Analysis of Macroeconomic Reports:

Very few macroeconomic reports are scheduled for Tuesday. Germany, the Eurozone, the UK, and the US will release second estimates of service sector business activity for July. It's worth noting that these indices are not among the most important indicators, and the market tends to react primarily to the initial estimates. The second estimates usually do not differ from the first. However, the US ISM Services PMI carries significant weight. It is expected to rise from 50.8 to 51.5 in July, but the actual figure may be less optimistic. The US dollar needs a new push downward.

Analysis of Fundamental Events:

There are absolutely no noteworthy fundamental events on Tuesday, but the market is now confident that the Federal Reserve will cut the key interest rate in September, and possibly again at the last two meetings in 2025. Therefore, there are currently plenty of reasons for the US currency to weaken.

The trade war remains the market's top concern, which took a new turn on Friday. We continue to believe that any trade agreements that retain tariffs are just the same trade war, "under a different guise." Deals like those with the European Union or Japan are certainly beneficial for the US. Hence, each new similar deal may provoke a rise in the US dollar. However, globally and fundamentally, the market will continue to take into account the new trade architecture and Donald Trump's protectionist policies. The US president continues to impose new tariffs and raise existing ones in his effort to extract payments from all countries around the world. We already saw how the US economy may respond to this last week. While GDP may still grow, other macroeconomic indicators are unlikely to improve.

Just recently, Trump raised tariffs for 60 countries, and now plans to impose tariffs against India, which refuses to stop buying Russian oil. As we anticipated, any agreement with Trump offers no guarantees that new accusations won't be made against you the very next day.

Conclusions:

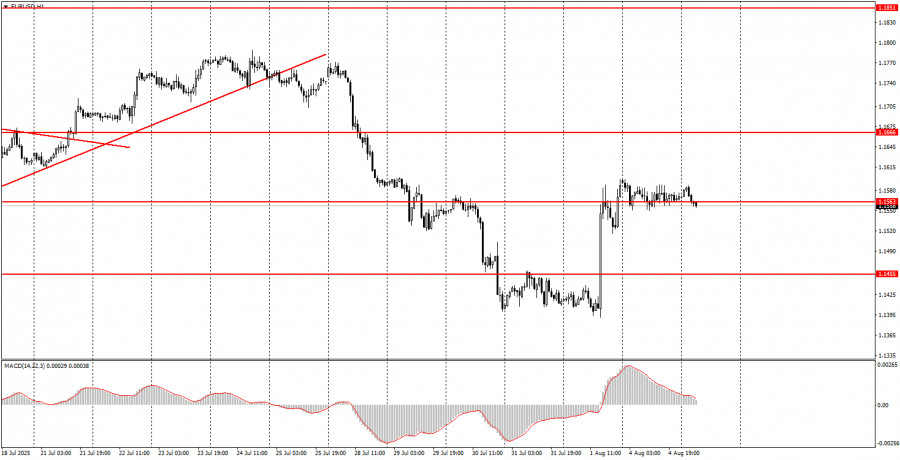

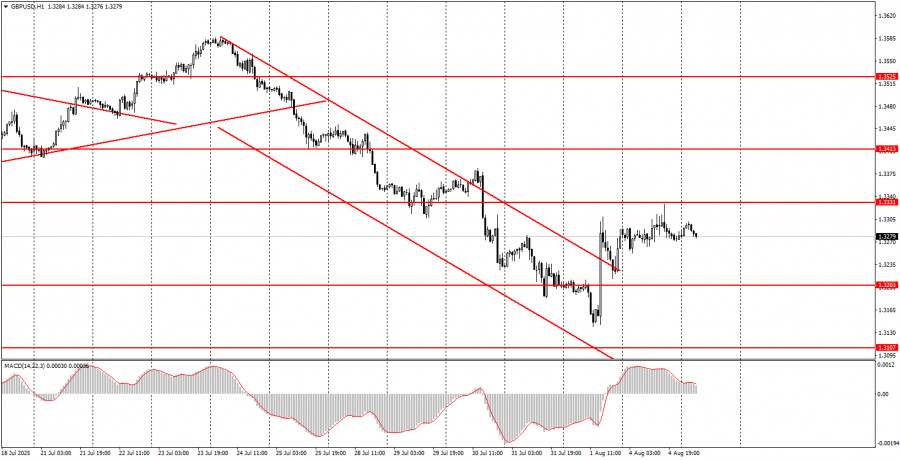

On the second trading day of the week, both currency pairs may resume the upward movement that began on Friday. In our view, Friday brought so many disappointing events for the US dollar that it could fuel a week's worth of losses for the currency. Therefore, trading today should be based on technical levels (as there will be little news), while keeping in mind the high probability of further growth for both currency pairs.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.