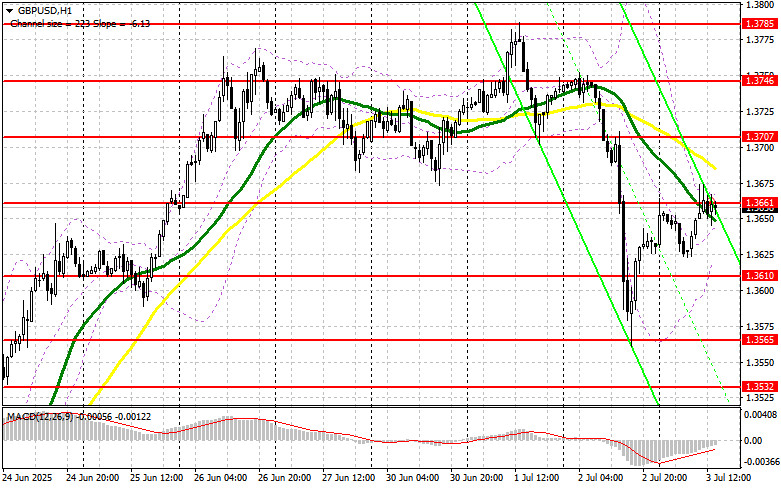

In my morning forecast, I focused on the 1.3659 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and review what happened. The price rose and formed a false breakout around 1.3659, providing a good entry point for selling the pound, but after a 15-point decline, demand returned. The technical outlook was revised for the second half of the day.

To open long positions on GBP/USD:

The British pound rose in the first half of the day on the back of a solid UK services PMI reading. However, further movement will depend on key U.S. labor market data, including non-farm employment change, unemployment rate, and average hourly earnings. The ISM services PMI and composite PMI for June will also be released later today.

If the U.S. data is strong, pressure on the pound will likely return. In that case, I plan to buy only near major support at 1.3610. A false breakout at this level will provide a good long entry point with a target of returning to the 1.3661 resistance, where trading is currently concentrated. A breakout and retest of this range from above on weak U.S. data will offer another buying opportunity, targeting 1.3707. The final target will be the 1.3746 level, where I plan to take profit.

If GBP/USD declines and there is no bullish activity around 1.3610 in the second half of the day, pressure on the pound may increase significantly. In this case, I will only buy on a false breakout near 1.3565. Alternatively, I plan to open long positions on a rebound from the 1.3532 support, targeting a 30–35 point intraday correction.

To open short positions on GBP/USD:

Sellers have taken a wait-and-see approach after yesterday's sell-off, as all attention now turns to the U.S. labor market data. The key task remains defending resistance at 1.3661, where trading is currently taking place. A false breakout after the data release will signal a short entry with a target of a decline toward the 1.3610 support.

A breakout and retest of this area from below will trigger stop-loss orders and open the path toward 1.3565. The final target will be the 1.3532 level, where I plan to take profit.

If demand for the pound returns in the second half of the day and bears do not act around 1.3661—just above where the moving averages are currently located, supporting the bearish outlook—GBP/USD could see a larger upward move. In that case, I will delay short entries until the 1.3707 resistance is tested, and only sell there on a false breakout. If there is no reversal at that level either, I'll look for short entries on a bounce near 1.3746, targeting a 30–35 point downward correction.

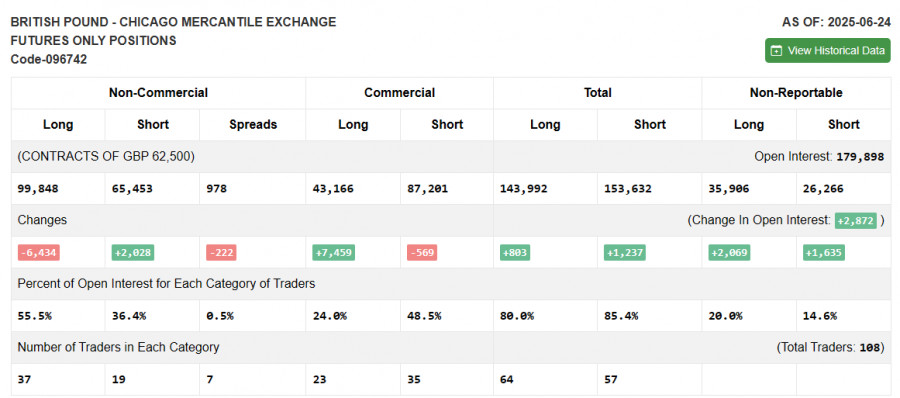

Commitment of Traders (COT) Report (June 24):

The latest COT report showed an increase in short positions and a reduction in long ones. The British pound continues to show solid bullish momentum, supported by recent UK GDP and inflation data. The fact that the U.S. Federal Reserve may cut interest rates earlier than previously expected is already weighing on the U.S. dollar.

Upcoming U.S. labor market reports will determine the next direction for GBP/USD. According to the latest COT report, long non-commercial positions decreased by 6,434 to 99,848, while short non-commercial positions rose by 2,028 to 65,453. As a result, the net long position narrowed by 222.

Indicator Signals:

Moving AveragesTrading is occurring below the 30- and 50-period moving averages, indicating potential downward pressure.

Note: The author uses the H1 chart to analyze moving averages, which differs from the classic daily (D1) chart approach.

Bollinger BandsIf the price declines, the lower Bollinger Band around 1.3625 will act as support.

Indicator Descriptions:

- Moving Average (MA): Smooths out volatility and noise to indicate the current trend.

- 50-period (yellow line)

- 30-period (green line)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA: 12-period

- Slow EMA: 26-period

- Signal line (SMA): 9-period

- Bollinger Bands:

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: The total long open interest held by non-commercial traders.

- Short non-commercial positions: The total short open interest held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions held by non-commercial traders.