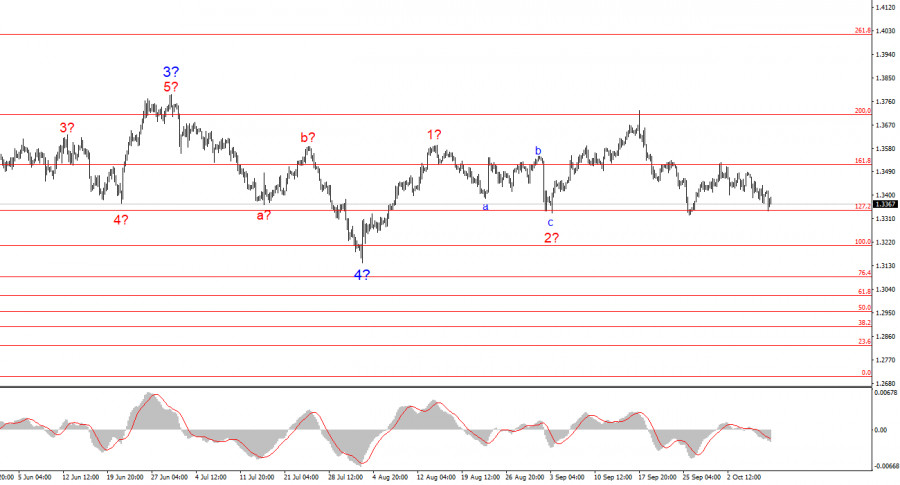

For GBP/USD, the wave pattern still indicates the construction of an upward wave structure, but in recent weeks it has taken on a complex and ambiguous form. The pound has dropped too sharply of late, so the trend section beginning on August 1 now looks unclear. The first thing that comes to mind is the complication of the supposed wave 4, which may take on a three-wave form, with each of its sub-waves also consisting of three waves. In this case, a decline of the instrument toward the 1.31 and 1.30 levels should be expected.

However, if this assumption is correct, then the euro will also decline, and therefore its wave structure will also undergo certain changes. At present, I do not see other alternative scenarios with a clear structure. The news background has greatly interfered with the realization of the most straightforward scenario, yet at the same time it should continue to support sellers in order for the alternative scenario to play out. And this could be problematic.

It should be remembered that at the moment, much in the currency market depends on Donald Trump's policies. The market fears Fed policy easing due to pressure from the U.S. president, and Trump has introduced a new round of tariffs, indicating the continuation of the trade war. Thus, the news background remains unfavorable for the dollar.

GBP/USD continues to decline, breaking the current wave structure. If the news background had suddenly reversed 180 degrees in favor of the U.S. dollar, everything would be clear. Wave patterns are an important element of analysis, but you cannot argue with global events. However, in my view, the news background for the dollar remains very weak, just as it has throughout 2025.

To recall: in just the first nine days of October, the U.S. currency has faced a government shutdown, weak ISM indices in both services and manufacturing, and a completely disastrous ADP report. This week, the FOMC minutes were released, confirming the market's expectations of the Fed's willingness to continue easing.

Accordingly, demand for the dollar should be declining rather than rising. Yet something is clearly not going according to plan. In my view, the Fed minutes should not be taken too seriously nor used as a basis for conclusions. They reflect the sentiment of Fed officials three weeks ago. Time passes, and the situation changes. On September 17, there was not even a hint of a government shutdown in the U.S., so this is one of those cases where much has changed in a short period of time.

At present, the Fed must act blindly, and I am not sure the American regulator will want to proceed in that fashion. Undoubtedly, the probability of two or three more rounds of monetary easing in the coming months remains high, since it is clear the labor market continues to "cool." The Fed can afford at least one preemptive rate cut, and by the December meeting the shutdown will be over, allowing unemployment, inflation, and labor market data to be analyzed. But all of this remains speculation.

General conclusions

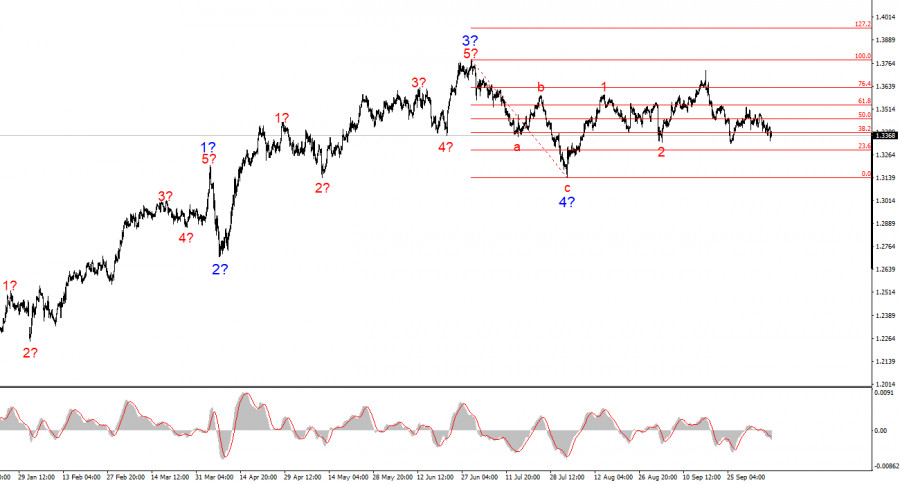

The GBP/USD wave pattern has changed. We are still dealing with an upward, impulsive trend section, but its internal wave structure has become unreadable. If wave 4 takes on a complex three-wave form, the structure will normalize, but in this case, wave 4 will be much more complicated and extended than wave 2. In my view, the best reference point for now is 1.3341, which corresponds to the 127.2% Fibonacci level. Two failed attempts to break this level pointed to the market's readiness for new purchases. A third failed attempt may again lead to a rebound from the lows reached. The instrument's targets still lie no lower than the 1.38 area.

The higher-degree wave pattern looks nearly perfect, even though wave 4 exceeded the high of wave 1. But let me remind you: perfect wave patterns exist only in textbooks. In practice, things are much more complicated. At present, I see no reason to consider alternative scenarios to the upward trend section.

Key principles of my analysis:

- Wave structures should be simple and clear. Complex structures are hard to trade and often change.

- If there is no confidence in the market situation, it is better to stay out.

- There is never and can never be 100% certainty in price direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.