On the 4-hour timeframe, the EUR/USD currency pair sharply reversed downward on Monday and posted a strong decline. In our opinion, this move is quite significant and telling. Let's examine it in detail.

On Monday night, Donald Trump announced the signing of a trade agreement between the EU and the U.S., alongside Ursula von der Leyen, President of the European Commission. The key points of the agreement are:

- European imports to the U.S. will be subject to a 15% tariff.

- The European Union commits to investing 600 billion dollars in the U.S. economy.

- The EU agrees to purchase U.S. military equipment.

- The EU commits to purchasing 750 billion dollars worth of U.S. energy products.

The immediate question is: What commitments has the U.S. made? This question remains unanswered. Either the obligations on the U.S. side were not reported in the official media, or they simply do not exist. Hats off — Trump indeed signed a deal that is beneficial to America in every respect. And the European Union. Well, what can be said? The EU, which gave the impression of being a strong force capable of resisting Trump, simply yielded to the American president. Once again, peaceful and well-fed Europe has demonstrated that it backs down in the face of real pressure and is willing to accept one-sided agreements to preserve peace and quiet within its borders.

Why did the euro fall as a result?

This also requires clarification. The euro fell on Monday solely because the trade deal negotiated by von der Leyen was unfavorable for the EU. In essence, the agreement encompasses not only tariffs but also substantial spending and investment by the EU in the United States. This gave a strong boost to the dollar — but what does it mean for the dollar's medium-term outlook?

Let's suppose that Trump manages to sign similar agreements with all major trading partners, as he has done with Japan and now the EU. This would mean that the U.S. continues trading globally just as before — but now on far more favorable terms. Accordingly, the entire dollar sell-off of 2025 would turn out to be a fiction. From this perspective, the dollar should return to where it started its decline — around the 1.03 level. But is that realistic?

In our opinion, this is unlikely to happen. While Trump did sign an extremely favorable trade deal with the EU, European goods will become more expensive in the U.S., which will reduce demand. As a result, trade volumes will decline while prices rise. Trump pays no attention to inflation and is heavily reliant on a "cheap" dollar. Therefore, it's doubtful that the U.S. president would allow the dollar to appreciate back to near parity with the euro.

Moreover, the dollar has been weakening not only due to the trade war but also because of Trump's leadership style. Many investors and central banks are unhappy with how he governs the country — and nothing has changed in that regard. However, we now allow for the possibility that the U.S. dollar could significantly strengthen in the near term.

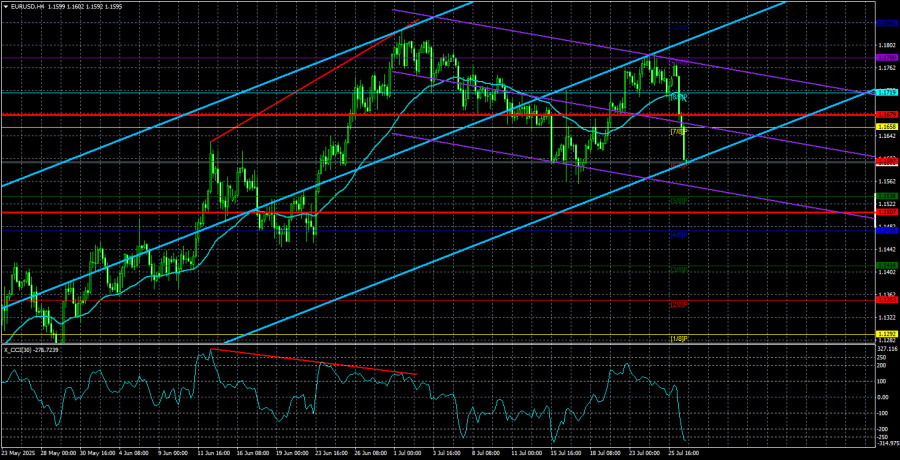

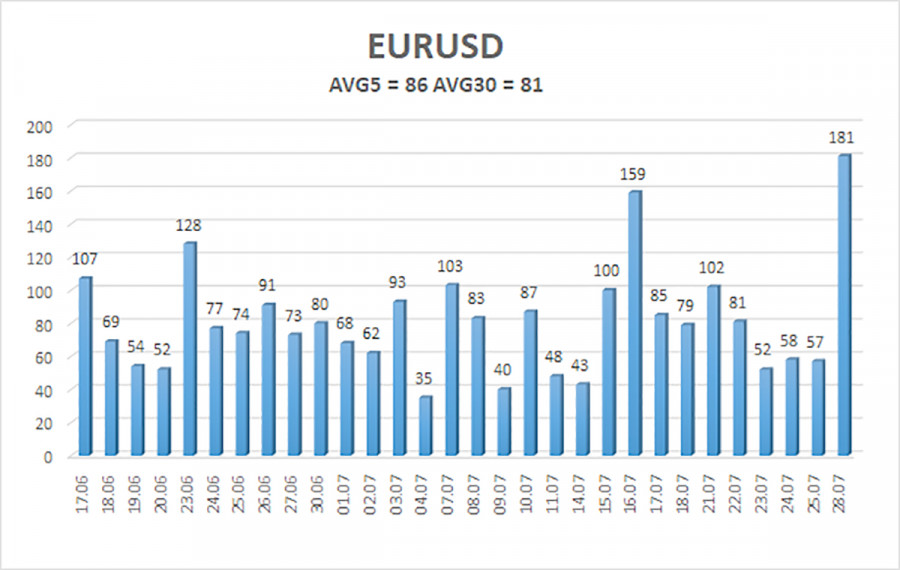

The average volatility of the EUR/USD currency pair over the last five trading days, as of July 29, is 86 pips, which is considered "moderate." We expect the pair to move between the levels of 1.1507 and 1.1679 on Tuesday. The long-term linear regression channel remains upward, indicating an ongoing upward trend. The CCI indicator has once again entered oversold territory, which may signal an upcoming resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading Recommendations:

The EUR/USD pair has begun a new leg of a corrective move. The U.S. dollar remains heavily influenced by Trump's policies, both foreign and domestic. At the start of the week, the dollar showed strength, but in our opinion, this still does not justify medium-term buying. As long as the price remains below the moving average, short positions can be considered with targets at 1.1536 and 1.1507. If the price moves above the moving average, long positions remain relevant with targets at 1.1780 and 1.1841 in line with the prevailing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.