Trade Review and Advice on Trading the British Pound

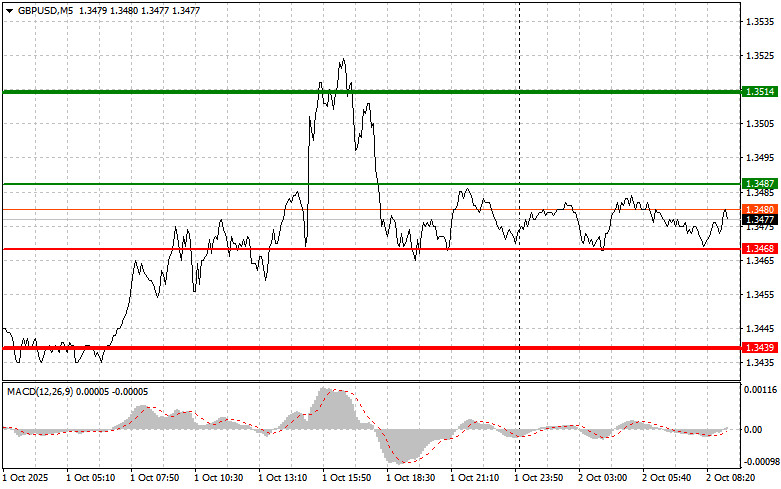

The test of the 1.3474 price level occurred at the moment when the MACD indicator had just started moving upward from the zero line, confirming the correct entry point for buying the pound and resulting in a 40-pip rise.

The sharp drop in U.S. employment data from ADP for August triggered a strong sell-off of the U.S. dollar and a strengthening of the British pound. Investors, concerned about a slowdown in the U.S. economic recovery, quickly moved away from dollar-denominated assets, while the pound, conversely, found support amid expectations of a more cautious monetary policy from the Bank of England. However, this outlook seems somewhat simplified. The fundamental factors that determine the long-term prospects of currency pairs remain complex and multifaceted. Inflationary pressures in the UK, despite the central bank's efforts, remain significantly above target, posing serious risks to the British economy. At the same time, the U.S. economy, despite some signs of slowing, remains resilient and has the potential for further growth.

Today, there are no economic reports scheduled for release in the UK, meaning the pound may face challenges in continuing its bullish momentum. The absence of macroeconomic data, which could serve as a catalyst for further strengthening, creates some uncertainty and may lead to consolidation or even a correction of previously gained positions. Investors, lacking access to fresh economic indicators, tend to become more conservative and adopt a wait-and-see approach. In such a situation, attention shifts to external factors that could impact the British currency.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3487 (indicated by the green line on the chart), with the goal of rising to the 1.3514 level (thicker green line on the chart). Around 1.3514, I plan to exit long positions and open short positions in the opposite direction, targeting a 30–35 pip correction from that level. Expecting pound growth today would be in line with a continuation of the bullish trend. Important! Before buying, ensure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3468 price level, provided that the MACD indicator is in the oversold area at the time. This would limit the pair's downside potential and lead to a reversal of the market upward. A rise toward the opposite levels of 1.3487 and 1.3514 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after a breakout below the 1.3468 level (red line on the chart), which would likely trigger a swift decline in the pair. The primary target for sellers will be the 1.3439 level, at which point I plan to exit short positions and immediately open long trades in the opposite direction, expecting a 20–25 point bounce from that level. Pound sellers will act cautiously against the trend. Important! Before selling, ensure the MACD indicator is below the zero line and is just beginning to move downward from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3487 level when the MACD indicator is in overbought territory. This will limit the pair's upside potential and may lead to a downward market reversal. A decline toward the opposite levels of 1.3468 and 1.3439 can be expected.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.