Bitcoin has slid to around $108,000, and Ethereum has dropped below $3,900, which undermines the bullish market expectations observed earlier this week.

Yesterday, as expected, the Federal Open Market Committee (FOMC) reduced the federal funds rate by 25 basis points to a range of 4% to 3.75%. However, the cryptocurrency market reacted with a decline, as it had anticipated more aggressive actions ahead of future monetary easing.

This market reaction highlights its sensitivity to the subtle nuances in central bank announcements. Cryptocurrency investors appeared to be hoping for a more definitive signal regarding further rate cuts, which could weaken the dollar and make alternative assets, including cryptocurrencies, more attractive. The lack of such a signal led to disappointment and profit-taking. Moreover, it's essential to recognize that the cryptocurrency market is becoming increasingly mature and interconnected with traditional financial markets. Therefore, the Federal Reserve's actions to stabilize the economy and control inflation directly affect traders' sentiment in the crypto space. Participants in the market will closely monitor any further signals from the Fed to assess the long-term nature of the current monetary policy.

In the near term, we should expect consolidation in the cryptocurrency market as investors reassess their positions amid the Fed's actions. There may be a reallocation of capital toward more resilient and promising crypto-assets, while less reliable projects could face increased pressure. In the long term, fundamental factors such as inflows into spot ETFs and advancements in blockchain technology will remain crucial for the market's future.

While Bitcoin currently hovers around $110,000, open interest in derivatives has reached record highs. Overall, a moderate risk appetite persists, and the possibility of Bitcoin surpassing its historical peak by the end of the year still exists. As for Ethereum, it may potentially retest the psychological barrier of $5,000 amid favorable political conditions, liquidity rotation, and positive sentiment.

I will focus on any significant pullbacks in Bitcoin and Ethereum, while anticipating the continuation of the medium-term bullish market.

As for short-term trading, the strategy and conditions are described below.

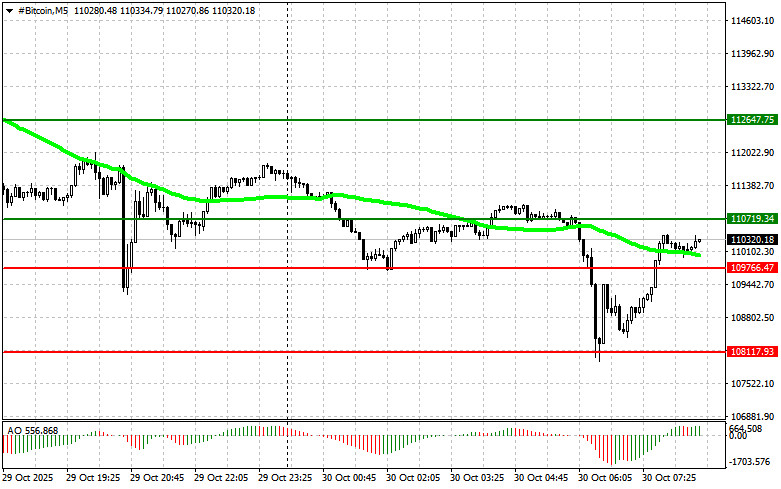

Bitcoin

Buying Scenario

- Scenario №1: I plan to buy Bitcoin today when it reaches an entry point around $110,700, targeting a rise to $112,600. I will exit my purchases near $112,600 and sell immediately on a bounce. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome indicator is above zero.

- Scenario №2: I can buy Bitcoin from the lower boundary of $109,700 if there is no market reaction after a breakout back toward levels of $110,700 and $112,600.

Selling Scenario

- Scenario №1: I plan to sell Bitcoin today when it reaches an entry point around $109,700, targeting a drop to $108,100. I will exit my sales and immediately buy on a bounce near $108,100. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome indicator is below zero.

- Scenario №2: I can sell Bitcoin from the upper boundary of $110,700 if there is no market reaction after a breakout back toward levels of $109,700 and $108,100.

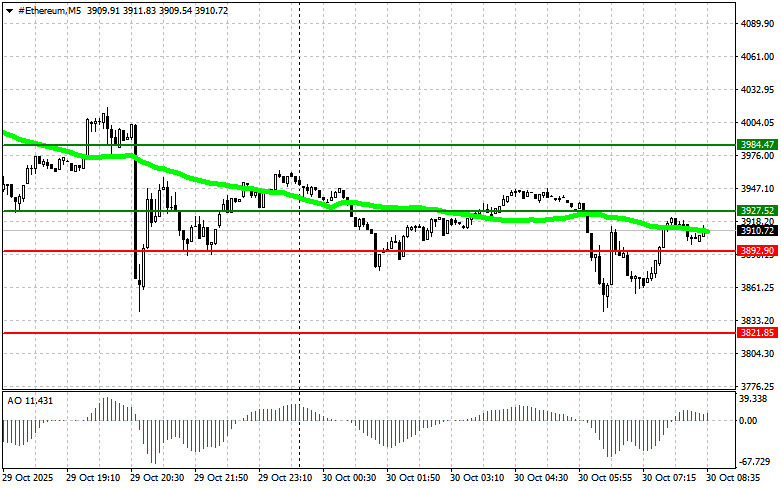

Ethereum

Buying Scenario

- Scenario №1: I plan to buy Ethereum today when it reaches an entry point around $3,927, targeting a rise to $3,984. I will exit my purchases near $3,984 and sell immediately on a bounce. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome indicator is above zero.

- Scenario №2: I can buy Ethereum from the lower boundary of $3,892 if there is no market reaction after a breakout back toward levels of $3,927 and $3,984.

Selling Scenario

- Scenario №1: I plan to sell Ethereum today when it reaches an entry point around $3,892, targeting a drop to $3,821. I will exit my sales and immediately buy on a bounce near $3,821. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome indicator is below zero.

- Scenario №2: I can sell Ethereum from the upper boundary of $3,927 if there is no market reaction after a breakout back toward levels of $3,892 and $3,821.