Analysis of Friday's Trades

1H Chart of EUR/USD

On Friday, the EUR/USD currency pair continued its upward movement after bouncing from the 1.1267 level during a brief correction. The uptrend remains intact, as the trendline indicates, and the dollar is again plunging into the abyss — seemingly without any specific reason. However, "without any specific reason" isn't entirely accurate. There is a reason which has remained relevant for four months. Its name is Donald Trump.

On Friday, the U.S. president announced his intention to raise tariffs on all imports from the European Union to 50% in response to the collapse of trade deal negotiations. As we can see, Trump is back to his favorite strategy. If his opponent refuses to accept his point of view, then it's time to threaten, blackmail, and issue ultimatums. And the market once again gave its clear verdict on Trump's policies — fresh dollar selling followed immediately.

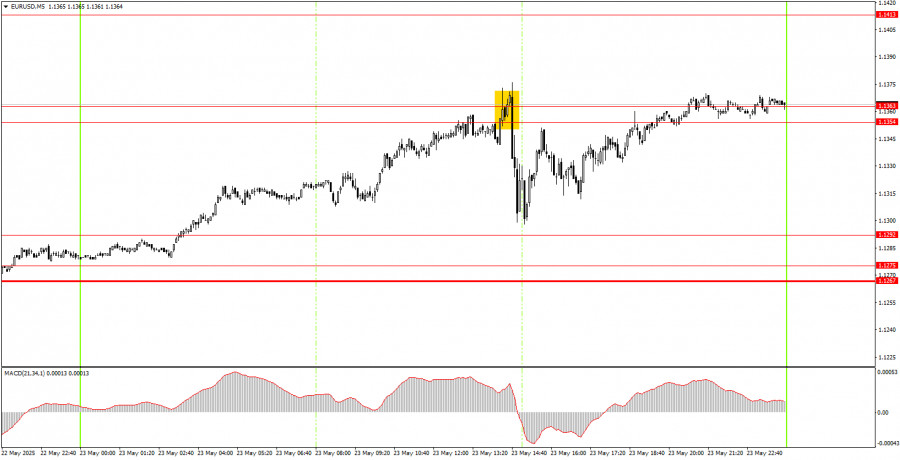

5M Chart of EUR/USD

On the 5-minute timeframe, Friday brought some quite interesting moves. Before the U.S. session began, the pair rose steadily, then plunged 70 pips, only to recover by the end of the day and return to the daily high. Only one trading signal was generated — around the 1.1354–1.1363 area. It wasn't particularly accurate, and the drop was so fast that entering a short position in time was difficult. Technically, the price also bounced off the 1.1267–1.1292 area overnight, but not all traders would have been able to act on that signal.

Trading Strategy for Monday:

The EUR/USD pair continues to move upward in the hourly timeframe. It appears the bullish trend that began when Trump became president is set to continue. At this point, the fact that Trump is president of the United States is reason enough for the market to sell off the dollar relentlessly. And when Trump starts threatening, issuing ultimatums, and imposing or increasing tariffs, the market has no choice.

On Monday, EUR/USD could continue climbing as Trump threatens to raise trade tariffs again, this time against the European Union. Even if we see temporary dollar strength, it's unlikely to disrupt the broader uptrend.

On the 5-minute chart, the following levels should be monitored: 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198, 1.1267–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. No significant events or data releases are scheduled for Monday in either the Eurozone or the United States, so we can expect either a sideways market (flat) or further dollar weakening. A rebound occurred near the 1.1267 level, so we expect the pair to continue rising.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.