Analysis of Trades and Trading Tips for the Euro

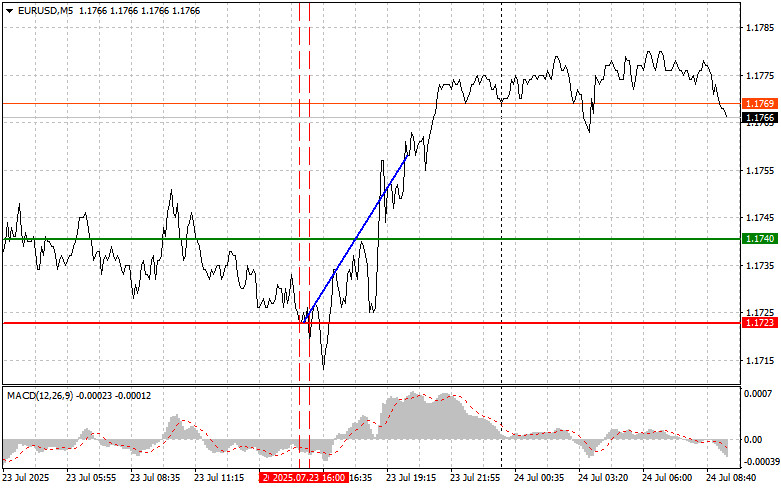

The first test of the 1.1723 level occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downside potential. The second test of 1.1723 happened when MACD was in the oversold area, which enabled the execution of Buy Scenario #2 and resulted in a rise of more than 35 points.

A significant drop in existing home sales in the U.S. had a negative impact on the U.S. dollar, triggering an upward move in the euro. A decline in housing market activity, particularly in the secondary market, is typically viewed as a sign of a slowing U.S. economy. In such cases, investors, concerned about unfavorable economic forecasts, tend to shift their funds into other currencies, which weakens the dollar and reduces its investment appeal.

Investor attention is currently on the upcoming European Central Bank meeting, where the decision regarding the key interest rate will be revealed. The subsequent press conference led by Christine Lagarde will also be of particular importance. Analysts agree that the ECB's rhetoric—especially concerning the future of its accommodative monetary policy—will have a significant impact on the euro's exchange rate. If the ECB sends a clear signal that the rate-cutting cycle is over, this could trigger a new wave of euro appreciation. If not, demand for the euro may decline.

In addition, today's eurozone data releases include the Manufacturing PMI, Services PMI, and Composite PMI for July. These are key indicators of the eurozone economy and may significantly affect the euro's value. The Manufacturing PMI reflects trends in industrial production, while the Services PMI gauges the health of the service sector. The Composite PMI combines data from both sectors, offering a more comprehensive picture of the eurozone's economic health. Growth in these indicators is typically viewed as a positive signal, indicating economic acceleration. In such a case, investors may respond by buying euros. Conversely, a decline in PMI figures could signal a slowdown or even a recession. That would likely prompt investors to sell euros, fearing the ECB might be forced to take action to stimulate the economy.

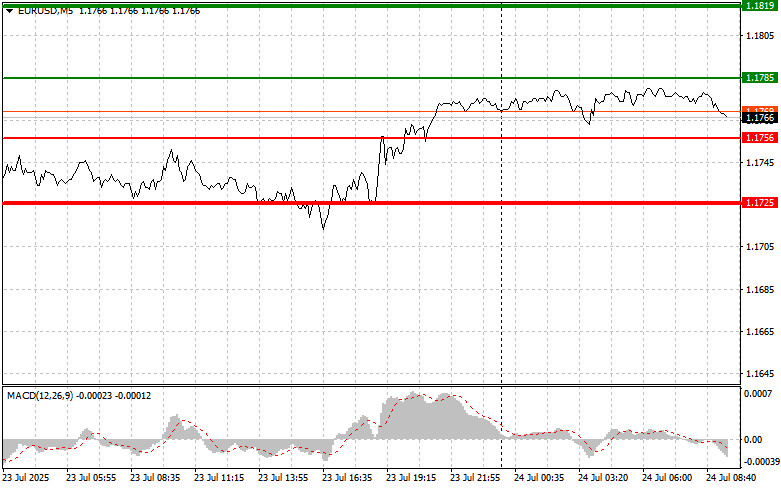

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: Today, I plan to buy the euro around the 1.1785 level (indicated by the green line on the chart) with a target of 1.1819. At 1.1819, I intend to exit the market and sell the euro in the opposite direction, aiming for a 30–35 point move from the entry level. A continuation of the current upward trend supports the idea of further growth.

Important: Before entering a long position, ensure the MACD indicator is above the zero line and is just starting to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1756 level while the MACD is in the oversold area. This would limit the pair's downside potential and lead to a market reversal upward. A rise toward 1.1785 and 1.1819 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro once it reaches 1.1756 (indicated by the red line on the chart). The target will be 1.1725, where I will exit and buy the euro in the opposite direction, aiming for a 20–25 point rebound. Downward pressure on the pair is expected to return after the ECB meeting.

Important: Before entering a short position, ensure the MACD is below the zero line and is just starting to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1785 level while MACD is in the overbought area. This would limit the pair's upside potential and lead to a downward reversal. A drop toward 1.1756 and 1.1725 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.