Analysis of Deals and Trading Tips for the Euro

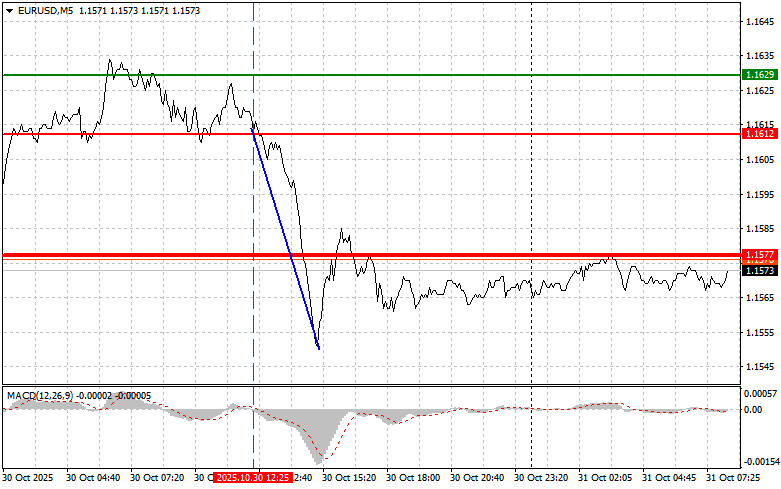

The price test at 1.1612 came as the MACD indicator began to move down from the zero mark, confirming the correct entry point for selling euros, resulting in a drop of more than 60 pips in the pair.

Among the key factors negatively impacting the euro, the US dollar's general strengthening stands out. After the conclusion of the trade agreement between the US and China, the American currency began to regain demand, even though European economic indicators yesterday were better than economists' forecasts, and the European Central Bank, unlike the US Federal Reserve, kept interest rates unchanged rather than lowering them.

Today, in the first half of the day, data on changes in Germany's retail sales for September and the Eurozone consumer price index for October are expected. Retail sales volumes in Germany, a barometer of consumer demand, will shed light on the state of the Eurozone's largest economy. A decline in indicators may indicate growing concerns among households and negatively affect the overall prospects of the region. The Eurozone consumer price index will provide key information on inflation dynamics. If the price growth rates turn out to be lower than expected, it may prompt the European Central Bank to consider more active measures to stimulate economic growth, which in the short term could harm the euro.

As for the intraday strategy, I will rely more on the implementation of scenarios #1 and #2.

Buying Scenarios

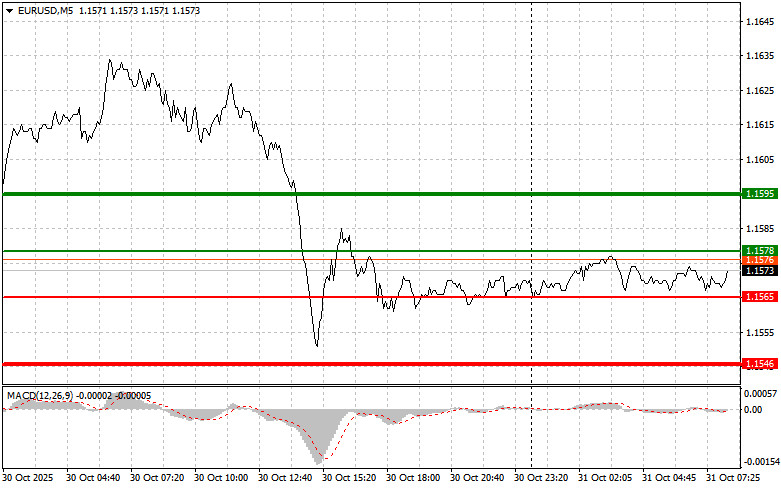

Scenario #1: Today, buying euros is possible when the price reaches around 1.1578 (green line on the chart), with the intention of rising to 1.1595. At point 1.1595, I plan to exit the market and also sell euros back, aiming for a movement of 30-35 pips from the entry point. Growth in euros can only be expected within the framework of a correction. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move.

Scenario #2: I also intend to buy euros today in case of two consecutive tests of the price at 1.1565 when the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to an upward market reversal. An increase to the opposite levels of 1.1578 and 1.1595 can be expected.

Selling Scenarios

Scenario #1: I plan to sell euros after the price reaches 1.1565 (red line on the chart). The target will be 1.1546, where I intend to exit the market and immediately buy back (aiming for a move of 20-25 pips in the opposite direction from the level). Pressure on the pair may return at any moment today. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning its downward movement from it.

Scenario #2: I also plan to sell euros today if the price tests 1.1578 twice in a row while the MACD indicator is in the overbought area. This will limit the upside potential of the pair and lead to a market reversal downwards. A decline to the opposite levels of 1.1565 and 1.1546 can be expected.

What is on the Chart:

Thin green line – entry price for buying the trading instrument;

Thick green line – estimated price where Take Profit can be placed or profits can be secured, as further growth above this level is unlikely.

Thin red line – entry price for selling the trading instrument;

Thick red line – estimated price where Take Profit can be placed or profits can be secured, as further decline below this level is unlikely;

MACD indicator. When entering the market, it is essential to rely on the overbought and oversold zones.

Important. Beginner traders in the Forex market need to be very cautious when making entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sudden exchange rate fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, you need a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are fundamentally a losing strategy for intraday traders.