Analysis of Tuesday's Trades

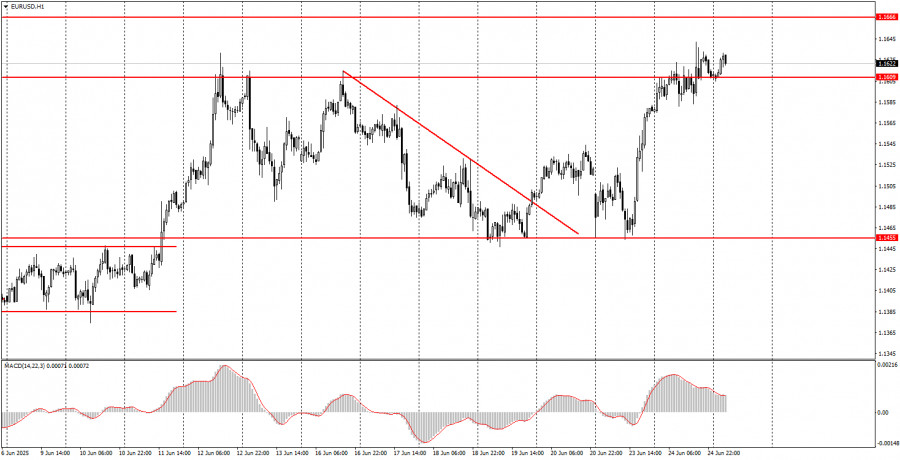

1H Chart of EUR/USD

The EUR/USD currency pair continued its upward movement on Tuesday overall. This time, the market witnessed an entire circus act performed by Donald Trump. Recall that on Tuesday morning, the U.S. President declared the war between Israel and Iran over. Yet just a few hours later, Tehran launched missiles toward its opponent, which immediately provoked a retaliatory strike. Throughout this time—while Jerusalem and Tehran kept shelling each other or preparing for new attacks—Trump was trying to mediate the conflict once again. Then, he wrote on his own social media platform that he was very displeased with both Israel and Iran.

Later in the day, Israeli authorities declared that Iran was no longer a "nuclear state," while Iranian authorities announced a complete victory over Israel, which had unilaterally ceased military actions. Everyone claimed victory, no one lost, goals were achieved, Trump became a peacemaker and is now ready to receive a Nobel Prize. Everyone is happy, everyone is satisfied—except for the U.S. dollar, which is once again falling into the abyss as market participants now view such a serious and grim situation as little more than a farce orchestrated by the U.S.

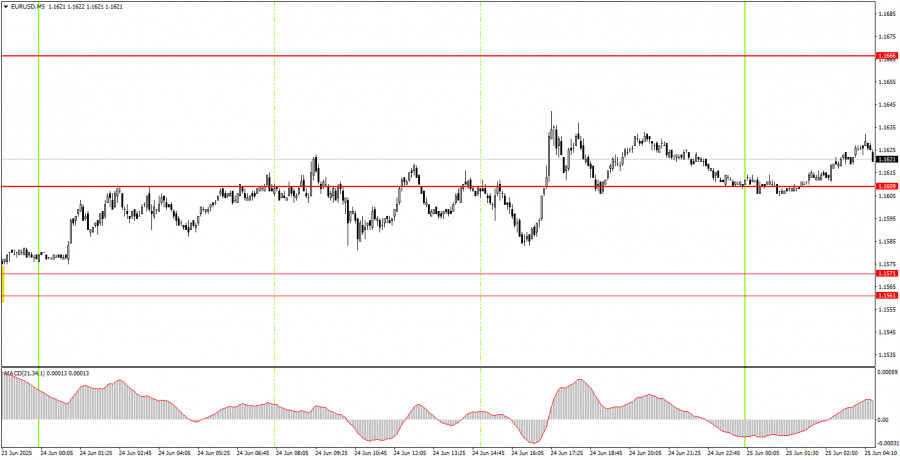

5M Chart of EUR/USD

On the 5-minute timeframe, Tuesday's movements were far from ideal, even though the euro appreciated by the end of the day. All five signals that formed during the day clustered around the 1.1609 level, and virtually all were false. Therefore, novice traders could only have profited from trading the pound, while in the case of the euro, only the first two signals were worth executing—and they didn't generate any profit.

Trading Strategy for Wednesday:

The EUR/USD pair continues its upward trend on the hourly timeframe, which began under Trump and will likely end only under the next president. In principle, Trump being the US president is sufficient for the US dollar to decline regularly. Even the escalation of the Iran-Israel conflict had little impact on the dollar's overall position since the U.S. turned out to be a full participant in the conflict. But now the war is over, geopolitical tension has subsided, oil prices are falling, and Trump has been nominated for a Nobel Prize. Once again, the dollar has no fundamental basis for growth.

On Wednesday, the EUR/USD pair may continue its upward movement, as the descending trendline has been broken. Yesterday, the price reached new three-year highs, overcoming the key level at 1.1609.

On the 5-minute timeframe, the relevant levels to watch are: 1.1132–1.1140, 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1561–1.1571, 1.1609, 1.1666, 1.1704, 1.1802. As for important events on Wednesday, we note only Powell's second testimony before the U.S. Congress. Since no significant information emerged from the first speech, we are not expecting any groundbreaking news from the second one either.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.