The GBP/USD currency pair traded predominantly sideways on Friday, despite a barrage of macroeconomic data. We will discuss these reports in more detail, but overall, the technical and fundamental picture for the pound aligns 80-90% with that of the euro. The difference lies in the fact that the British currency has seen slightly more justification for its decline in recent months than the euro. Recall that the euro had almost no grounds for a decline. In the UK, a significant portion of important statistics has faltered, and the Bank of England may lower its key interest rate at its last meeting of the year, unlike the European Central Bank, which has already completed its easing cycle. This is likely why the British currency has fallen slightly more than the euro and exited the sideways channel on the daily timeframe.

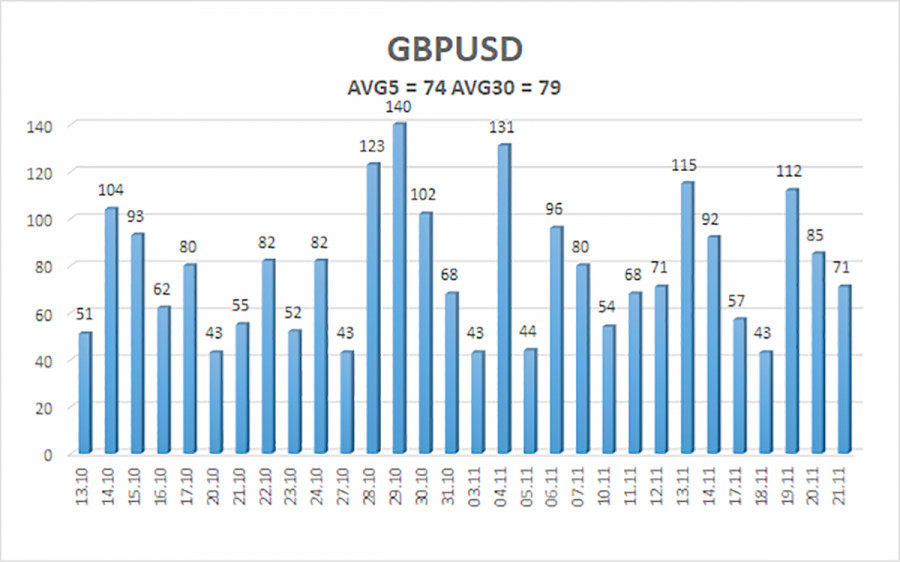

Since the steeper decline was somewhat coincidental, we continue to view the entire drop in GBP/USD over the past months as a correction. A correction that has dragged on significantly, but the market shows no eagerness to move right now. Volatility has dropped to, if not minimum levels, then certainly to quite low levels. Historically, the British pound has been more volatile than the euro, so 50 pips in the euro is comparable to 70 pips in the pound.

What to do with all this information? We maintain our view that the upward trend will resume in any case. When it does resume, the current picture might be reversed. The dollar could fall daily, while experts will once again frantically concoct explanations for such movement, using the favorite phrase "rising risk appetite." In reality, the dollar has accumulated factors for a drop of at least 700-800 pips. It's just that market makers have not finalized their positions or are waiting for a suitable moment to start a new trend.

It must be acknowledged that the British economy indeed looks very weak. It has been weak for about 10 years, since Britain decided to leave the EU. However, the American fundamental backdrop is significantly more important than the British one, if only because there is far more U.S. currency in circulation than British currency, and the dollar itself remains a pillar of the global financial system. Its attractiveness has been declining since Donald Trump became President of the United States, but losing global leadership cannot happen in just one year. Hence, the more negative news from across the ocean, the more likely the dollar is to fall in the long run.

In the short term, the British pound will again attempt to "find the bottom" from which it can bounce. As we have mentioned many times, the indicator has grown tired of drawing "bullish" divergences and entering oversold territory. All these are signals indicating a potential resumption of an upward trend. Therefore, in the near future, we will pay close attention to signals of a trend change on the 4-hour timeframe. The pair cannot correct forever.

The average volatility of the GBP/USD pair over the last five trading days is 74 pips, and it continues to decline. For the GBP/USD pair, this value is considered "average." On Monday, November 24, we expect movement within the range limited by levels 1.3021 and 1.3169. The upper channel of the linear regression is downward-sloping, but this is only due to a technical correction on the higher timeframes. The CCI indicator has entered oversold territory for the sixth time in recent months and has formed another bullish divergence.

Nearest Support Levels:

S1 – 1.3062

S2 – 1.2939

S3 – 1.2817

Nearest Resistance Levels:

R1 – 1.3184

R2 – 1.3306

R3 – 1.3428

Trading Recommendations:

The GBP/USD currency pair is attempting to resume the upward trend of 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the U.S. currency to appreciate. Therefore, long positions with targets of 1.3306 and 1.3428 remain relevant in the near term if the price is above the moving average. If the price is below the moving average line, short positions can be considered with a target of 1.3021 on technical grounds. From time to time, the dollar hints at corrections (on a global scale), but for a trend to strengthen, it needs real signs of an end to the trade war or other global positive factors.

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, then the trend is currently strong;

- The moving average line (settings 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted;

- Murray levels are targeted levels for movements and corrections;

- Volatility levels (red lines) denote the probable price channel within which the pair will trade in the coming day, based on current volatility metrics;

- The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.