Bitcoin yesterday once again climbed to the $113,200 level but quickly slipped back, indicating a lack of active buyers above this range. Apparently, many are hesitant to push higher and are taking a wait-and-see approach.

This is also confirmed by Santiment data, which notes that sentiment among crypto traders has deteriorated significantly. The crowd is now expecting BTC to fall below $100,000, and ETH below $3,500.

Such a shift in sentiment, however, is nothing unusual for the volatile world of cryptocurrencies. After a period of strong growth and optimism, correction and pessimism are usually inevitable. It's a kind of pendulum swinging between hope and fear, causing investors to act impulsively and often irrationally. But it is precisely at such moments—when most are panicking and predicting an imminent crash—that opportunities arise for more disciplined and calculated players. The ability to stay calm, analyze long-term prospects, and not follow the crowd's mood—that's what sets successful investors apart from those who lose their savings during periods of short-term fluctuations.

Santiment experts describe current market sentiment as "FUD" and remind us that this is historically bullish. Indeed, a state of general Fear, Uncertainty, and Doubt (FUD) often signals the coming of a trend reversal and provides a unique opportunity to enter the market at attractive prices. When most traders are panicking and rushing to get rid of assets, it creates an ideal environment for consolidation and subsequent growth. It's a kind of "spring cleaning" in the market, sweeping out the weak hands while the strong accumulate positions.

However, it's important to understand that not every FUD period ends with an immediate price surge. Sometimes it takes time for emotions to settle and the market to absorb the negative news. Still, historical data shows that a cautious and measured approach to investing during FUD phases can yield tangible results. The key is not to panic with everyone else, but to look at the situation with a clear head and remember that after every storm, calm inevitably follows.

As for my intraday strategy in the crypto market, I will continue to buy any major dips in Bitcoin and Ether, expecting the medium-term bull market—which hasn't gone anywhere—to continue.

For short-term trades, my strategy and conditions are described below.

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today upon reaching an entry point around $111,800, aiming for a rise to $113,000. Around $113,000, I will exit buy positions and sell immediately on the pullback. Before buying a breakout, ensure the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory.

Scenario #2: You can also buy Bitcoin from the lower boundary at $111,200 if there is no market reaction to its breakdown, aiming for a reversal to $111,800 and $113,000.

Sell Scenario

Scenario #1: I will sell Bitcoin today upon reaching an entry point around $111,200, aiming for a fall to $110,300. Around $110,300, I will exit sell positions and immediately buy on the rebound. Before selling a breakout, make sure the 50-day moving average is above the current price and that the Awesome Oscillator is in negative territory.

Scenario #2: You can also sell Bitcoin from the upper boundary at $111,800 if there is no market reaction to its breakdown, aiming for a reversal to $111,200 and $110,300.

Ethereum

Buy Scenario

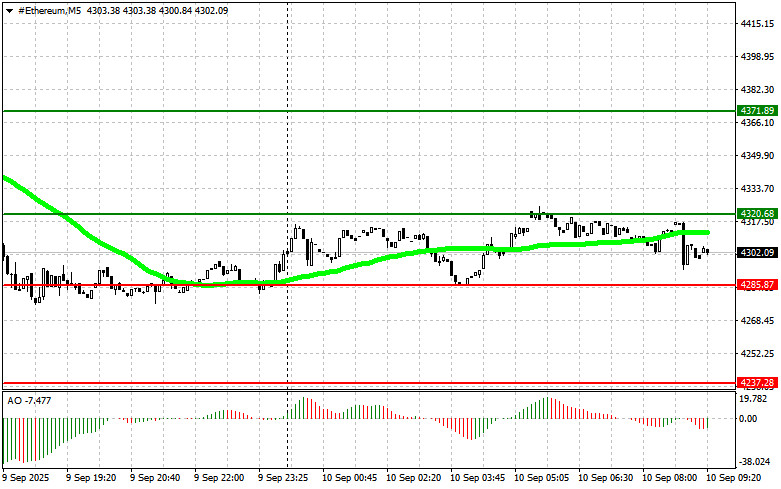

Scenario #1: I will buy Ether today upon reaching an entry point at $4,320, aiming for growth to $4,370. Around $4,370, I will exit buys and sell immediately on the pullback. Before buying a breakout, make sure the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory.

Scenario #2: You can also buy Ether from the lower boundary at $4,285 if there is no market reaction to its breakdown, aiming for a reversal to $4,320 and $4,370.

Sell Scenario

Scenario #1: I will sell Ether today upon reaching an entry point at $4,285, aiming for a fall to $4,237. Around $4,237, I will exit sell positions and immediately buy on the rebound. Before selling a breakout, make sure the 50-day moving average is above the current price and that the Awesome Oscillator is in negative territory.

Scenario #2: You can also sell Ether from the upper boundary at $4,320 if there is no market reaction to its breakdown, aiming for a reversal to $4,285 and $4,237.