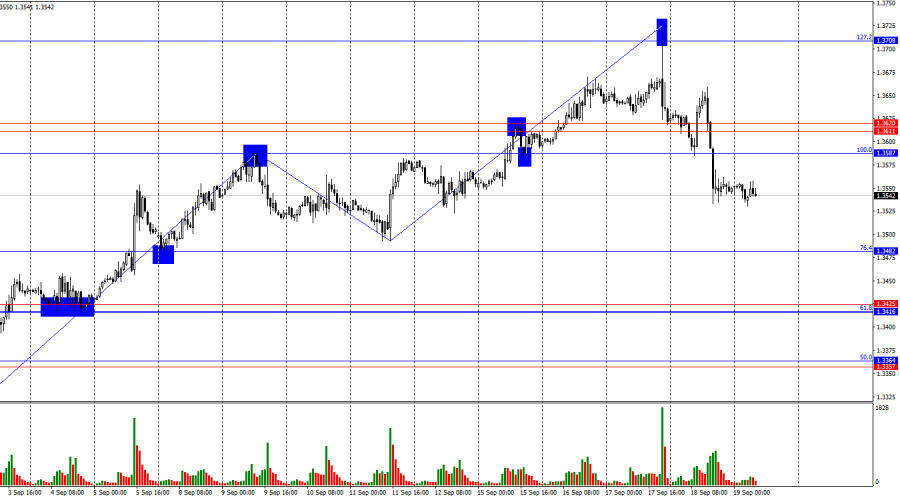

On the hourly chart, the GBP/USD pair on Thursday consolidated below the support zone of 1.3587–1.3611, which allows for a continued decline of the pound toward the 76.4% retracement level at 1.3482. A rebound from 1.3482 followed by growth will keep the trend "bullish." However, over the past two days, developments have been unfavorable for bulls and for the pound.

The wave structure remains "bullish." The last completed downward wave did not break the previous low, while the last upward wave easily broke the previous peak. For the most part, the news background this week was neutral for the pound, but Thursday and Friday spoiled the picture. The trend will shift to "bearish" after a confident break of the last wave's low.

The Bank of England concluded another meeting yesterday and hinted at the possibility of another monetary policy easing before year-end. If that happens, the UK regulator will have cut rates four times in total, as was planned at the start of the year. In recent months, many traders (myself included) began to doubt the rationale for another easing, given that inflation in the UK continues to rise. It did not increase in August, and core inflation even slowed slightly, but overall both measures remain far from the Bank of England's target. Nevertheless, Andrew Bailey believes inflation will return to 2% over time, which opens the door for another rate cut. I personally doubt that inflation will fall while rates are being reduced, but traders received a "dovish" signal yesterday, prompting bears to go on the offensive. How long their attack will last remains unclear. This morning, the UK released another important retail sales report, which came in above traders' expectations. However, bears continue their attack, which is somewhat at odds with the news background. Chart analysis gave a sell signal, but the news background does not allow me to expect a sharp fall in the pound.

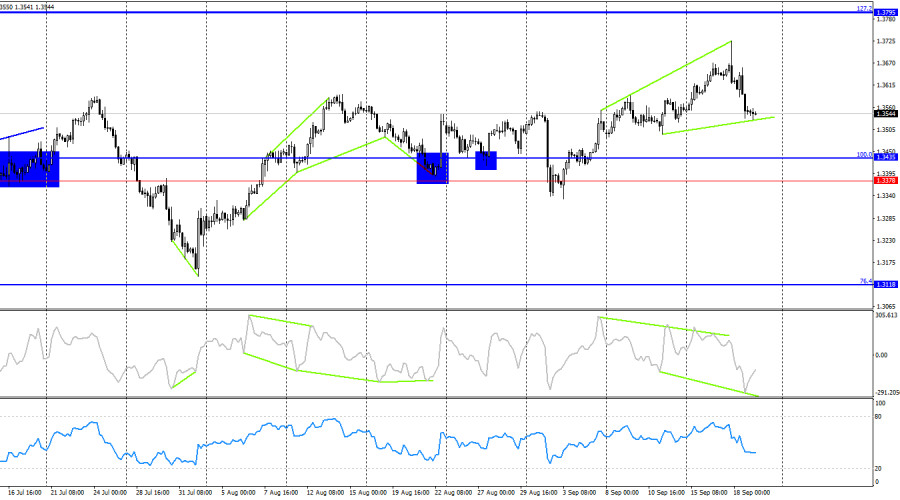

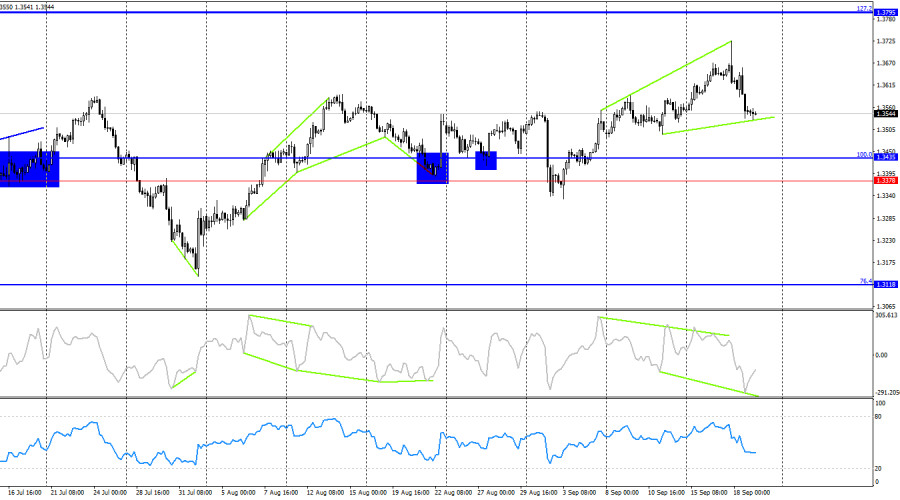

On the 4-hour chart, the pair reversed in favor of the US dollar after forming a "bearish" divergence on the CCI indicator and following the Bank of England and Fed meetings. The decline continues at present toward the support zone of 1.3378–1.3435, despite another, now "bullish," divergence on the CCI. A rebound from the 1.3378–1.3435 zone will work in favor of the pound and some upward movement.

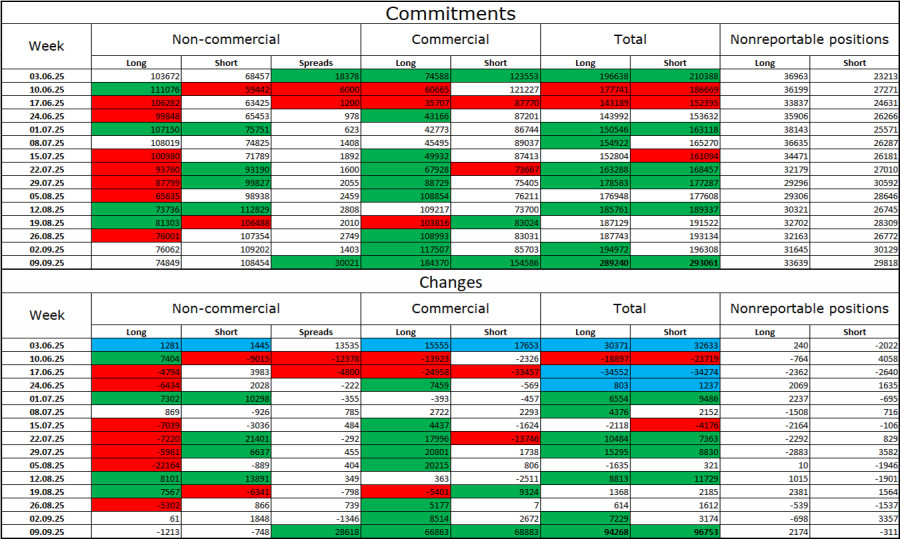

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" category of traders did not change over the last reporting week. The number of long positions held by speculators decreased by 1,213, while the number of short positions fell by 748. The gap between long and short positions is now roughly 75,000 versus 109,000. Yet, as we can see, the pound still tends toward growth, and traders lean toward buying.

In my view, the pound retains prospects for decline. The news background for the US dollar during the first six months of the year was dreadful, but it is gradually improving. Trade tensions are easing, key deals are being signed, and the US economy in the second quarter will recover thanks to tariffs and various investments in the country. At the same time, expectations of further Fed monetary easing in the second half of the year are already creating significant pressure on the dollar: the US labor market is weakening, and unemployment is rising. Thus, I still see no grounds for a "dollar trend."

News calendar for the US and the UK:

United Kingdom – Retail Sales (06:00 UTC).

On September 19, the economic calendar contains exactly one entry, which has already been released and had no impact on trader sentiment. The news background will not affect market sentiment for the rest of the day.

GBP/USD forecast and trading tips:

Sales of the pair were possible on a rebound from the 1.3708 level on the hourly chart with a target at the 1.3611–1.3620 level. That target was achieved. New sales could be considered on a close below the 1.3587–1.3620 level with a target at 1.3482. These trades can now remain open, and a close below 1.3482 will open the way toward the 1.3416–1.3425 level. Purchases can be considered on a rebound from 1.3482 or from the 1.3416–1.3425 level.

The Fibonacci grids are built from 1.3586–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.