Analysis of Trades and Trading Tips for the British Pound

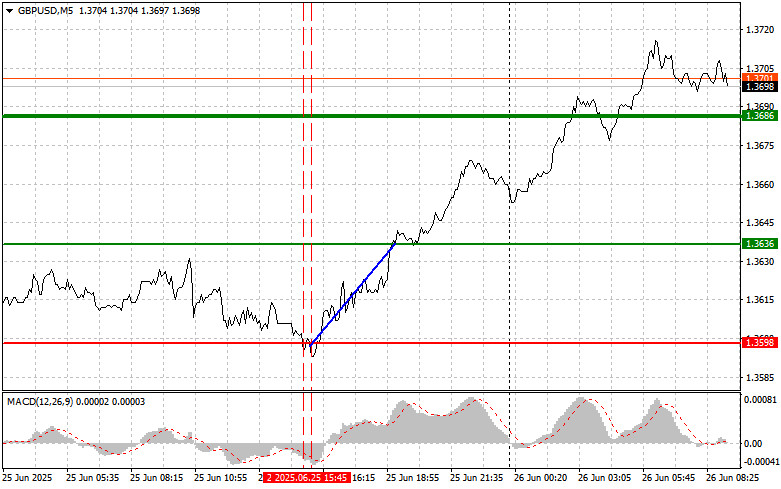

The first test of the 1.3598 price level occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downside potential. The second test of 1.3598 happened when the MACD was in the oversold zone, enabling the execution of Buy Scenario #2, which led to a rise of more than 40 pips.

The growing disagreement between President Trump and Federal Reserve Chair Jerome Powell had a negative impact on the U.S. dollar against the British pound. Disappointing data in the housing sector also contributed to the weakening of the U.S. currency. A new wave of criticism directed at the Fed Chair due to delays in implementing monetary easing raised investor concerns about the Fed's stability and independence. Such statements set a dangerous precedent, undermining fundamental principles of monetary policy and casting doubt on its future effectiveness.

Today's economic calendar includes the release of retail sales data from the Confederation of British Industry, followed by a speech by Bank of England Governor Andrew Bailey. The CBI's retail sales figures can serve as an indicator of consumer sentiment in the UK. Analyzing these numbers will help assess the pace of household spending and the effectiveness of government stimulus measures following a recent series of interest rate cuts. A drop in sales could indicate a decline in consumer confidence and a potential slowdown in economic growth, which may compel the BoE to implement further monetary easing.

Bailey's speech may significantly influence the British pound. Aggressive comments suggesting the BoE is ready to keep interest rates unchanged for longer—which is unlikely—would strengthen the pound. Meanwhile, cautious remarks expressing concern over economic growth could pressure the UK currency.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

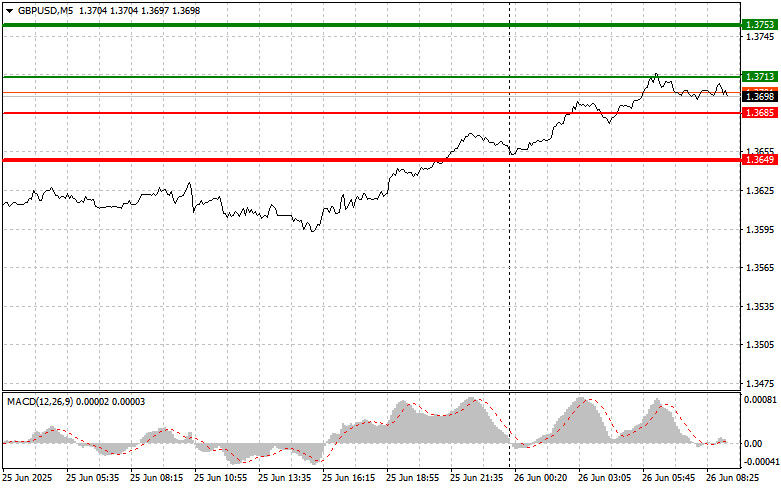

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3713 (green line on the chart), targeting a rise to 1.3753 (thicker green line on the chart). Around 1.3753, I plan to exit long and open short positions in the opposite direction (expecting a 30–35 pip to move downward from the level). A pound rally today should only be expected following strong comments.

Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3685 price level at a moment when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to a reversal to the upside. A rise to the opposite levels of 1.3713 and 1.3753 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after breaking below the 1.3685 level (red line on the chart), which may lead to a sharp decline in the pair. The key target for sellers will be the 1.3649 level, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 pip move upward from the level). Selling the pound can be considered after negative comments.

Important! Before selling, make sure the MACD indicator is below the zero line and starting to decline from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3713 level at a moment when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a reversal to the downside. A decline to the opposite levels of 1.3685 and 1.3649 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.