Trade Analysis and Pound Sterling Trading Tips

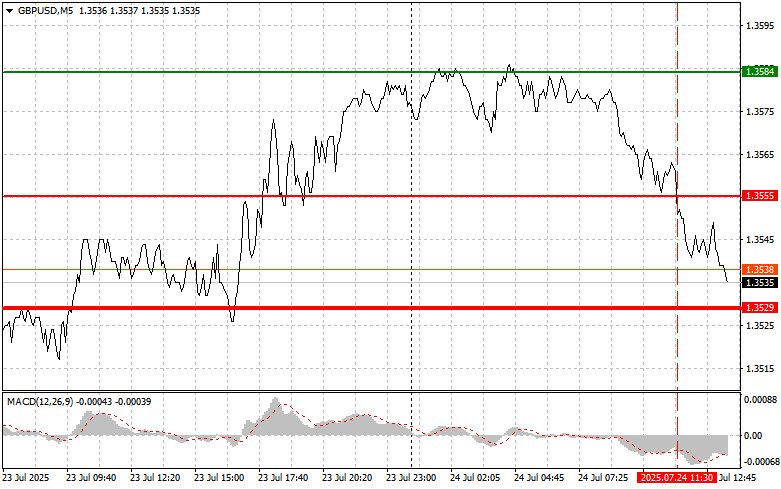

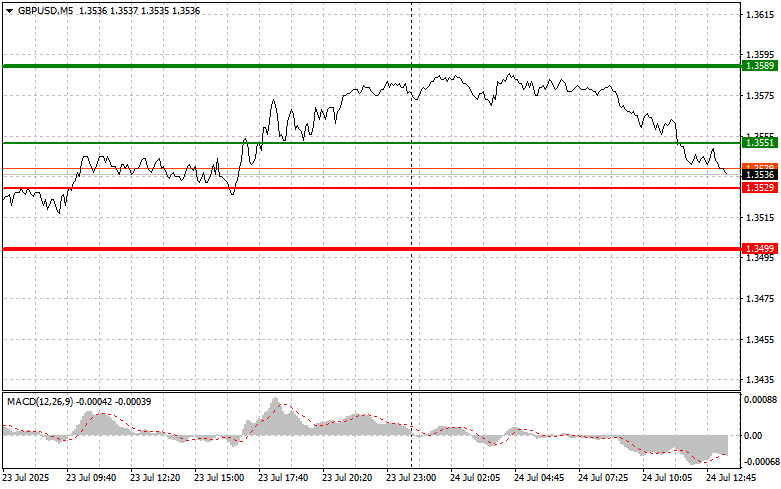

The test of the 1.3555 level coincided with the MACD indicator having moved well below the zero line, which limited the pair's downward potential.

Weak UK services PMI data exerted pressure on the British pound in the first half of the day. This news came as an unpleasant surprise for investors who had hoped for steady economic growth following recent positive signals. The services sector, as the dominant component of the UK economy, is traditionally viewed as a barometer of overall conditions. The PMI decline signals a slowdown in growth and potential future challenges. The market reacted quickly: the pound weakened against major currencies, particularly the U.S. dollar and the euro. Going forward, special attention will be paid to upcoming economic reports and statements from the Bank of England. The market will be closely monitoring any signals about possible monetary policy easing, which could add further pressure on the pound.

Upcoming reports include U.S. manufacturing and services PMIs, initial jobless claims, and new home sales data. These indicators are critical for assessing the current state and outlook of the U.S. economy. Their influence extends beyond domestic markets and significantly affects global capital flows. The manufacturing PMI provides insights into the health of the manufacturing sector, a key driver of economic growth. A rising PMI indicates increased production, new orders, and improved business conditions, while a decline suggests slower growth and potential issues ahead. The services PMI reflects the condition of the services sector, which makes up a significant share of U.S. GDP and covers a broad range of industries from healthcare and education to finance and entertainment.

New home sales figures reflect the state of the housing market and consumer confidence. Rising sales signal growing demand for housing, positively impacting related industries such as construction materials and furniture. Evaluating these indicators collectively provides a comprehensive picture of the U.S. economy and helps form forward-looking expectations.

As for intraday strategy, I will rely mainly on the implementation of Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the entry point at around 1.3551 is reached (green line on the chart), with a target of rising to 1.3589 (thicker green line). At 1.3589, I will exit long positions and open short positions in the opposite direction, aiming for a 30–35 point move downward from that level. A strong rally in the pound can only be expected after weak U.S. data. Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3529 level while the MACD indicator is in the oversold zone. This will limit the downward potential and likely lead to a reversal to the upside. Growth toward the opposite levels of 1.3551 and 1.3589 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.3529 level is broken (red line on the chart), which would likely trigger a sharp decline. The key target for sellers is 1.3499, where I will exit shorts and immediately enter long positions in the opposite direction, aiming for a 20–25 point rebound from that level. Sellers are likely to act if the U.S. data is strong. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3551 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal. A decline toward the opposite levels of 1.3529 and 1.3499 can then be expected.

Chart Notes:

- Thin green line – entry price for buying the instrument

- Thick green line – projected level for setting Take Profit orders or manually securing profits, as further growth beyond this level is unlikely

- Thin red line – entry price for selling the instrument

- Thick red line – projected level for setting Take Profit orders or manually securing profits, as further decline beyond this level is unlikely

- MACD indicator – it is important to use overbought and oversold zones as guidance when entering the market

Important:

Beginner traders in the Forex market must exercise caution when making market entries. It's best to avoid trading during the release of important economic reports to reduce the risk of being caught in sharp price swings. If you choose to trade during news events, always use stop-loss orders to limit losses. Trading without stop-losses can result in rapid loss of your entire deposit, especially if you're not using proper money management and are trading large volumes.

And remember, successful trading requires a well-defined trading plan like the one outlined above. Making spontaneous decisions based on the current market situation is a fundamentally losing strategy for intraday traders.