Wall Street Ends Lower as Tariff Concerns Resurface

U.S. stocks slipped on Tuesday as investor sentiment turned cautious following fresh warnings from major companies about the impact of trade tariffs. Yum Brands was among those pointing to tariffs as a key factor affecting their performance and forecasts.

Trade Gap Narrows on Declining Imports

Government data revealed that the U.S. trade deficit shrank in June, driven by a sharp drop in consumer goods imports. Notably, the trade shortfall with China fell to its lowest point in more than two decades — a signal of shifting economic dynamics.

Services Sector Feels the Heat

The services sector showed signs of cooling in July. Businesses cited rising costs directly linked to new import tariffs, highlighting a growing strain on operations across a wide range of industries.

Corporate Earnings Reflect Tariff Pressures

Second-quarter earnings have laid bare the weight of escalating trade policies. Yum Brands, parent company of fast-food chains like KFC, saw its shares tumble by 5.1 percent after falling short of expectations — a result partially attributed to reduced consumer spending under the pressure of high tariffs.

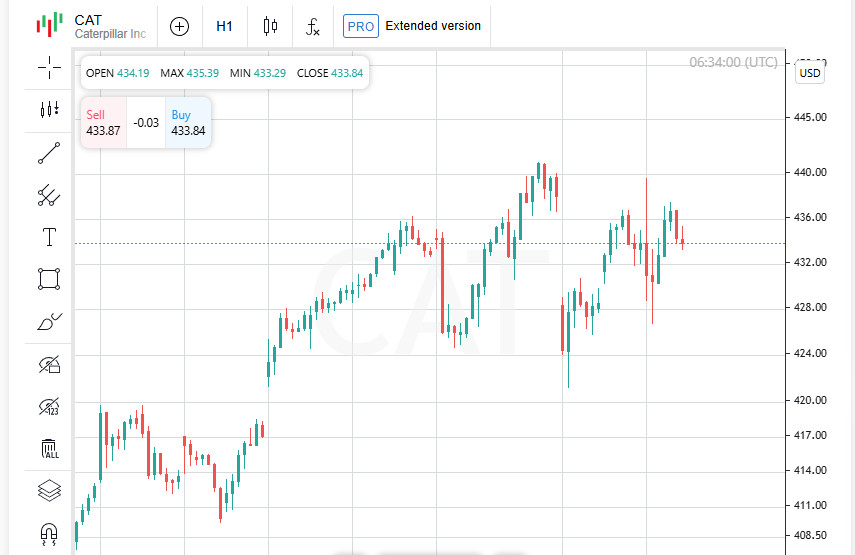

Caterpillar echoed similar concerns, forecasting that U.S. tariffs would cost the company up to 1.5 billion dollars this year. Despite this, its stock dipped only slightly by 0.1 percent.

Earnings Season Still Offers Optimism

Despite these warnings, the broader earnings picture remains upbeat. Around 80 percent of S and P 500 companies have reported results above analyst forecasts, lending support to market confidence.

Indices Close in the Red

By market close, the Dow Jones Industrial Average had fallen by 61.9 points or 0.14 percent to finish at 44111.74. The S and P 500 dropped 30.75 points, a decline of 0.49 percent, ending at 6299.19. The Nasdaq Composite retreated 137.03 points or 0.65 percent to close at 20916.55.

Trump Signals New Tariffs Ahead: Pharma and Chip Imports Under Scrutiny

On Tuesday, Donald Trump reignited trade tensions with a fresh warning about upcoming tariffs. The president said the United States is considering initial, relatively small levies on pharmaceutical imports, with the possibility of raising them over time. He also indicated that new tariffs targeting semiconductors and microchips could be announced as early as next week.

Markets Climb Despite Policy Uncertainty

Despite renewed trade concerns, Wall Street has continued its strong momentum. The S and P 500 has climbed 7.1 percent since the start of the year, reaching a series of all-time highs alongside the Nasdaq, buoyed by strong performances in tech and consumer sectors.

Marriott Lowers Outlook Amid Economic Worries

Earnings season remains in full swing. Marriott International revised down its annual forecast for revenue and profit growth, citing a slowdown in travel demand and growing global economic uncertainty. Surprisingly, shares of the hotel chain edged up by 0.2 percent at market close, signaling limited investor concern.

Disney and McDonald's Reports Awaited

Although earnings season is nearing its end, several key reports are still on deck. Investors are closely watching for Wednesday's results from entertainment giant Walt Disney and fast-food powerhouse McDonald's, both of which could influence broader market sentiment.

Asia Follows Wall Street Downward

Asian stock markets mirrored Wall Street's losses on Wednesday, as soft U.S. economic data fueled concerns over the real costs of trade tariffs. Investors reacted to evidence that tariffs are weighing on economic activity and corporate profits, while the U.S. dollar weakened amid falling bond yields.

Service Sector Stalls While Costs Spike

New data released Tuesday showed that the U.S. services sector stagnated in July, with no significant change in business activity. Employment levels continued to decline, while production costs surged to their highest level in nearly three years — a clear sign of the mounting pressure created by Trump's tariff strategies.

Asian Markets Show Mixed Performance

On Tuesday, Asia-Pacific equity markets closed with a mixed tone. The MSCI index tracking the region outside of Japan slipped by 0.2 percent, while Japan's Nikkei index edged up by the same amount, rising 0.2 percent.

Chinese and Hong Kong Benchmarks Hold Steady

Key indices in mainland China and Hong Kong remained largely flat. Both the CSI 300, representing top Chinese blue chips, and the Hang Seng index in Hong Kong showed minimal movement, reflecting a wait-and-see attitude among investors.

US Futures in the Red

Early morning trading saw US stock futures trending lower. Nasdaq futures dropped by 0.3 percent, while S and P 500 futures declined by 0.1 percent, as traders responded cautiously to renewed political rhetoric and potential tariff moves.

Trump Teases New Tariffs on Tech and Pharma

US President Donald Trump revealed plans to impose fresh tariffs on imported semiconductors and microchips, hinting that an official announcement could come as soon as next week. He also mentioned an initial round of modest tariffs on pharmaceutical imports, with a possibility of significant increases over the next one to two years.

China Talks Progress, But India Faces Warning

Trump added that the United States is nearing a trade agreement with China. He expressed optimism about meeting Chinese President Xi Jinping before year-end, provided the deal is finalized. However, he also issued a stern warning to India, threatening higher tariffs on Indian goods in response to continued purchases of Russian oil.

Dollar Recovers After Job Report Shock

On currency markets, the US dollar has regained some footing following a sharp drop last Friday triggered by disappointing employment data. That report led investors to believe a Federal Reserve rate cut in September is almost certain. Currently, the dollar index, which tracks the greenback against six major currencies, stands at 98.821 — unchanged from the previous session but up 0.1 percent so far this week, partly recovering from the prior 1.4 percent fall.

Markets Expect Rate Cut as Odds Hit 94 Percent

According to the latest figures from CME's FedWatch tool, futures are now pricing in a 94 percent probability that the Federal Reserve will lower interest rates at its upcoming meeting. Traders are also factoring in at least two rate cuts by the end of the year, reflecting growing market conviction that monetary easing is on the horizon.

Oil Prices Rebound After Four-Day Slump

Crude oil prices posted a slight recovery following four consecutive sessions of declines. US West Texas Intermediate crude edged up by 0.2 percent to settle at 65.3 dollars per barrel. Meanwhile, Brent crude gained 0.1 percent, though it remains at a one-month low of 67.78 dollars per barrel.

Trump Eyes Sanctions on Russian Oil Buyers

On Tuesday, Donald Trump said he would consider imposing sanctions on nations that continue to purchase oil from Russia. The president noted that a final decision would follow a meeting scheduled for Wednesday with Russian officials.

Gold Holds Steady Amid Market Caution

Spot gold prices showed no movement, remaining flat at 3381 dollars per ounce. The stability in precious metals suggests that investors are in a wait-and-see mode, possibly anticipating further economic developments before making new moves.