Analysis of Trades and Trading Tips for the Euro

The test of the 1.1599 price coincided with the moment the MACD indicator had just started to move upwards from the zero line, confirming the correct entry point for buying euros. As a result, the pair rose toward the target level of 1.1635.

Statements by US Federal Reserve officials the previous day clearly signaled a likely lively discussion at the September meeting, where a decision to ease monetary policy through lower interest rates is possible. Such remarks negatively impacted the dollar and triggered a strengthening of the euro. In the short term, the dynamics of EUR/USD will depend on several factors, including decisions by the Fed and European Central Bank, macroeconomic data, and global geopolitical events. Investors are advised to exercise caution and consider various possible scenarios.

In the first half of the day, reports are expected to reflect the dynamics of private sector lending in the Eurozone and changes in the M3 money supply measure. A bit later, the ECB will issue a report based on the meeting devoted to monetary policy. These indicators are important for assessing the health of the European economy. Growth in business and consumer lending may signal increased economic activity and higher consumer spending. An expanding M3 indicates more money circulating in the economy. Analysts and investors will also be closely analyzing the ECB report. The document will provide detailed information on opinions and discussions within the central bank, as well as its assessment of the current economic situation and possible policy directions. The greatest attention will be paid to signals about potential interest rate adjustments. The euro's response to these releases will depend on how actual results match market expectations. Stronger-than-expected data may support the euro, reflecting optimism about the European economic outlook. Conversely, weaker data could weigh on the single currency, forcing traders to adjust expectations for future ECB moves.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

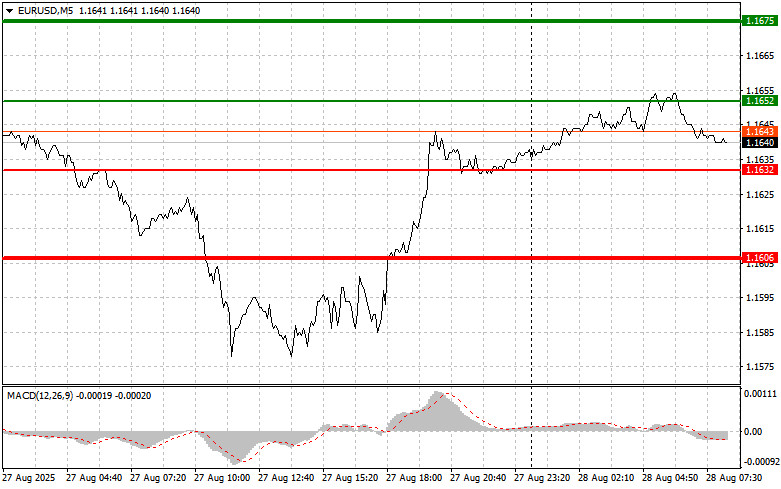

Scenario #1: Today, I plan to buy the euro if the price reaches around 1.1652 (indicated by the green line on the chart), with a target of rising to 1.1675. At 1.1675, I plan to exit the position and sell euros on the reversal, aiming for a move of 30–35 pips from the entry point. Buying the euro is only reasonable after strong data. Important! Before buying, ensure that the MACD indicator is above zero and is just starting to rise from this level.

Scenario #2: I also plan to buy euros today in the event of two consecutive tests of the 1.1632 price while the MACD is in the oversold area. This will limit the pair's downside and lead to an upward reversal. A rise toward the 1.1652 and 1.1675 levels can be expected.

Sell Scenario

Scenario #1: I plan to sell euros after the price reaches the 1.1632 level (red line on the chart). My target will be 1.1606, where I'll exit and immediately buy on the reversal (aiming for a move of 20-25 pips from the level). Pressure on the pair may return if the data is weak. Important! Before selling, ensure that the MACD is below zero and is just starting to decline from this level.

Scenario #2: I also plan to sell euros today in the event of two consecutive tests of the 1.1652 price while the MACD is in the overbought area. This will limit the upside and trigger a reversal downward. A decline to 1.1632 and 1.1606 can be expected.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.