Analysis of Transactions and Trading Tips for the Euro

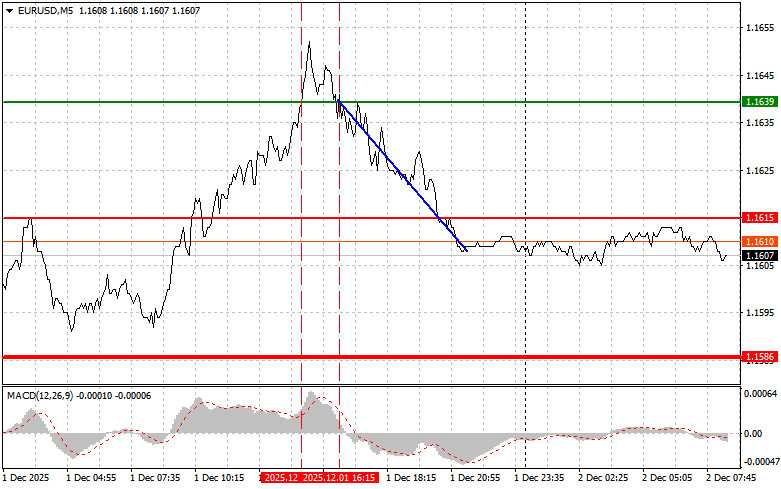

The test of the price at 1.1639 occurred when the MACD indicator had moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy euros. The second test at 1.1639 shortly thereafter coincided with the MACD being in the overbought area, allowing the execution of Scenario #2 to sell euros, resulting in a decline of more than 20 pips in the pair.

Pressure on the US dollar increased immediately after the release of the disappointing ISM Manufacturing Index. Contrary to expectations, the indicator characterizing the state of the manufacturing sector showed a decline, signaling a slowdown in industrial growth. This circumstance has again raised questions about the future of the American economy. Unsatisfactory economic indicators increase the likelihood that the Federal Reserve will cut interest rates, which certainly puts pressure on the dollar.

Today, economic indicators for the eurozone will be published in the first half of the day, including the consumer price index, core consumer price index, and unemployment data. These reports are crucial for assessing the region's economic health, with particular emphasis on the consumer price index. If the CPI shows a sharp increase, it will further confirm the European Central Bank's cautious approach. The core CPI, which excludes highly volatile components such as food and energy prices, also allows for assessing the resilience of inflationary processes in the economy. A stable core CPI could strengthen the ECB's confidence in the effectiveness of current measures and provide more flexibility in responding to changes in the economic situation.

Data on the unemployment rate will provide insight into the state of the labor market. A reduction in unemployment could support consumer demand and increase inflationary pressure, while an increase might indicate slowing economic growth. A general analysis of all three indicators will provide a more complete picture of the eurozone's economic situation and define the most likely scenario for future developments.

As for the intraday strategy, I will rely more on implementing Scenarios #1 and #2.

Buying Scenarios

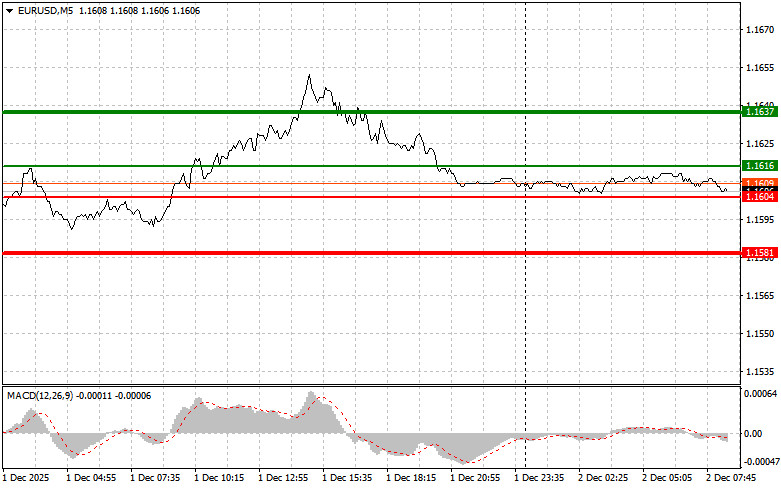

Scenario #1: Today, buy euros when the price reaches around 1.1616 (green line on the chart), targeting growth to the level of 1.1637. At point 1.1637, I plan to exit the market and sell euros immediately in the opposite direction, aiming for a movement of 30-35 pips from the entry point. Expecting growth of the euro can only be done after good reports are released. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario #2: I also plan to buy euros today if there are two consecutive tests of 1.1604 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise can be expected towards the opposite levels of 1.1616 and 1.1637.

Selling Scenarios

Scenario #1: I plan to sell euros after reaching the level of 1.1604 (red line on the chart). The target will be the level of 1.1581, where I intend to exit the market and buy immediately in the opposite direction (targeting a movement of 20-25 pips in the opposite direction from the level). Pressure on the pair will return with weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario #2: I also plan to sell euros today if there are two consecutive tests of 1.1616 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected towards the opposite levels of 1.1604 and 1.1581.

What's on the Chart:

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or take profit yourself, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or take profit yourself, as further decline below this level is unlikely;

- MACD Indicator. When entering the market, it is essential to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.