Trade Analysis for Friday:

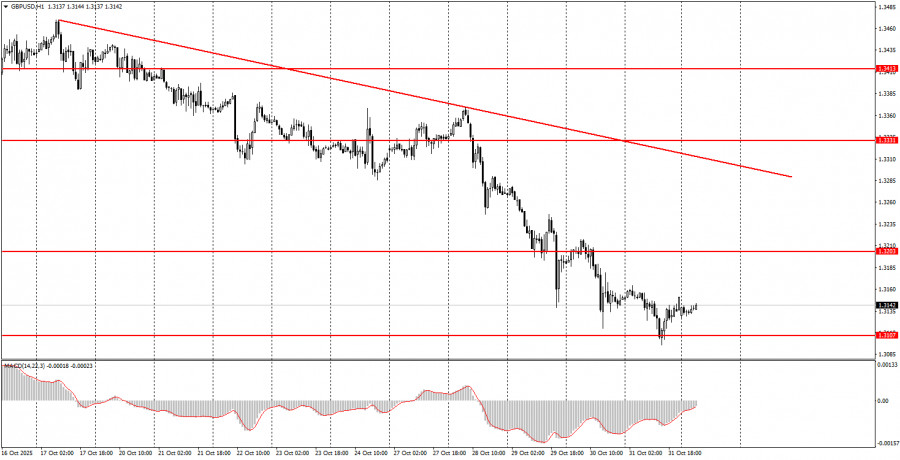

1H Chart of the GBP/USD Pair

The GBP/USD pair continued its downward movement on Friday but bounced back by the end of the day. As a reminder, the British pound has been falling for an entire month with no clear reason for the decline. On Friday, the European currency could theoretically drop on the EU inflation report, whereas the pound has no grounds for falling at all. There were no significant reports or events in either the UK or the US during the day. Therefore, it can be said that the illogical decline of the pair continues. However, on the daily timeframe, the price reached the lower line of the sideways channel (1.3140) and has been unable to break through it for three consecutive days. Thus, we may be at the beginning of a new long-term rise of the British pound, which the fundamental and macroeconomic background will fully justify. On the hourly timeframe, the level of 1.3107 can be considered a support point. A move below this price would indicate that the illogical correction on a global scale will continue.

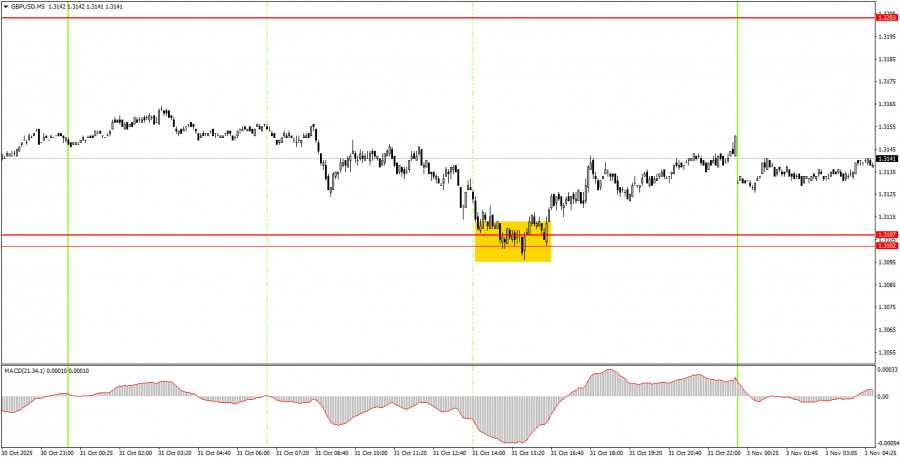

5M Chart of the GBP/USD Pair

On the 5-minute timeframe, one buy trading signal was formed on Friday—a bounce from the area of 1.3102-1.3107. We believe these areas could not only see a bounce of 50-60 pips but may also initiate a new local upward trend. Therefore, it is advisable to set a Stop Loss to break even and wait for greater profits.

How to Trade on Monday:

On the hourly timeframe, the GBP/USD pair began to form a new upward trend but quickly completed it. Currently, the British pound is declining again for absolutely any reasons. As we mentioned earlier, there are no grounds for the dollar's continued growth, so we expect only upward movement in the medium term. However, the flat factor in the long term continues to pull the pair down, which is an absolutely illogical development of events.

On Monday, novice traders can comfortably trade in the 1.3102-1.3107 range or remain in long positions opened on Friday with a Stop Loss at breakeven.

On the 5-minute timeframe, trading can currently occur at the following levels: 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590, 1.3643-1.3652. On Monday, business activity indices are scheduled for publication in the UK and the US, with particular emphasis on the ISM index in the US, which could provoke a strong reaction.

Basic Rules of the Trading System:

- The strength of a signal is determined by the time it took to form (bounce or breach a level). The less time needed, the stronger the signal.

- If two or more trades based on false signals are opened around any level, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate numerous false signals or none at all. In any case, it's best to stop trading at the first signs of a flat market.

- Trades should be opened during the timeframe between the start of the European session and halfway through the American session; all trades must then be manually closed.

- On the hourly timeframe, signals from the MACD indicator should ideally be traded only in the presence of good volatility and a trend confirmed by a trendline or trend channel.

- If two levels are too close to each other (between 5 and 20 pips), they should be regarded as a support or resistance area.

- After the price moves 20 pips in the right direction, a Stop Loss should be set to break even.

What to Look at on the Charts:

- Support and resistance price levels are targets for opening buy or sell positions. Take profit levels can be placed near them.

- Red lines indicate channels or trend lines that show the current trend and suggest the preferred direction of trade.

- The MACD indicator (14,22,3) provides a histogram and signal line, serving as an auxiliary indicator that can also be used as a source of signals.

Important statements and reports (always found in the news calendar) can significantly influence the movement of the currency pair. Therefore, during their release, traders should proceed with maximum caution or exit the market to avoid sudden price reversals against the preceding movement.

Beginners trading in the Forex market should remember that not every trade can be profitable. Developing a clear strategy and practicing sound money management are key to long-term trading success.