Industrial sector: leader at start, test of strength ahead

Amid a challenging environment on Wall Street in 2025, the industrial sector has confidently taken the lead, but the upcoming corporate earnings season will serve as a serious test of its resilience.

Rapid growth outpacing marketThe S&P 500 industrial index, which includes aerospace and engineering firms, electrical equipment manufacturers, transport, and construction corporations, has gained 15% since the beginning of the year. This is the highest result among the index's 11 sectors and more than double the overall gain of the S&P 500.

Focus shifting to earningsInvestor attention is turning to a packed week ahead. The quarterly earnings season kicks off, and more than 20% of the companies in the S&P 500 will report financial results. Of particular interest are the reports from Alphabet and Tesla, the first of the so-called "Magnificent Seven" tech giants to present data.

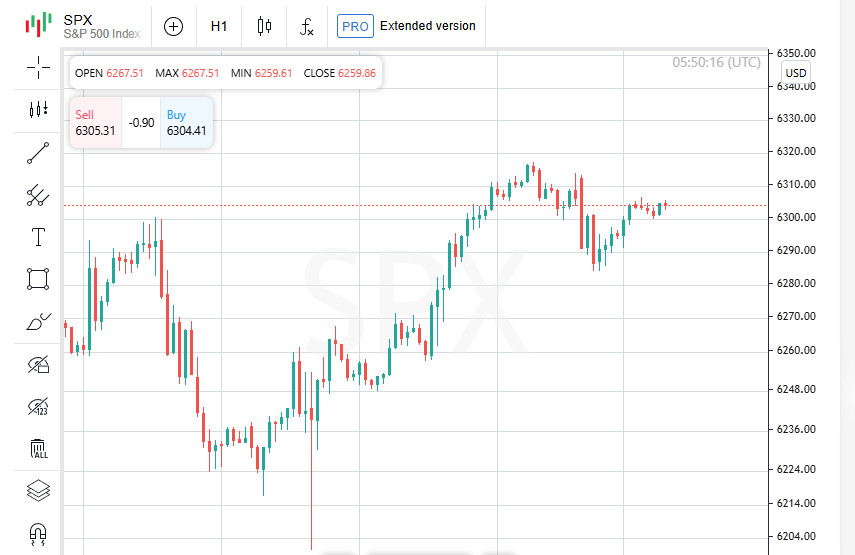

Optimism amid previous fearsSince spring, the S&P 500 has climbed 26%, as investors have moved past earlier recession fears triggered by tariffs announced by former President Donald Trump on Independence Day.

Aerospace and defense on riseAmong the key beneficiaries are defense and aerospace companies, whose shares have risen against the backdrop of growing geopolitical tensions in Ukraine and the Middle East, as well as increased military spending from Germany and other nations.

Defense surge: industrial sector flies high but testing week aheadAerospace and defense stocks continue to set the pace in 2025, showing impressive growth. However, the coming days will bring a new wave of earnings reports and potentially a reset of expectations.

Defense in spotlightSince the beginning of the year, the S&P 500 aerospace and defense group index has risen by 30%. Next week, investors will see fresh results from major sector players like RTX, Lockheed Martin, and General Dynamics — all three will report quarterly earnings.

GE success: both startup and heavyweightGE Aerospace continues its ascent: the company's shares have already added around 55%, and on Thursday, the management raised its full-year 2025 profit forecast.GE Vernova, a new player formed after the General Electric split, is also catching up. The power equipment manufacturer has become the fastest-growing stock in the industrial sector this year, with a gain of more than 70%. Its quarterly report is due Wednesday.

Uber in industry: unexpected boostInterestingly, Uber also made a significant contribution to sector growth this year. The transportation tech company's shares have surged by roughly 50%.

Transport could not keep upNot all transport sector companies were as fortunate. UPS and FedEx shares fell, while airline carriers such as United Airlines and logistics firms like JB Hunt also ended up in the red.

Earnings week: who else is on listNext week, Honeywell, Union Pacific, and United Rentals will also report financial results. Their data could have a significant impact on the overall sector sentiment.

Tariff factor: tensions remainIn addition to earnings, investors are closely watching developments in trade policy. Starting August 1, the US will implement new, higher tariffs on several countries, which may shift momentum across various industries.

Federal Reserve under pressure: Powell at the center of political stormThis week, investors will pay close attention to news from the Federal Reserve. Fed Chair Jerome Powell is under new political pressure. President Donald Trump publicly demanded his resignation while increasing pressure on the central bank to cut interest rates quickly. The next Fed meeting on the key rate is scheduled for July 29–30.

Stock market maintains momentumDespite geopolitical turbulence, the S&P 500 has shown moderate but steady growth since the beginning of the year — about 7%.

Asia: political instability did not derail marketAsian stock markets, along with the Japanese yen, remained stable on Monday, despite an unfavorable election outcome in Japan for the ruling coalition. The market had priced in the potential political setback, and the reaction remained muted. At the same time, US index futures signaled readiness for the upcoming earnings season of major tech firms.

Hope for dialogue ahead of tariff deadlineInvestors are also closely watching for progress in trade negotiations. The deadline for Donald Trump's new tariff ultimatum is August 1. US Commerce Secretary Howard Lutnick expressed confidence that a deal with the EU is still possible.

Washington and Beijing: toward dialogue, but not yetA potential meeting between Donald Trump and Chinese President Xi Jinping is also on the agenda. According to preliminary information, talks may take place no earlier than October. Meanwhile, European Commission President Ursula von der Leyen is preparing for a meeting with the Chinese leader scheduled for Thursday.

Japan: parliamentary blow to prime minister's authorityJapan's domestic political scene also remains tense: the ruling coalition has lost control of the upper house of parliament. This is a serious blow to Prime Minister Shigeru Ishibe amid external political challenges and the approaching US tariff deadline.

Bank of Japan remains cautiousDespite internal political pressure, the Bank of Japan continues to weigh the possibility of raising interest rates. However, market participants broadly see the chance of such a move before the end of October as quite low.

Markets early this week: Asia cautious, US and defense stocks climbingThe trading week began with mixed signals: Asian stock markets are showing cautious dynamics, while US futures continue to edge toward record highs amid expectations of strong corporate earnings.

Nikkei on hold, Asia mixedAlthough Japan's Nikkei index was closed today, futures remained virtually unchanged at 39,820 points, matching the previous close. The MSCI Asia index (excluding Japan) declined by 0.1%, while South Korea's market gained 0.5%. Chinese blue chips rose by 0.3% after the People's Bank of China, as expected, left key interest rates unchanged.

Europe under pressureFutures on leading European indices opened lower. EUROSTOXX 50 and DAX both fell by 0.3%, while the FTSE declined by 0.1%. Investors continue to assess risks related to slowing economic growth and geopolitical tensions.

Wall Street gears up for earningsFutures on the S&P 500 and Nasdaq rose by 0.1% and are hovering near record levels. The focus is on the release of quarterly earnings reports. This week features updates from giants such as Alphabet, Tesla, and IBM, with markets expecting positive signals.

Defense sector among favoritesShares of defense companies remain among the top performers. Investors are awaiting earnings reports from RTX, Lockheed Martin, and General Dynamics. On the back of large-scale government spending worldwide, the sector has grown by 30% since the beginning of the year.

EUR retreats, USD gains strengthThe euro held steady at $1.1622, remaining below the recent high of $1.1830. Last week, the euro lost 0.5%. The US dollar index edged up to 98.465, reflecting increased demand for safe-haven assets.

Gold on hold, oil caught between sanctions and supplyThe commodity markets started the week with moderate moves: gold remained stable, while oil prices hovered between geopolitical risks and expectations of rising supply.

Precious metals stay flatGold prices remained nearly unchanged at $3,348 per troy ounce. This pause followed a recent rally in platinum, which last week reached its highest level since August 2014.

Oil markets in a state of uncertaintyOil prices are showing cautious gains as markets weigh two opposing forces: the possibility of increased production from OPEC+ and potential EU export restrictions on Russian oil under sanctions.

Brent and WTI edge higherBrent crude futures rose by 0.1% to $69.36 per barrel. The US benchmark, WTI, also climbed, gaining 0.2%, to $67.45 per barrel. Overall, the market remains in a wait-and-see mode and reacts to every new geopolitical signal.