The EUR/USD currency pair traded relatively calmly on Monday, although we expected higher volatility. This is because the last events that traders could react to were from Friday. And on Friday, the only known event was Israel's initial strike on Iran's nuclear and military facilities. Over the weekend, both sides continued exchanging strikes, often hitting civilian infrastructure. It is evident that this situation is no longer a military operation with a clearly defined objective.

So why is the dollar falling again? In the initial hours following Israel's strikes, demand for the U.S. dollar surged on Friday. But from our point of view, the situation unfolded roughly like this:

As soon as the conflict escalated, traders rushed to buy what used to be the safest currency—the dollar. However, just a few hours later, they remembered or realized that the dollar no longer plays that role. Since Donald Trump officially became president for the second time, the U.S. currency has done nothing but fall. Instead of ending wars, stimulating the economy, lowering taxes, and building ties with trade partners and neighbors, Trump continues to destroy, make Americans pay more for the same goods, expel migrants who have lived in the U.S. for years, and quarrel with the entire world.

As a result – previously solid economic indicators have sharply deteriorated, America's credit rating has been downgraded, there's a risk of default on external debt this summer, the trade war is in full swing, and investors are extremely cautious toward anything American. The world is now gripped by total uncertainty. And who likes uncertainty? No one. Who is to blame for it? Trump. And if global uncertainty is at a peak, what can be said about the situation within the U.S.?

So, as the conflict between Iran and Israel (with U.S. involvement and support) escalated further, the market quickly recognized that Trump is destroying the American economy. Under such conditions, how can the dollar be a "safe haven" or a "refuge currency"? That's why the dollar, in its typical manner over the last four months, briefly rose—and then quickly fell again. It rose for specific reasons and fell—for no reason at all.

It's simple: the dollar is no longer a safe-haven currency. Now, the yen, pound, and euro have taken the lead. These currencies are gaining strength as the dollar continues to plummet rapidly. On Monday, the market was reacting solely to the escalation of the military conflict, as there were no other notable events. Therefore, the dollar's decline was once again the market's way of expressing its view of the dollar, Trump, and his policies.

When might the situation turn favorable for the dollar? Only if Trump leaves office or changes the direction of his foreign and trade policy. Of course, the dollar won't fall nonstop for the next four years—there will be pauses. However, the general trend appears upward (not for the dollar, but against it).

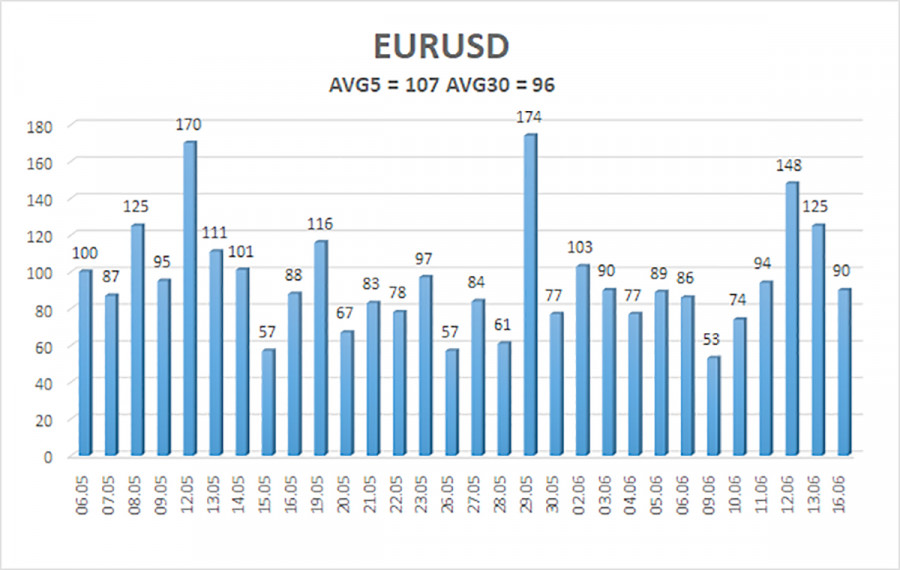

As of June 17, the average volatility of the EUR/USD pair over the past five trading days is 107 pips, which is considered "moderate." We expect the pair to move between 1.1476 and 1.1690 on Tuesday. The long-term regression channel remains upward, signaling a continued uptrend. The CCI indicator entered oversold territory, forming a bullish divergence, which triggered the trend's resumption. Not without Trump's help, of course.

Nearest Support Levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest Resistance Levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair continues its upward trend. The U.S. dollar is still under intense pressure due to Trump's foreign and domestic policies. Moreover, the market increasingly interprets data negatively for the dollar or simply ignores it. We are witnessing a distinct reluctance in the market to purchase the dollar under any circumstances. If the price is below the moving average, short positions remain relevant with a target of 1.1353, although a deep decline should not be expected under current conditions. If the price is above the moving average, long positions targeting 1.1597 and 1.1690 are valid as a continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.