Wednesday Trade Review:

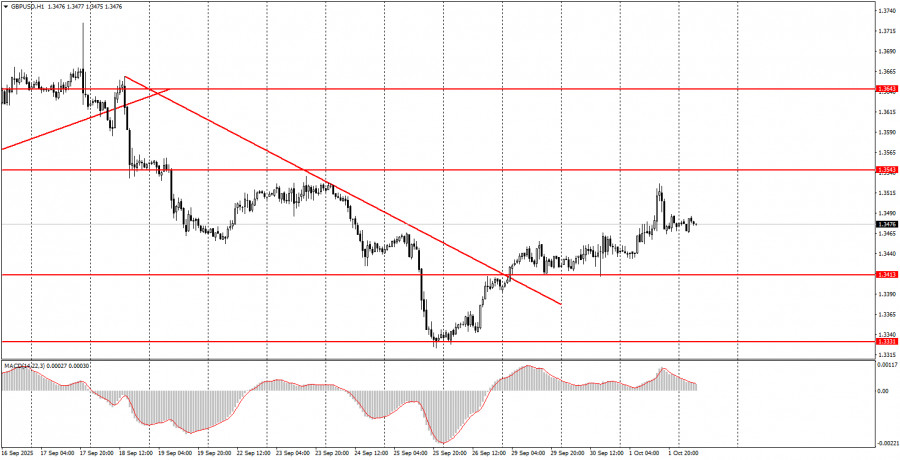

1H Chart of GBP/USD

On Wednesday, the GBP/USD pair was also influenced by macroeconomic factors. Since there were no major UK data releases during the day, the British pound avoided participating in the early-morning decline that affected other currencies. Given the generally unfavorable macro and fundamental backdrop for the U.S. dollar, the pound continued its steady appreciation.

The selloff in the dollar accelerated after the release of the extremely weak U.S. ADP employment report. The subsequent ISM Manufacturing PMI came in slightly better, which helped the dollar recover briefly. However, it's important to remember that the U.S. government has entered a shutdown, the trade war is ongoing, and the Federal Reserve is still leaning toward cutting rates two more times before the end of the year. Therefore, we maintain our bearish outlook on the dollar.

On the hourly chart, a descending trendline was broken a few days ago, indicating a shift in the short-term trend to an upward direction. The technical picture also favors continued growth in the GBP/USD exchange rate.

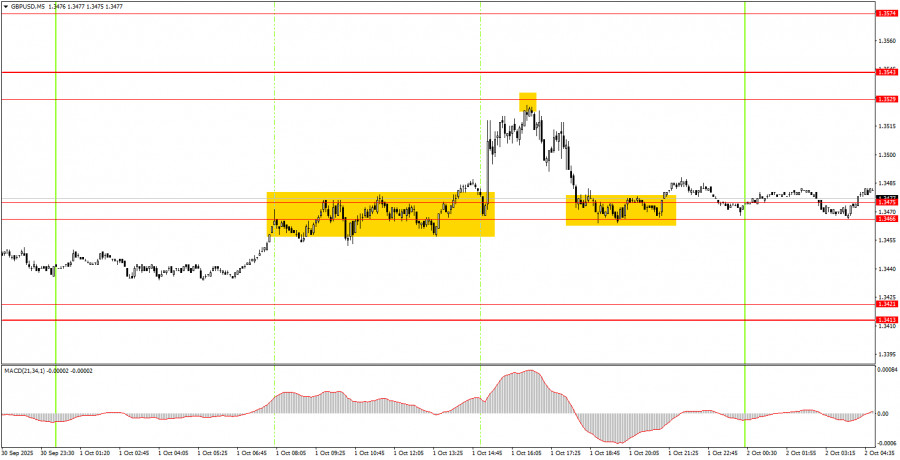

5M Chart of GBP/USD

On the 5-minute timeframe, price movements yesterday were volatile and erratic. During the European session, the pair repeatedly attempted to either bounce off or break through the 1.3466–1.3475 area. However, a clear directional move only began after the release of the ADP report in the U.S.

It was practically impossible to react to the initial buy signal in real time. The first signal that new traders could realistically act on was a bounce from the 1.3529 level. After this bounce, the price returned to the 1.3466–1.3475 zone, allowing for a modest but successful profit on the trade.

How to Trade on Thursday:

On the hourly chart, GBP/USD has completed its previous downtrend. As we've stated before, there are no fundamental reasons for the dollar to sustain any long-term growth, so our medium-term outlook remains bullish for the pair. Recent developments in both the UK and the U.S. temporarily supported the dollar, leading to justified short-term gains. However, the overarching fundamental picture still works against the greenback, and the downtrend is over.

On Thursday, GBP/USD may continue to rise. A bounce from the 1.3466–1.3475 area will once again create opportunities for long positions targeting 1.3529–1.3543. A confirmed break below the 1.3466–1.3475 zone would shift focus to the downside, making shorts toward 1.3413–1.3421 relevant.

Levels to Watch on the 5-Minute Timeframe: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3529–1.3543, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763. No major economic events are scheduled in the UK for Thursday. The U.S. will release weekly jobless claims, which are typically considered a secondary-tier report. As such, today's market movements may be weaker but also more technically driven.

Key Trading System Rules:

- The strength of a signal is determined by how quickly the signal forms (rejection or breakout of a level). The shorter the time, the stronger the signal.

- If false signals triggered two or more trades at the same level, all subsequent signals from that level should be ignored.

- During a flat (sideways market), false signals are common or nonexistent. Either way, it's best to stop trading at the first sign of range-bound movements.

- Trades should be opened between the start of the European session and the middle of the U.S. session. All trades must be manually closed after that time.

- On the 1H time frame, MACD indicator signals should be used only during trending markets and when supported by a trendline or channel.

- If two levels are too close to each other (5 to 20 pips apart), treat them as a single support or resistance zone.

- Once a trade moves 20 pips in the desired direction, the Stop Loss should be moved to breakeven.

Key Chart Elements:

Support and resistance price levels: Targets to consider when opening buy or sell trades. Potential take-profit levels can be placed near them.

Red lines: Trendlines or channels indicating the current market direction and preferred trading bias.

MACD (14,22,3) indicator: Histogram and signal line used as a secondary signal generator.

Important speeches and news reports (always listed in economic calendars) can have a strong impact on currency movement. Therefore, during such releases, it is advisable to either trade with extreme caution or exit the market altogether to avoid sharp reversals against the prior trend.

Note for beginners: Not every trade can be profitable. Developing a clear strategy and adhering to solid money management principles is the key to long-term success in forex trading.