The US and EU have averted a trade war after reaching a deal on 15% tariffs. Nike shares have climbed following a JP Morgan upgrade. US and Chinese officials have resumed trade talks. Analysts warn that tariffs are acting as a drag on both the US and EU economies. Index performance: Dow Jones down 0.14%, S&P 500 up 0.02%, Nasdaq up 0.33%.

Wall Street climbs: S&P 500 extends record streak

On Monday, US stock market benchmarks once again surprised traders. The S&P 500 closed at a record high for the sixth consecutive session, while the Nasdaq pushed to fresh peaks amid volatile swings. Investors are closely monitoring the latest US-EU agreements as they brace for a news-heavy week.

US and Europe draw closer: tariff cuts ahead

Following a Sunday meeting, US President Donald Trump and European Commission President Ursula von der Leyen announced a provisional agreement — EU import tariffs will be reduced to 15%. A previously proposed double-tariff regime was avoided through compromise. France, however, criticized the deal, claiming it compromises European interests.

US expands trade outreach

The US-EU deal marks another step in Washington's push to secure trade pacts abroad — recent days also brought announcements of agreements with Japan and Indonesia. Meanwhile, high-level US and Chinese officials met in Stockholm in an effort to de-escalate the ongoing trade dispute.

Steady gains amid fresh headwinds

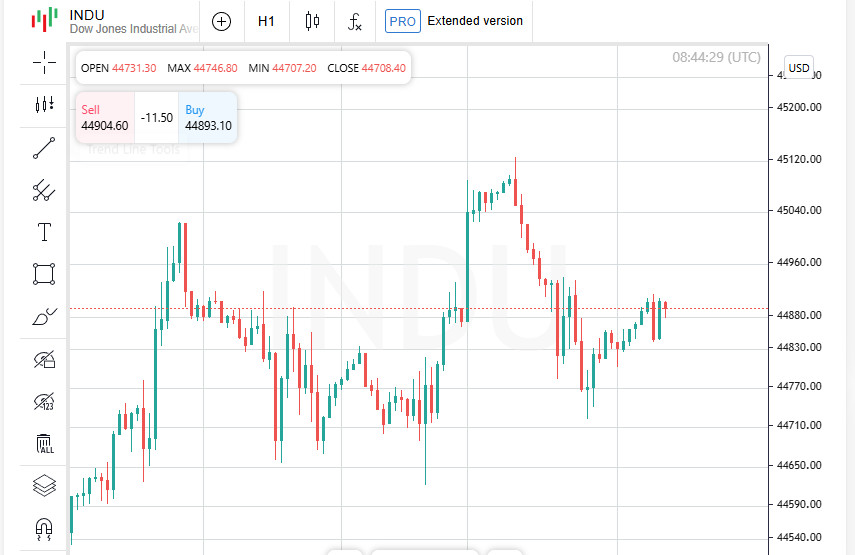

The Dow Jones slipped by 64.36 points, or 0.14%, closing at 44,837.56. The S&P 500 edged higher by 1.13 points (0.02%) to end at 6,389.77. The Nasdaq gained 0.33%, or 70.27 points, closing at 21,178.58.

The S&P 500 notched its sixth straight all-time high and appears on track for its fifteenth record of the year. US equities have clawed back spring losses that stemmed from fresh trade policy threats made by the US president.

AI enthusiasm and corporate tailwinds fuel rally

Global markets continue to accelerate, driven by growing investor confidence in the potential of artificial intelligence. Optimism is further buoyed by recent trade agreements and early signs of robust corporate performance — this quarter's earnings may surpass even the most bullish expectations.

In focus: Fed decision and pressure from White House

On Wednesday, investor attention shifted to statements from the Federal Reserve. Forecasts are largely aligned: the central bank is expected to leave the key interest rate unchanged. Meanwhile, President Trump has intensified pressure on Fed Chair Jerome Powell, urging a more dovish policy stance and lower borrowing costs.

Tech giants reveal their hand

Earnings from major IT companies, including Microsoft, Amazon, Apple, and Meta, are poised to significantly influence market sentiment. Each release has the potential to trigger sharp moves, and analysts are preparing to assess whether the tech sector can live up to expectations.

New data on economic health

In addition to the Fed meeting and quarterly earnings reports, the week will bring key macroeconomic data. Particular focus is on the Personal Consumption Expenditures index, widely seen as a core inflation indicator, along with fresh figures on public sector employment. Investors are watching closely to assess how previously announced tariffs have impacted inflation and labor markets.

Nike in crosshairs of optimists

Nike shares gained nearly 4% after JPMorgan analysts upgraded their rating on the stock, recommending investors to "just buy" with a promise of strong returns.

Energy surges, real estate slumps

The energy sector led the S&P 500, advancing more than 1% amid a solid rally in oil prices. In contrast, real estate and materials were the session's laggards, each losing over 1%.

Asian markets retreat, EUR struggles to recover

Tuesday opened with losses across Asian exchanges, while the euro attempted to claw back recent declines. Investors continue to dissect the latest trade agreement between the United States and the European Union, which appears to have fallen short of resolving the core issue of steep tariffs. Expectations of persistent trade restrictions are amplifying concerns over slowing economic growth and the potential acceleration of inflation.

Old World disrupted by new global order

While initial optimism around the introduction of a new 15% European tariff was palpable, it quickly faded. Not long ago, before Donald Trump's presidency, the tariff stood at just 1 or 2%. France and Germany voiced disappointment with the outcome of the negotiations, stressing that higher tariff burdens weigh on economic prospects, undermine bond yields, and weaken the euro's position.

Cautious markets, hesitant investors

This sentiment was reflected in equity performance: the MSCI Asia-Pacific Index declined by nearly 1%. Japan's Nikkei dropped just under 1%, and leading Chinese stocks posted no growth. In Europe, following sharp sell-offs earlier in the week, some stabilization emerged — futures on key indices rose by about 0.2%.

Currency swings: USD gains, EUR balances

The euro is attempting to stabilize after a sharp overnight drop of more than 1%, hitting its lowest point in recent months and settling near 1.1587. The next support level is slightly lower, around 1.1556.

Meanwhile, the US dollar index surged to 98.675 following a broad wave of short-covering. The Japanese yen retreated from its weekly highs, falling to 148.27.

US index futures edge higher

Futures on American equity indices are showing modest gains: S&P 500 contracts rose by 0.1%, while Nasdaq futures climbed by 0.2%.

Investors eye rate-setting catalysts

Financial markets remain on alert for potential catalysts. Key US macroeconomic data due out this week could reshape rate expectations. Analysts are particularly focused on Q2 GDP figures — economists forecast a rebound in annualized growth to 2.4% after a 0.5% contraction earlier this year.

Labor market steps into spotlight

Tuesday will bring fresh job openings data. These numbers will help analysts refine their outlook ahead of Friday's closely watched nonfarm payrolls report, which traditionally has a significant impact on investor sentiment.

Bank of Canada ready for pause

On Wednesday, market attention will shift to the Bank of Canada's policy meeting. Most experts expect the central bank to hold its key rate steady at 2.75%. Canadian authorities appear reluctant to act for now, opting to wait for outcomes from ongoing trade talks with the United States.

Diverging trends in commodities market

Industrial metal prices remain under pressure — both copper and iron ore continue to decline amid demand uncertainty. Gold is holding steady at $3,315 per troy ounce, reflecting stability against the backdrop of market volatility.

Oil market undergoes correction

Brent crude has edged down slightly to $69.90 per barrel, despite gaining more than 2% in the previous session. US crude remains stable around $66.60 per barrel.