Wednesday Trade Review:

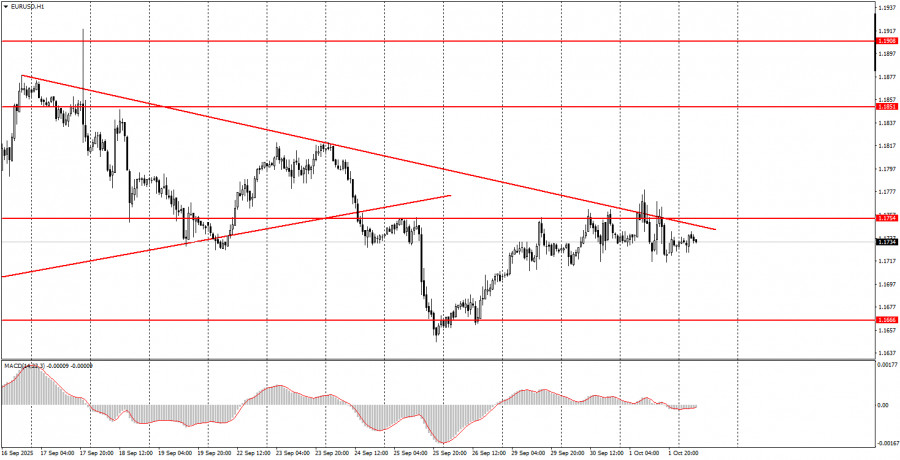

1H Chart of EUR/USD

On Wednesday, the EUR/USD currency pair continued to trade erratically, effectively moving sideways. The primary reason behind this choppy and unattractive behavior was the macroeconomic environment. Both the EU and the U.S. released several significant reports, each triggering its own market reaction.

The day began with euro area inflation data, which, unlike German inflation, did not exceed forecasts. This disappointed traders and triggered a decline in the value of the euro. Later during the U.S. session, an extremely weak ADP labor market report was published. This report could serve as the main reference going forward if the Non-Farm Payrolls (NFP) report is delayed due to the government shutdown. According to ADP, the U.S. economy lost 32,000 private-sector jobs in September — a dismal figure.

The situation was slightly redeemed later in the day by the ISM Manufacturing PMI, which came in at 49.1, slightly above the 49.0 forecast. In general, the pair reacted in different directions throughout the day. The macroeconomic backdrop continues to look pessimistic for the U.S. dollar.

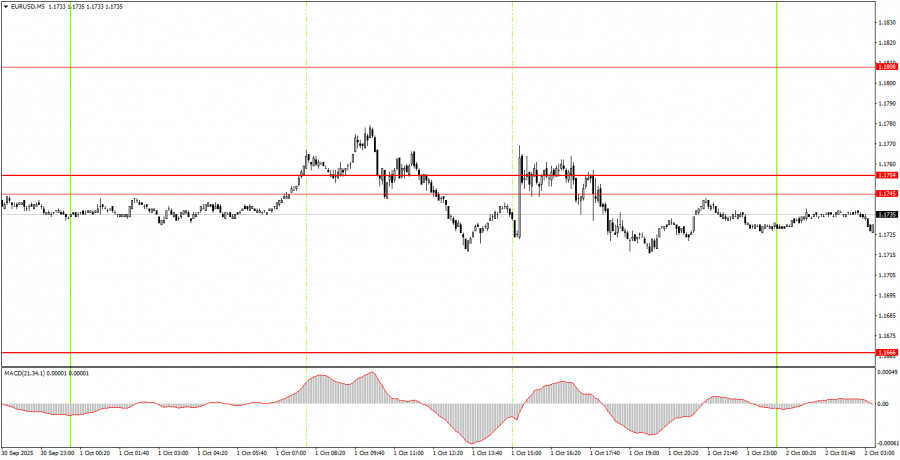

5M Chart of EUR/USD

On the 5-minute timeframe, numerous trading signals were generated on Wednesday. However, all of them were undermined by conflicting economic data. Each time a technical signal formed, a new macro report would be released shortly afterward, reversing the current price direction. For this reason, trading on Wednesday was only feasible if traders responded directly to real-time macroeconomic data.

How to Trade on Thursday:

On the hourly chart, EUR/USD is still technically in a downtrend and has not yet broken through the trendline. The broader fundamental and macro backdrop remains unfavorable for the dollar, so strong greenback appreciation still seems unlikely. From our perspective, as before, the dollar can only count on short-lived technical corrections — one of which appears to be unfolding now.

For Thursday, EUR/USD is expected to trade around the 1.1745–1.1754 zone. A rejection from this area would be a reason to open short positions targeting 1.1666. A breakthrough above this zone would make long entries toward 1.1808 viable. Today's macro backdrop is relatively quiet, so more technical and smoother market movements are expected compared to Wednesday.

Levels to Watch on the 5-Minute Timeframe: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. On Thursday, the eurozone will release its unemployment report, alongside U.S. weekly jobless claims. Both reports are considered secondary and may provoke only small or short-lived market reactions.

Key Trading System Rules:

- The strength of a signal is determined by how quickly the signal forms (rejection or breakout of a level). The shorter the time, the stronger the signal.

- If false signals triggered two or more trades at the same level, all subsequent signals from that level should be ignored.

- During a flat (sideways market), false signals are common or nonexistent. Either way, it's best to stop trading at the first sign of range-bound movements.

- Trades should be opened between the start of the European session and the middle of the U.S. session. All trades must be manually closed after that time.

- On the 1H time frame, MACD indicator signals should be used only during trending markets and when supported by a trendline or channel.

- If two levels are too close to each other (5 to 20 pips apart), treat them as a single support or resistance zone.

- Once a trade moves 15 pips in the desired direction, the Stop Loss should be moved to breakeven.

Key Chart Elements:

Support and resistance price levels: Targets to consider when opening buy or sell trades. Potential take-profit levels can be placed near them.

Red lines: Trendlines or channels indicating the current market direction and preferred trading bias.

MACD (14,22,3) indicator: Histogram and signal line used as a secondary signal generator.

Important speeches and news reports (always listed in economic calendars) can have a strong impact on currency movement. Therefore, during such releases, it is advisable to either trade with extreme caution or exit the market altogether to avoid sharp reversals against the prior trend.

Note for beginners: Not every trade can be profitable. Developing a clear strategy and adhering to solid money management principles is the key to long-term success in forex trading.