Analysis of Trades and Trading Tips for the Euro

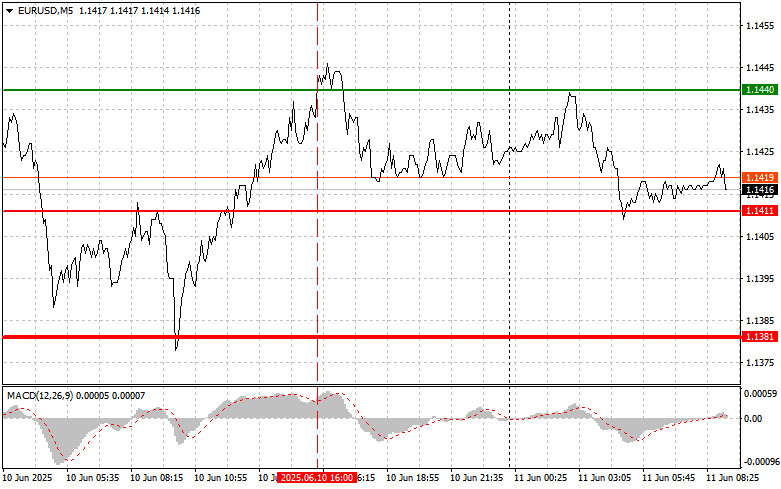

The test of the 1.1440 level occurred when the MACD indicator had already risen significantly above the zero line, which limited the pair's upside potential. For this reason, I did not buy the euro.

There has been progress in the trade negotiations between China and the United States: yesterday, both sides stated that consensus had been reached on the main issues. This breakthrough, the result of several months of intense discussions, gives hope for the stabilization of global financial markets. Though not disclosed in detail, the agreements likely included key issues such as the export of rare earth materials from China to the U.S. and the export of technology from the U.S. to China. Nevertheless, despite the optimistic statements, analysts advise against excessive enthusiasm. Previous negotiation rounds also ended with promises that were later unfulfilled. The key to success will be both sides' ability to honor their commitments and show willingness for further concessions. The impact of this progress on the global economy is hard to overestimate. Reducing trade tensions could stimulate the growth of international trade, ease inflationary pressures, and bolster consumer confidence. However, risks remain, and the agreement's long-term outcome will depend on both countries' subsequent actions.

Today, we should pay attention to the speech by Philip Lane, a European Central Bank representative, as there are no macroeconomic releases from the eurozone. Markets will closely monitor his rhetoric for hints regarding the central bank's plans on interest rates. Investors hope to hear more clarity from Lane about how the ECB intends to proceed with rates and whether the regulator plans further cuts this summer. Overall, Philip Lane's speech will be the key event of the day for financial markets. His comments may influence currency movements in the first half of the day. Investors are advised to watch his remarks closely and consider them in decision-making.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

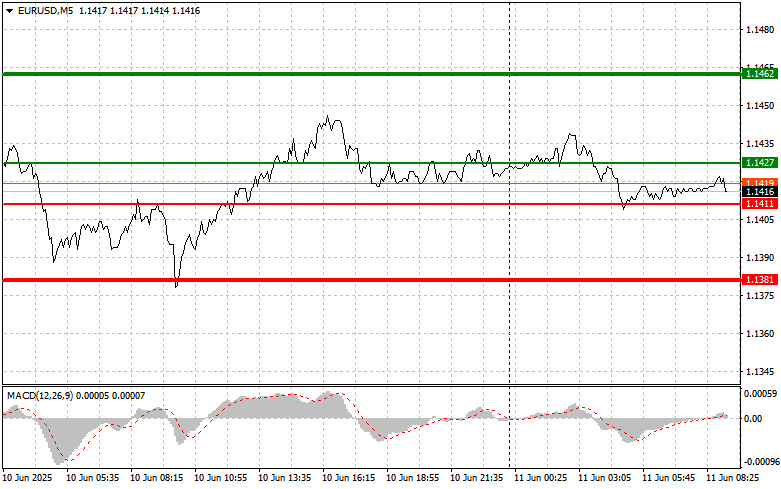

Scenario #1: Buy the euro today at 1.1427 (green line on the chart) with a target of 1.1462. At 1.1462, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35 pip move from the entry point. Euro growth is expected within the current uptrend.

Important: Before buying, ensure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: We plan to buy the euro in case of two consecutive tests of the 1.1411 level while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and trigger an upward market reversal—expected targets: 1.1427 and 1.1462.

Sell Scenario

Scenario #1: Plan to sell the euro after the price reaches 1.1411 (red line on the chart). The target is 1.1381, where I plan to exit the market and immediately buy in the opposite direction, targeting a 20–25 pip rebound from that level. If buyers fail to hold near the daily highs, downward pressure may return today.

Important: Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: Also planning to sell the euro if the price tests the 1.1427 level twice in a row while the MACD is in the overbought zone. This would limit the pair's upside potential and cause a downward market reversal—expected targets: 1.1411 and 1.1381.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.