Trade Analysis and Tips for Trading the British Pound

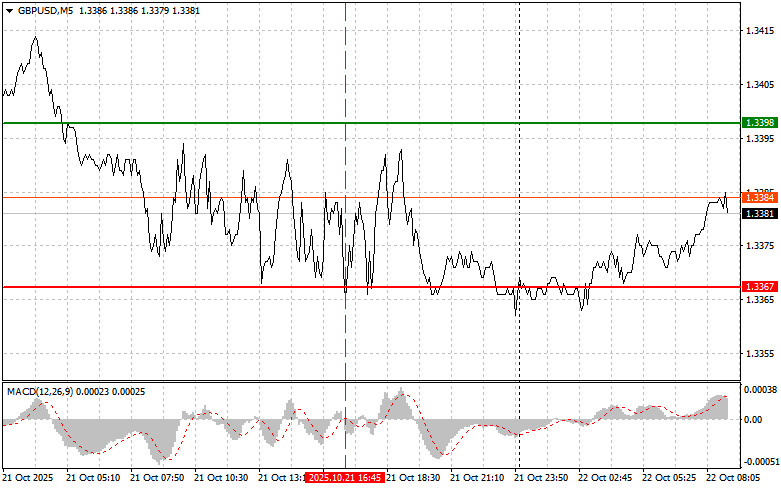

The test of the 1.3367 level coincided with the moment when the MACD indicator had just begun moving down from the zero mark, confirming a valid entry point for selling the pound. However, the pair did not experience a significant drop.

The British pound continues to decline against the US dollar—especially against the backdrop of ongoing geopolitical uncertainty and unresolved trade disputes between the United States and China. Investors are exercising caution due to the unpredictability of global trade and the potential impact on the UK economy, which is already facing political and economic challenges. Yesterday's data on the sharp increase in public sector borrowing confirms this pressure.

Today, all market participants' attention is focused on the upcoming release of the Consumer Price Index (CPI), Core CPI, and Retail Price Index (RPI) in the UK for September. These reports will serve as key indicators of the current inflation landscape in the country. Analysts will carefully assess the figures to understand the extent of inflationary pressure on the British economy and to gauge the Bank of England's potential policy response.

Should inflation data prove high, it may encourage the BoE to maintain a hawkish stance on interest rates. Such a move would likely support the pound sterling but could simultaneously act as a brake on economic growth, as more expensive credit would reduce business investment and consumer spending. Conversely, low inflation could prompt the BoE to consider easing monetary policy, which could weaken the pound but give a boost to the economy. Investors will weigh the potential risks and benefits to determine the most probable scenario going forward.

Particular attention will be paid to the Core Consumer Price Index, which excludes energy and food prices—components known for their high volatility. It provides a clearer view of underlying inflation trends. The Retail Price Index is also important, as it is used to adjust wages, pensions, and other social payments.

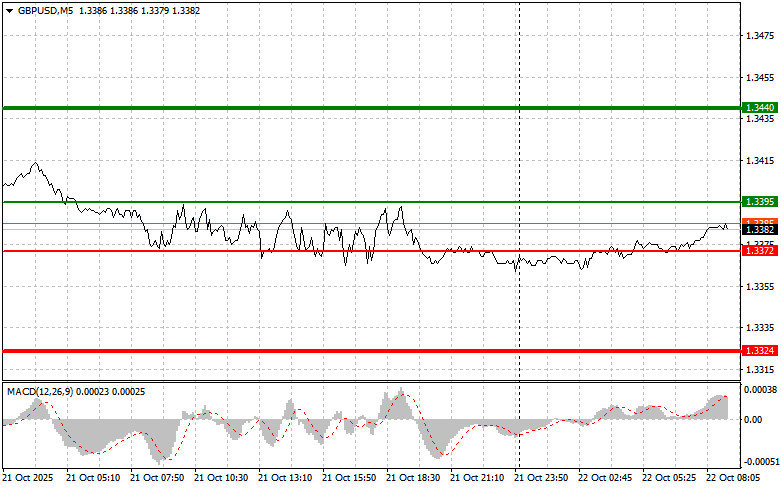

Regarding the intraday strategy, I will focus primarily on executing Scenarios #1 and #2.

Buy Scenarios

- Scenario #1: Today, I plan to buy the pound upon reaching the entry point around 1.3395 (green line on the chart), targeting growth toward the 1.3440 level (thicker green line on the chart). Around 1.3440, I plan to exit long positions and enter short positions (expecting a counter-move of 30–35 pips). A bullish outlook on the pound today is only justified in the case of very strong economic data.

- Important: Before buying, ensure that the MACD indicator is above the zero level and just beginning to rise from it.

- Scenario #2: I also plan to buy the pound in case of two consecutive tests of the 1.3372 level at a time when the MACD indicator is in the oversold zone. This will likely limit the pair's downside potential and initiate a reversal to the upside. Expected targets for growth include the 1.3395 and 1.3440 levels.

Sell Scenarios

- Scenario #1: I plan to sell the pound after a breakout below 1.3372 (red line on the chart), which may lead to a rapid decline of the pair. The sellers' key target will be the 1.3324 level, where I will exit short positions and immediately open long positions in the opposite direction (expecting a counter-move of 20–25 pips). Pound sellers are likely to return if inflation data shows a decline.

- Important: Before selling, ensure that the MACD indicator is below the zero level and just beginning to fall from it.

- Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3395 level at a time when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and may lead to a market reversal to the downside. A decrease is expected toward the 1.3372 and 1.3324 levels.

What's on the Chart:

- Thin green line – entry price to buy the trading instrument

- Thick green line – projected price for placing Take Profit or manually exiting long positions (further growth beyond this point is unlikely)

- Thin red line – entry price to sell the trading instrument

- Thick red line – projected price for placing Take Profit or manually exiting short positions (further decline below this point is unlikely)

- MACD Indicator – when entering trades, it's important to follow overbought and oversold zones

Important: Beginner traders on the Forex market must be very cautious when making entry decisions. Before the release of key fundamental reports, it is generally best to stay out of the market to avoid sudden price swings. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-loss protection, you could quickly lose your entire deposit—especially if you do not use money management and trade with high volumes.

Remember: successful trading requires a clear trading plan, such as the one outlined above. Spontaneous decision-making based on the current market situation is an inherently losing strategy for intraday traders.