Review of Trades and Trading Tips for the British Pound

A price test at 1.3369 occurred when the MACD indicator had just begun moving downward from the zero line, confirming a correct entry point for selling the pound. As a result, the pair declined toward the target level of 1.3331.

The British pound plummeted after additional U.S. Federal Reserve officials expressed concern over inflation yesterday, favoring a more cautious stance on interest rate policy. This unexpected tightening in the rhetoric of the U.S. central bank had an immediate impact on the currency markets.

Investors, who had previously hoped for a quick rate cut to stimulate the economy, are now forced to revise their strategies. The pound, which is traditionally sensitive to changes in U.S. monetary policy, came under intense pressure.

The reason for this sharp shift in Fed sentiment lies in persistently high inflation, which, contrary to expectations, shows little sign of weakening. Fed officials fear that further monetary easing could lead to uncontrolled price growth and destabilization of the financial system.

Today, there is no economic data from the United Kingdom. Therefore, in the first half of the day, the pair may show a slight recovery. After yesterday's sell-off marathon—triggered by concerns over the Fed's monetary policy trajectory and its potential impact on the British economy—this break in the news flow creates opportunities for technical correction.

The absence of new macroeconomic data that could worsen investor sentiment may allow the pair to take a breather and recover some of the lost ground. However, optimism should be treated with caution. Any recovery will likely be short-term and limited. The fundamental challenges pressuring the British pound have not gone away.

As for the intraday strategy, I will focus mainly on implementing Scenarios 1 and 2.

Scenarios for Buying

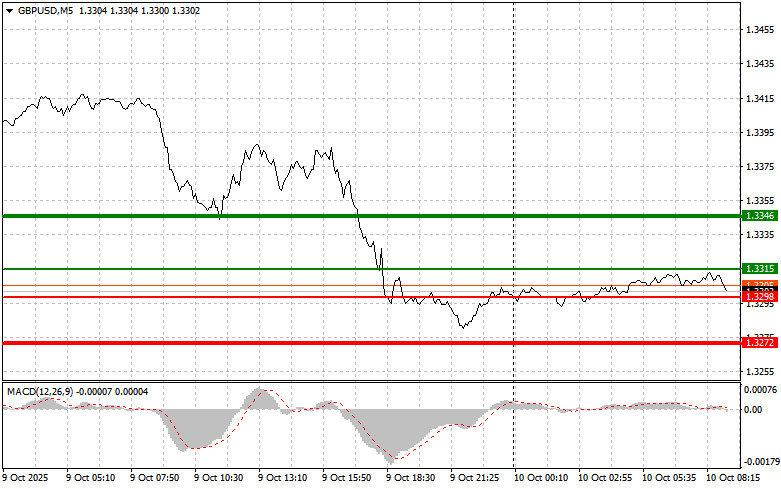

Scenario 1: I plan to buy the pound today upon reaching the entry point around 1.3315 (green line on the chart), with a target of rising to 1.3346 (thicker green line on the chart). Around 1.3346, I intend to exit long positions and open short positions in the opposite direction (anticipating a 30–35 pip pullback from the level). Buying the pound today should be considered only within the framework of a correction. Important: Before buying, make sure the MACD indicator is above the zero line and has just started to rise from it.

Scenario 2: I also plan to buy the pound today in case of two consecutive tests of the 1.3298 level while the MACD indicator is in the oversold zone. This will limit the downside potential of the pair and lead to an upward reversal. Growth can be expected toward 1.3315 and 1.3346.

Scenarios for Selling

Scenario 1: I plan to sell the pound today after breaking below the 1.3298 level (red line on the chart), which will lead to a quick decline of the pair. The key target for sellers will be 1.3272, where I intend to exit short trades and immediately open long trades in the opposite direction (anticipating a 20–25 pip move back from the level). Pound sellers will seek to extend their advantage at every opportunity. Important: Before selling, make sure the MACD indicator is below the zero line and has just started to decline from it.

Scenario 2: I also plan to sell the pound today in case of two consecutive tests of the 1.3315 level while the MACD indicator is in the overbought zone. This will limit the upside potential of the pair and result in a downward reversal. Price movement may continue toward 1.3298 and 1.3272.

What is represented on the chart:

A thin green line — the entry price at which the trading instrument can be bought

A thick green line — the estimated level where taking profit is advisable or where profit can be fixed manually, since further growth above this level is unlikely

A thin red line — the entry price at which the trading instrument can be sold

A thick red line — the estimated level where taking profit is advisable or where profit can be fixed manually, since further decline below this level is unlikely

MACD Indicator — When entering the market, it is important to consider overbought and oversold zones

Important. Beginner traders in the Forex market must make very cautious decisions when entering the market. Before important fundamental reports are released, the best option is to stay out of the market to avoid sudden price volatility. If you decide to trade during data releases, always place stop orders to minimize losses. Without using stop orders, you can very quickly lose your entire deposit, especially if you avoid using money management and trade in large volumes.

And remember, for successful trading, you need a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.