Analysis of Trades and Trading Tips for the Euro

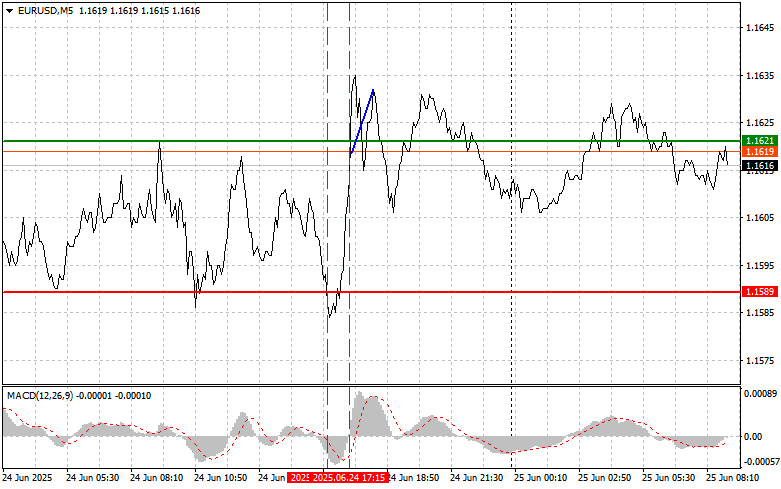

The test of the 1.1621 level occurred just as the MACD indicator began rising from the zero mark, which confirmed a valid entry point for buying the euro. As a result, the pair rose by only 12 pips before demand for the euro declined.

There were very few willing buyers near the monthly high. Although Federal Reserve Chair Jerome Powell refrained yesterday from making direct comments about the potential for interest rate cuts, he emphasized the need for more data to determine whether the rise in tariffs would lead to faster inflation. Powell noted that if conditions develop favorably, monetary policy easing would occur promptly. This vague yet promising stance triggered a wave of optimism in financial markets. Investors interpreted the hint at the Fed's readiness for swift action as a green light for the continued growth of risk assets, including the euro.

The absence of significant economic reports today creates conditions for EUR/USD stabilization and the continuation of the upward trend. A likely pause in the rally may also serve as a launchpad for further gains, as the analysis of current technical indicators points to prevailing optimism. It's important to keep in mind the potential risks as well. Unexpected political statements or geopolitical tensions could alter the current dynamics. Therefore, close attention to news and a quick reaction to changes in market sentiment are key to success.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

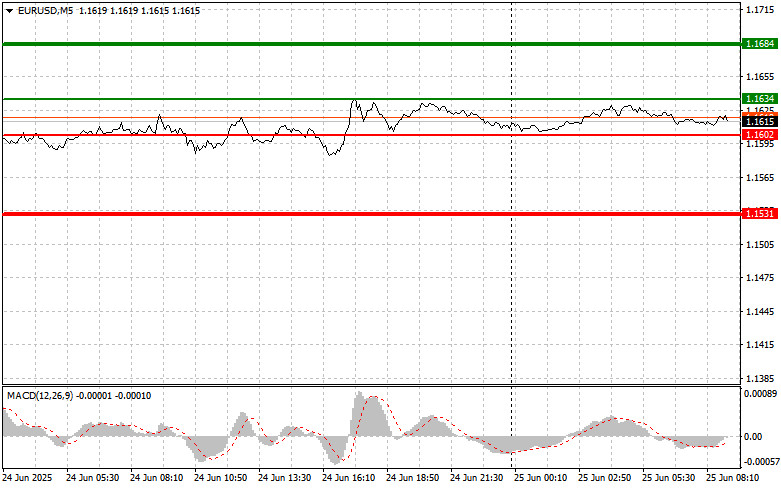

Scenario #1: Today, I plan to buy the euro at 1.1634 (green line on the chart), targeting a rise toward 1.1684. At 1.1684, I will exit the market and initiate a sell trade in the opposite direction, aiming for a 30–35 pip movement from the entry point. If economic data is favorable, the euro is likely to rise today.

Important: Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the euro today if the price tests the 1.1602 level twice in a row while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. A rise toward the opposite levels of 1.1634 and 1.1684 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after the price reaches the 1.1602 level (red line on the chart). The target will be 1.1531; at this point, I will exit the market and buy in the opposite direction (expecting a 20–25 pip rebound from the level). Pressure on the pair may return today in the case of weak data.

Important: Before selling, ensure the MACD indicator is below the zero line and starting to decline from it.

Scenario #2: I also plan to sell the euro today if the price tests the 1.1634 level twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and trigger a downward market reversal. A decline toward the opposite levels of 1.1602 and 1.1531 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.