China

China remains the key — and practically irreplaceable — buyer of Iranian oil, accepting up to 90% of its exports, or around 1.1 million barrels per day, according to Kpler. Much of this oil is routed around sanctions under the guise of “Malaysian” crude and sent to independent refineries known as “teapots.” For these facilities, Iranian oil is not just an alternative — it’s the cornerstone of their business model. Any disruption — from tighter sanctions to a blockade of the Strait of Hormuz — would immediately hit these refiners and trigger fuel supply issues within China.

Syria

Syria is almost entirely reliant on Iranian oil: up to 80% of its imports come via tankers docking at the port of Baniyas. This crude fuels the country’s largest refinery and keeps the national power grid functioning. After political unrest earlier this year temporarily halted deliveries, the Baniyas refinery was partially shut down, leading to blackouts in major cities. Damascus has no real Plan B — even a short-term disruption in supply could cripple its energy infrastructure.

Turkey

After a four-year break, Turkey resumed importing Iranian oil. According to Eurostat, the country received shipments of around 30,000 barrels per day in 2024. These supplies go to Tupras refineries as a cheaper alternative to traditional grades, helping reduce processing costs. While volumes are still small, this is a strategic move for Ankara: in a volatile global market, even partial dependence on Iranian crude poses a risk to fuel security.

United Arab Emirates (UAE)

Despite its formal neutrality, the UAE plays a key role in the shadow logistics of Iranian oil. The ports of Jebel Ali and Khor Fakkan have seen record transit volumes. According to vessel trackers, some tankers carrying Iranian oil enter under foreign flags, blend their cargoes, and re-export them as “legal” shipments. This gray re-export trade generates millions in transit fees for the UAE. However, if the conflict with Israel escalates, this entire flow could grind to a halt within hours, dealing a blow to UAE revenues and global oil logistics.

Malaysia

Malaysia has become a quiet yet critical link in Iranian oil logistics. Vessel tracking data showed that up to 40% of all ship-to-ship transfers involving Iranian crude took place off its coast in 2024. Tankers frequently disable transponders in the Strait of Malacca, where oil is transferred, reflagged, and re-documented. In April, the US Treasury imposed sanctions on a Malaysian logistics firm for participating in these repackaging schemes. Any tightening of oversight could disrupt this gray route and destabilize regional supply chains.

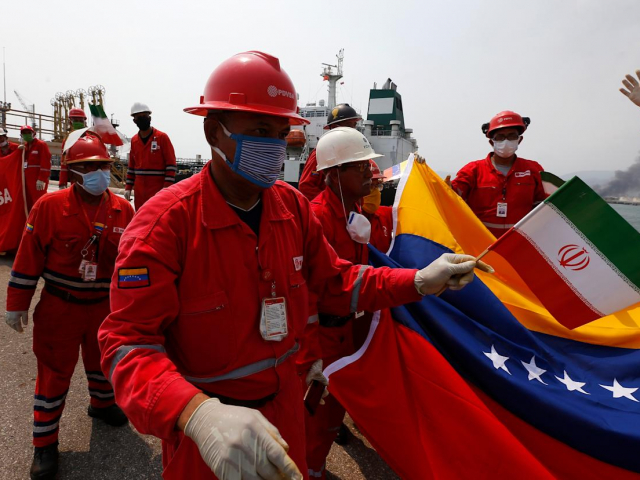

Venezuela

Venezuela relies on Iranian condensate to dilute its ultra-heavy Orinoco crude. Without it, state oil firm PDVSA cannot produce exportable blends for the international market. When swap volumes with Iran temporarily dropped in 2023, national output plunged by nearly 12%, according to Argus. A renewed outbreak of conflict between Israel and Iran threatens to derail these flows again, jeopardizing Venezuela’s already fragile oil sector recovery.

Afghanistan

Afghanistan sources up to 25% of its petroleum products — including diesel and liquefied gas — from Iran, its main land-based supplier. With no access to the sea and few alternatives, any disruption along the Persian route immediately impacts domestic markets. After a sharp increase in Iranian fuel prices in early 2024, transport fares in Kabul soared by 30%, and gas prices nearly doubled. A new escalation in the region threatens to destabilize the country's already vulnerable fuel system.

-

Grand Choice

Contest by

InstaForexInstaForex always strives to help you

fulfill your biggest dreams.JOIN CONTEST -

Chancy DepositDeposit your account with $3,000 and get $1000 more!

In June we raffle $1000 within the Chancy Deposit campaign!

Get a chance to win by depositing $3,000 to a trading account. Having fulfilled this condition, you become a campaign participant.JOIN CONTEST -

Trade Wise, Win DeviceTop up your account with at least $500, sign up for the contest, and get a chance to win mobile devices.JOIN CONTEST

424

424 7

7