Analysis of Trades and Trading Tips for the British Pound

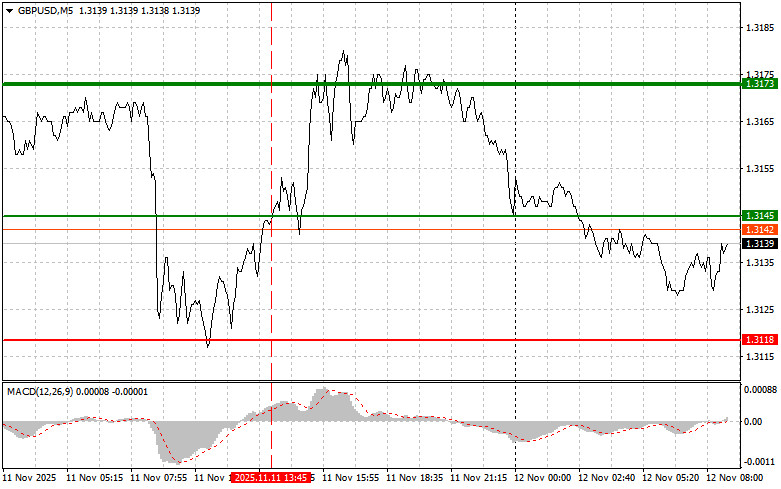

The price test at 1.3145 occurred when the MACD indicator had risen significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy the pound and missed the pair's upward movement.

The unexpectedly high unemployment rate and the slowing wage growth caused a brief panic among investors, leading to a momentary drop in the pound. However, demand quickly returned, resulting in trading within a range. The main factor for the pound's recovery was the overall weakness of the US dollar, which, in turn, was driven by growing expectations regarding further interest rate cuts by the Federal Reserve.

Today, apart from the speech by Bank of England Monetary Policy Committee member Huw Pill, no economic indicators are scheduled for release, so the market's attention will be entirely focused on his statements. Market participants and experts will try to catch signals about the BoE's future monetary policy decisions in every word. His thoughts on combating inflation, economic growth prospects, and future moves regarding the key interest rate will be particularly significant. The market is eager to hear Pill's opinion on the latest labor market data, which suggests a slowdown. If he implies that the BoE is considering this information and is ready to take a softer stance on rate cuts, it could negatively affect the pound's exchange rate. Conversely, if he emphasizes the importance of maintaining a strict policy to curb inflation, the pound may strengthen.

Regarding the intraday strategy, I will rely more on implementing Scenario #1 and Scenario #2.

Buy Signal

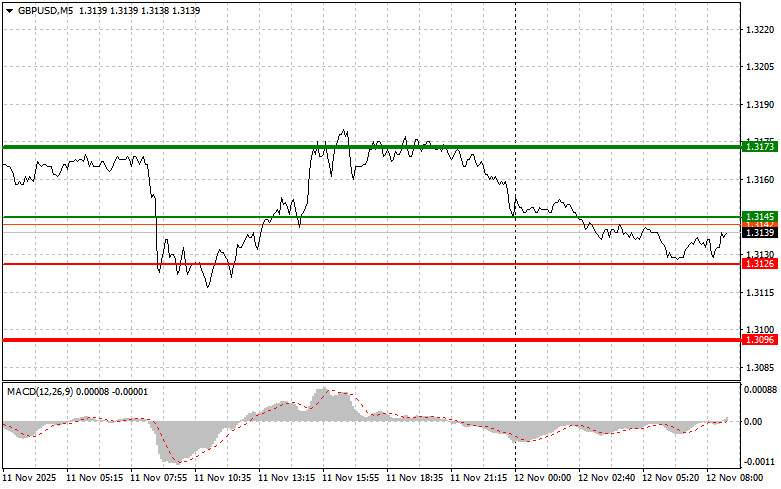

- Scenario #1: Today, I plan to buy the pound at an entry point around 1.3145 (green line on the chart), targeting a move to 1.3173 (thicker green line on the chart). At 1.3173, I will exit my long positions and open shorts in the opposite direction, anticipating a movement of 30-35 pips from the level. Growth in the pound today is expected to follow the pair's observed upward trend. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

- Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3126 while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. One can expect growth to the opposing levels of 1.3145 and 1.3173.

Sell Signal

- Scenario #1: I plan to sell the pound today after the 1.3126 level (red line on the chart) is breached, which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3096 level, where I will exit the short positions and immediately buy in the opposite direction, anticipating a move of 20-25 pips from there. Pressure on the pound will return if Pill adopts a soft position. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline from it.

- Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3145 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. One can expect a decrease to the opposing levels of 1.3126 and 1.3096.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.