Tesla leads, markets rally

On Tuesday, the S&P 500 closed higher, largely driven by a strong surge in Tesla shares. Investor sentiment was buoyed by hopes of progress in US-China trade negotiations aimed at resolving the prolonged tariff standoff that has weighed on global markets for much of the year.

Washington and Beijing: cautious progress

Following the signing of a preliminary agreement last month, markets have been awaiting further steps. However, tensions have resurfaced as the US accused China of restricting exports of rare earth elements critical to high-tech industries ranging from aerospace to defense.

Breakthrough hopes build for today

According to US Commerce Secretary Howard Lutnick, talks are progressing constructively, with a resolution potentially reachable as early as Tuesday evening, though discussions could extend into Wednesday if necessary.

Tech sector lacks clear direction

Among the market's largest tech names, movements were mixed. Tesla shares jumped 5.6%, while Microsoft slipped 0.4%. Alphabet rose 1.4% after analysts reported that OpenAI plans to use Google's cloud infrastructure to handle surging computing demands.

US stock indices close with gains

At the close of Tuesday's session, key US equity benchmarks posted solid gains:

• The S&P 500 rose 0.55%, finishing at 6,038.81 points.

• The Nasdaq Composite advanced 0.63% to 19,714.99 points.

• The Dow Jones Industrial Average added 0.25%, closing at 42,866.87 points.

Energy leads the charge

Among the 11 sectors in the S&P 500, most ended the day higher. The energy sector led with a 1.77% gain, followed by consumer discretionary, which climbed 1.19%.

All eyes on inflation

Investors are now bracing for fresh US consumer price data due out Wednesday. The report is expected to play a pivotal role in shaping expectations for the Federal Reserve's next moves on interest rates.

World Bank warns of slowing growth

Meanwhile, the World Bank cut its forecast for global economic growth in 2025 by 0.4 percentage points to 2.3%, citing rising trade barriers and escalating geopolitical uncertainty as key headwinds.

Corporate news brings both triumph and turmoil

Insmed shares soared nearly 29% after reports that its experimental drug significantly improved lung function and boosted physical endurance in patients during clinical trials.

Meanwhile, J.M. Smucker, the maker of the iconic Jif peanut butter, saw its stock plunge 15.6% following profit guidance that fell well short of market expectations.

Snap joins tech race

Shares of Snap Inc. slipped 0.1% after the company announced plans to launch a consumer version of its smart glasses next year. Analysts believe the move will intensify competition with Meta in the growing wearable tech market.

Bond market holds its breath

Fixed-income investors are closely watching upcoming US inflation data, hoping to catch early signals of how tariff measures may be influencing price trends. Additional focus is on the upcoming Treasury auction, which will gauge how strong demand for US debt remains amid rising economic uncertainty.

Step forward: framework for trade deal outlined

In London, US and Chinese negotiators announced that they had reached preliminary agreements. According to officials, a framework for a future trade agreement has been drafted and will now be presented to the leaders of both nations for final approval.

Legal uncertainty clouds US tariff policy

In the United States, the judiciary has injected fresh uncertainty into the tariff landscape. A federal appeals court allowed major tariffs imposed by the Trump administration to remain in place, despite a lower court ruling that sought to block them. The decision has added another layer of tension for investors.

Cautious thaw in Asia

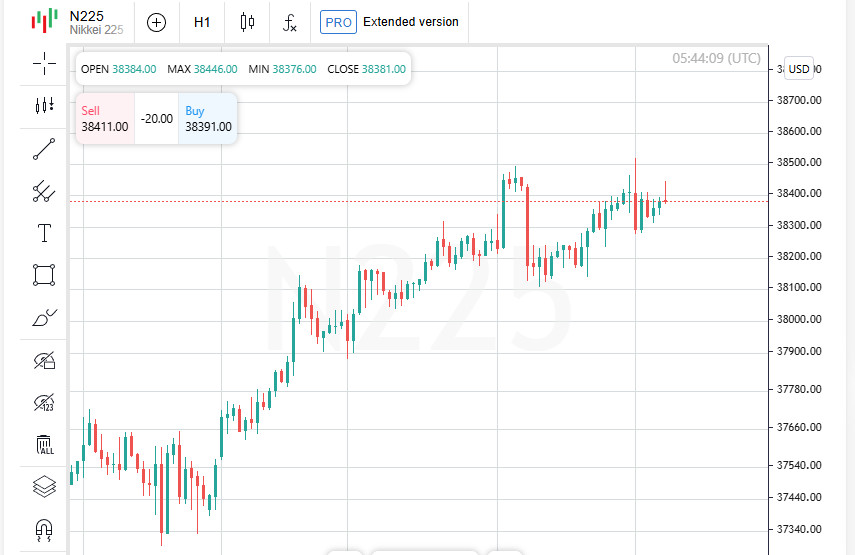

Asia-Pacific equity markets responded with moderate optimism. The MSCI index tracking the region excluding Japan rose 0.2%.

In Japan, the Nikkei advanced 0.4%, while Australia's ASX 200 posted a similar 0.4% gain.

Europe and US futures under pressure

European equity futures opened the session with modest losses:

• EUROSTOXX 50: down 0.2%

• FTSE: down 0.2%

• DAX: down 0.2%

US futures also showed weakness:

• S&P 500: down 0.1%

• Nasdaq: down 0.1%

Currency markets hold steady

Currency trading remained subdued, with limited surprises. The US dollar edged down 0.1% against the Japanese yen to 144.73. The euro strengthened to $1.1433, while the dollar index was largely unchanged at 98.971.

Gold inches higher, oil pulls back

In the commodity market, gold rose 0.3% to reach $3,333 per ounce.

Oil, however, moved lower as traders locked in profits following a rally to near seven-week highs, while awaiting fresh US crude inventory data:

• Brent slipped 31 cents to $66.56 per barrel.

• WTI fell 28 cents to $64.71 per barrel.