Trade Analysis and Euro Trading Tips

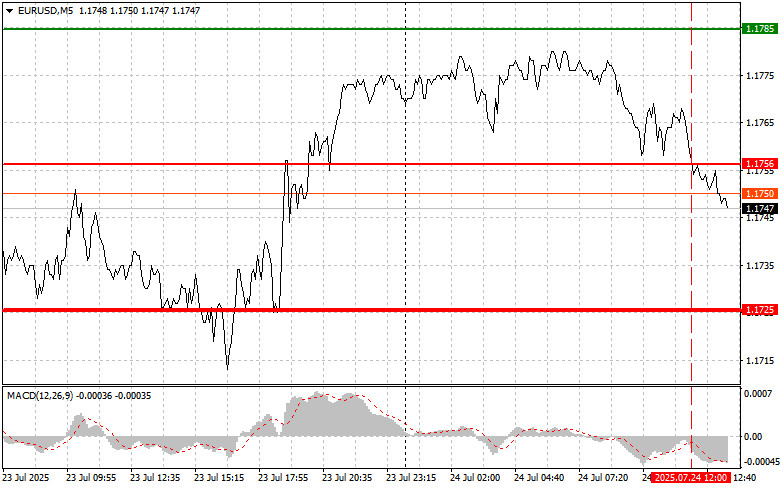

The test of the 1.1756 level coincided with the MACD indicator moving well below the zero line, which limited the pair's downward potential.

Eurozone PMI data came in better than economists had forecast, but this did not help the euro. The market remained indifferent to the positive news, showing that behind the figures lies a much deeper and more complex picture. Instead of a rally, the euro experienced a correction. Clearly, the PMI growth has been heavily dependent on the ECB's ultra-loose policy throughout the year. Now that the ECB appears ready to end its rate-cutting cycle, future PMI readings may not look as optimistic.

In the second half of the day, a number of key U.S. economic indicators are scheduled for release, including manufacturing and non-manufacturing PMIs as well as the composite index. In addition, the weekly jobless claims report and new home sales data will be published. These indicators are important gauges of the U.S. economy. PMI data reflect sentiment in key sectors and help assess whether economic growth is accelerating or slowing. Initial jobless claims characterize labor market conditions, while new home sales indicate consumer confidence and activity in the construction sector. Special attention will be paid to the services PMI, as this is the largest sector of the U.S. economy. Unexpected changes in this indicator could have a significant impact on the markets.

As for intraday strategy, I will primarily focus on implementing Scenarios #1 and #2.

Buy Signal

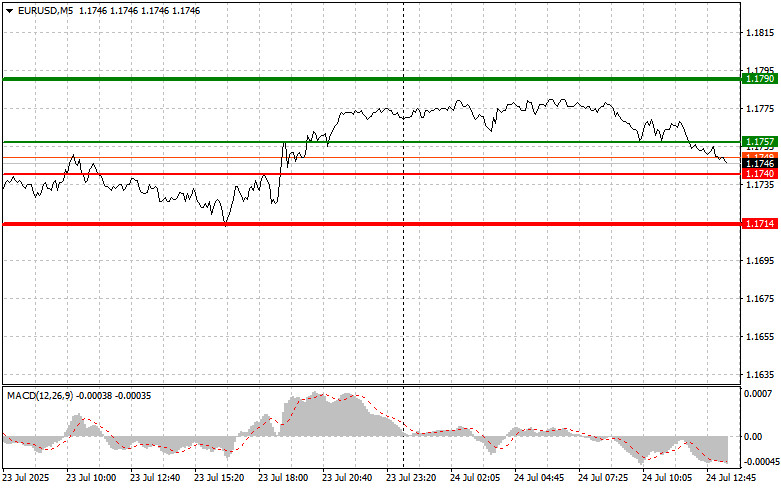

Scenario #1: Buy the euro today if the price reaches the level around 1.1757 (green line on the chart) with a target of rising toward 1.1790. At 1.1790, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A strong rise in the euro today can be expected only after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1740 level, while the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger a reversal to the upside. A rise toward the opposite levels of 1.1757 and 1.1790 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches the 1.1740 level (red line on the chart). The target is 1.1714, where I intend to exit the market and immediately buy in the opposite direction (aiming for a 20–25 point rebound). Downward pressure on the pair is likely to return if the ECB maintains a dovish stance and U.S. statistics come out strong. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1757 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A drop toward the opposite levels of 1.1740 and 1.1714 can be expected.

Chart Notes:

- Thin green line – entry price for buying the trading instrument

- Thick green line – anticipated level for placing Take Profit orders or manually locking in gains, as further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – anticipated level for placing Take Profit orders or manually locking in gains, as further decline below this level is unlikely

- MACD indicator – when entering the market, pay attention to overbought and oversold zones

Important:

Beginner traders on the Forex market should make entry decisions with great caution. Before major fundamental reports are released, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Trading without stop-losses can result in rapid loss of your entire deposit, especially if you trade large volumes without proper money management.

And remember: successful trading requires a clear trading plan, like the one provided above. Making spontaneous decisions based on the current market situation is a losing strategy for any intraday trader.