Analysis of Trades and Trading Tips for the British Pound

The test of the price at 1.3052 coincided with the MACD indicator moving significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the pound. The second test at 1.3052 occurred when the MACD was in the oversold area, allowing the implementation of Scenario #2 to buy the pound, resulting in a rise of more than 50 pips.

Mixed U.S. data failed to provide the support the dollar needed. Nevertheless, market participants betting on a stronger pound waited for the right moment and became active after John Williams, President of the Federal Reserve Bank of New York, stated his readiness to lower interest rates at the December meeting. Williams's comments, which contrasted with the more hawkish rhetoric of other Fed representatives, prompted an immediate reaction in the currency markets. The U.S. dollar weakened significantly, opening up space for other currencies, particularly the British pound, which has recently been under pressure amid uncertainty over the approval of next year's budget.

As for today, unfortunately, there are no significant data from the UK. In this case, investors' attention is focused on the statements from the Bank of England representatives, which may shed light on the central bank's future monetary policy. The market will closely watch the rhetoric, with any hints of a policy easing potentially having a significant impact on the pound's exchange rate.

Regarding the intraday strategy, I will focus more on the implementation of Scenarios #1 and #2.

Buying Scenarios

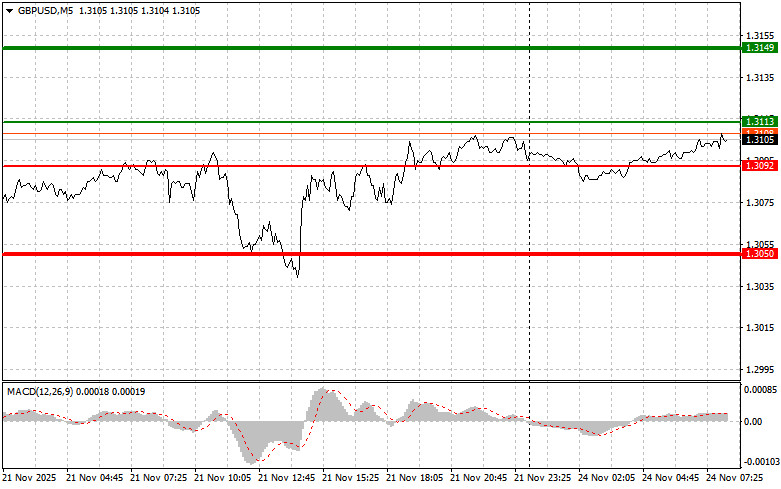

- Scenario #1: Today, I plan to buy the pound at the entry point around 1.3113 (green line on the chart), targeting a rise to 1.3149 (thicker green line on the chart). At around 1.3149, I plan to exit the market and open short positions in the opposite direction (expecting a movement of 30-35 pips back from that level). I can only anticipate a rise in the pound within a channel. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just starting to rise from it.

- Scenario #2: I also plan to buy the pound today if the price tests 1.3092 twice in a row while the MACD indicator is oversold. This will limit the downward potential of the pair and lead to a market reversal upwards. An increase can be expected towards the opposite levels of 1.3113 and 1.3149.

Selling Scenarios

- Scenario #1: I plan to sell the pound today after the 1.3092 level is broken (red line on the chart), which could lead to a rapid decline in the pair. The key target for sellers will be the 1.3050 level, where I intend to exit shorts and also buy immediately in the opposite direction (expecting a 20-25-pip move back from that level). Pound sellers are likely to show strength near the upper boundary of the channel at 1.3115. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

- Scenario #2: I also plan to sell the pound today if the price tests 1.3113 twice in a row, when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downwards. A decrease can be expected towards the opposite levels of 1.3092 and 1.3050.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.