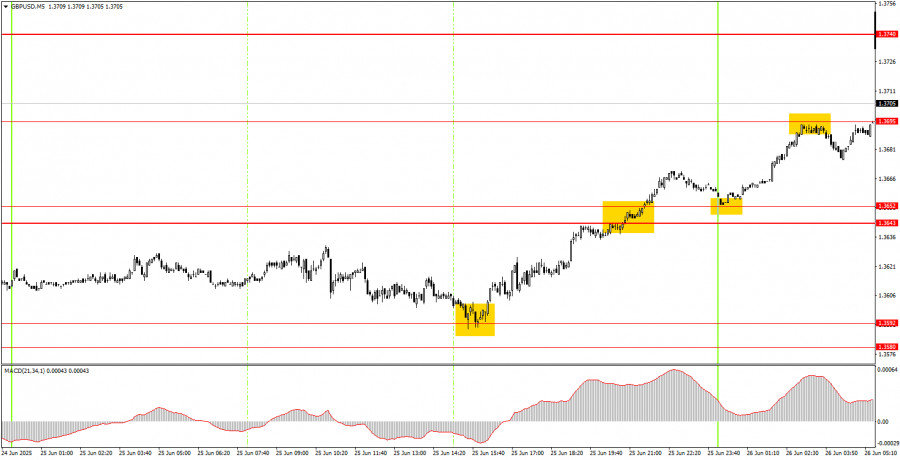

5M Chart of GBP/USD

On the 5-minute timeframe, several trading signals were formed on Wednesday. The first buy signal near the 1.3580–1.3592 area was highly profitable, as this was the point from which the next leg of the pound's rally began. By late evening, the price broke through the 1.3643–1.3652 area; by Thursday morning, it had reached the 1.3695 level. Thus, novice traders could have closed long positions at almost any point and still make a profit.

Trading Strategy for Thursday:

On the hourly timeframe, the GBP/USD pair continues to react primarily to Donald Trump's actions and remains highly skeptical of his policies. As a result, the market continues to sell the dollar or wait for more negative developments from overseas to justify further selling. This situation will likely persist until there are clear signs that the trade war is ending or until Trump stops making unilateral decisions that shock market participants. As expected, the 1.3643 level provided no resistance—the price hovered around it briefly and then moved right past it.

On Thursday, the GBP/USD pair could continue rising as the market appears to be building a new upward trend. While the dollar may occasionally correct, the current uptrend is stable and well-founded.

On the 5-minute TF it is now possible to trade at 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3518-1.3535, 1.3580-1.3592, 1.3643-1.3652, 1.3695, 1.3747, 1.3814-1.3833. On Thursday, Bank of England Governor Andrew Bailey is scheduled to speak, and in the U.S., GDP and durable goods orders reports will be released. These are fairly significant events, but we do not expect them to significantly influence trader sentiment or the overall market trend.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.