Trade Review and Recommendations for Trading the British Pound

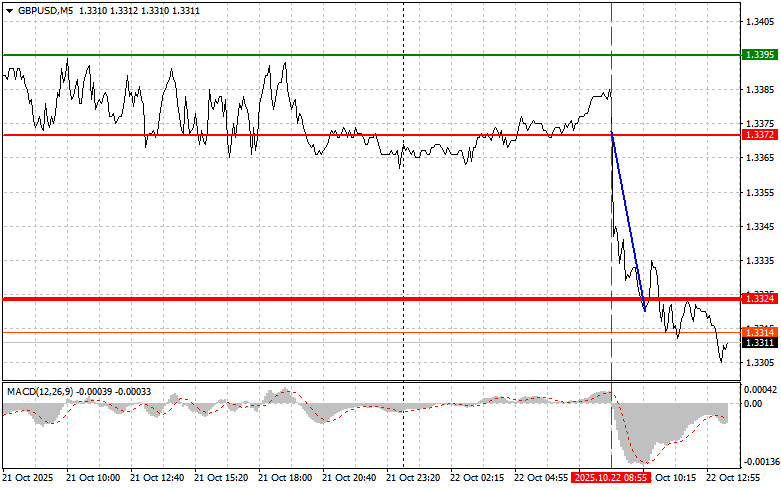

The price test of 1.3372 coincided with the moment when the MACD indicator had just started moving downward from the zero line, confirming the correct entry point for selling the pound. As a result, the pair declined toward the target level of 1.3324.

Inflation growth in the United Kingdom slowed in September, leading to a sharp fall in the British pound. The decline in the Consumer Price Index (CPI) came in below analysts' forecasts, which may weaken expectations of further monetary tightening by the Bank of England (BoE). Investors have revised their forecasts for the level of the key interest rate that they expect the BoE to set in the coming months.

Although the slowdown in inflation was minor, it was taken as a sign of a possible deceleration in economic growth, which limits the central bank's ability to maintain high interest rates. However, despite the decline, UK inflation remains significantly above the BoE's 2% target, meaning the central bank still faces a dilemma: it must curb inflation on one hand while avoiding a recession on the other. Future BoE decisions will depend on incoming economic data, including figures on employment and GDP growth.

Later in the day, FOMC member Michael S. Barr is scheduled to speak. Market participants are currently focused on any hints of a possible shift in Federal Reserve policy. In the short term, if Barr refrains from commenting on the Fed's next steps, investors may take that as a sign that a rate cut at the end of October is still likely.

As for intraday trading strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

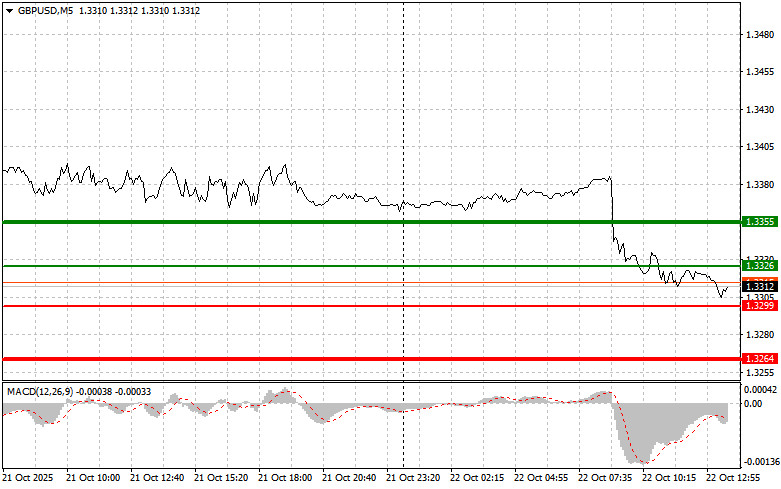

Scenario #1: I plan to buy the pound today near the entry point of 1.3326 (green line on the chart) with a target at 1.3355 (thicker green line). Around 1.3355, I intend to exit long positions and open shorts in the opposite direction, expecting a 30–35-point pullback. A strong rise in the pound today is unlikely.

Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if the price tests 1.3299 twice, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposite levels of 1.3326 and 1.3355 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound after a breakout below 1.3299 (red line on the chart), which will likely trigger a rapid decline. The key target for sellers will be 1.3264, where I plan to exit short positions and immediately open buys in the opposite direction, expecting a 20–25-point rebound. The pound could experience a strong drop later in the day.Important: Before selling, make sure the MACD indicator is below the zero line and just starting to move downward.

Scenario #2: I also plan to sell the pound if the price tests 1.3326 twice, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and likely trigger a reversal downward, with targets at 1.3299 and 1.3264.

Chart Legend

- Thin green line – entry price for buying the trading instrument.

- Thick green line – suggested price for setting Take Profit or manually closing long positions, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – suggested price for setting Take Profit or manually closing short positions, as further decline below this level is unlikely.

- MACD indicator – when entering the market, focus on overbought and oversold zones.

Important Note for Beginner Forex Traders

Beginner traders in the Forex market should make entry decisions very carefully. Before the release of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize potential losses. Without stop-loss protection, you can quickly lose your entire deposit — especially if you neglect money management and trade with large volumes.

And remember: successful trading requires a clear, structured plan, like the one presented above. Spontaneous trading decisions based on the current market situation are a losing strategy for intraday traders.