Trade Analysis and Recommendations for the European Currency

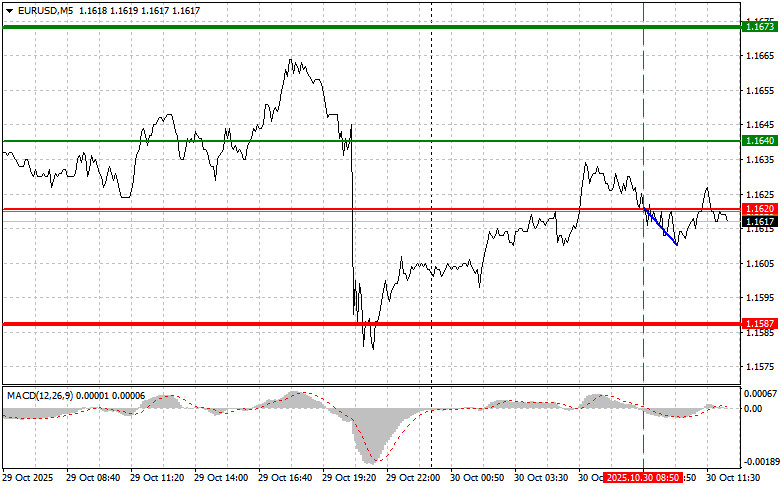

The price test of 1.1620 occurred at the moment when the MACD indicator had just begun to move downward from the zero line, confirming the correct entry point for selling the euro. As a result, the pair fell by 12 points, after which the pressure subsided.

The European currency showed a moderate reaction to German employment data, which exceeded analysts' expectations. The released figures undoubtedly added positivity to the overall outlook, indicating the resilience of the German economy despite external pressures. However, this favorable trend did not lead to active euro buying, as market participants are focused on the European Central Bank (ECB) meeting. It is evident that the regulator will once again leave interest rates unchanged, emphasizing the positive decline in price pressures. Nevertheless, any signals of more decisive measures to support the economy could significantly affect the euro's value. In addition, it is important to consider the complex geopolitical situation, which continues to have an indirect impact on currency markets. An escalation of conflicts or, conversely, signs of resolution can cause significant euro fluctuations, as we have recently observed. Therefore, investors are advised to exercise caution and take into account a wide range of factors when making investment decisions.

After the ECB meeting, attention should shift to Christine Lagarde's speech. Every word spoken by the ECB President will be carefully analyzed for the slightest hints about the ECB's future plans. Of particular interest will be the ECB's assessment of the current economic state of the eurozone and its outlook. Any mention of growth slowdown risks would likely push the ECB to adopt a softer policy stance.

Regarding intraday strategy, I will rely primarily on Scenarios #1 and #2.

Buy Signal

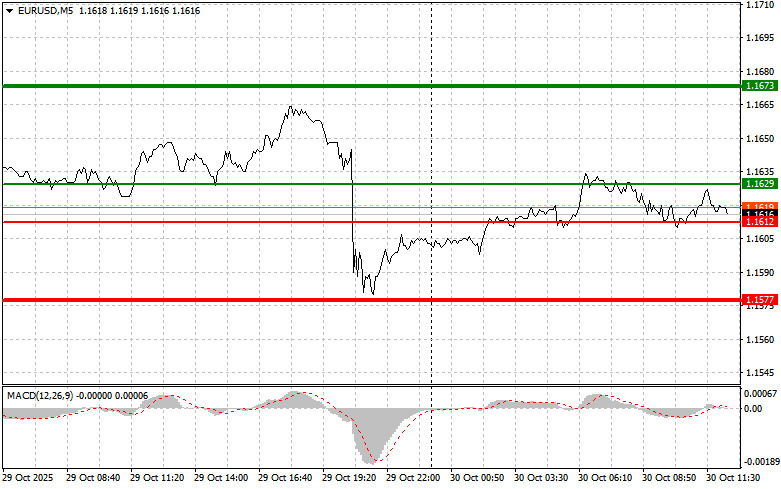

Scenario #1: Today, the euro can be bought when the price reaches around 1.1629 (green line on the chart) with a target of 1.1673. At 1.1673, I plan to exit the market and open a sell position in the opposite direction, expecting a movement of 30–35 points from the entry point. Euro growth today may occur if the ECB takes a firm stance.Important: Before buying, make sure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1612 price level at a time when the MACD is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward the 1.1629 and 1.1673 levels can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.1612 level (red line on the chart). The target will be 1.1577, where I intend to exit the market and immediately open a buy position in the opposite direction (expecting a movement of 20–25 points upward from that level). Pressure on the pair could return at any moment today.Important: Before selling, make sure the MACD indicator is below the zero line and is just beginning to move downward from it.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1629 price level while the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the 1.1612 and 1.1577 levels can be expected.

Chart Explanation

- Thin green line – Entry price at which a buy position can be opened.

- Thick green line – Approximate price where Take Profit can be placed or profits can be taken manually, as further growth above this level is unlikely.

- Thin red line – Entry price at which a sell position can be opened.

- Thick red line – Approximate price where Take Profit can be placed or profits can be taken manually, as further decline below this level is unlikely.

- MACD indicator – When entering the market, it is important to use overbought and oversold zones as guidance.

Important Note for Beginner Traders

Forex beginners should be very cautious when making entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news events, always use stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

And remember: successful trading requires a clear trading plan, such as the one outlined above. Spontaneous trading decisions, based on current market fluctuations, are a losing strategy for intraday traders from the very start.