The GBP/USD currency pair showed no interesting movements on Monday. However, given the current situation in the U.S., it's hard to envision any growth for the dollar. It turns out that economic decline, the trade war, deteriorating relations with many countries (including allies), questionable decisions regarding international agreements and organizations, the "One Big Beautiful Bill," and failure to mediate between Ukraine and Russia were merely the starting points. These issues were just the initial signs of trouble that impacted many people, but not as severely and brutally as the current events.

Mass protests have erupted in several U.S. cities. America is a country of immigrants—this is widely known and has always been the case. The Biden administration, like previous administrations, took a liberal stance on immigration, fully understanding that illegal immigration exists in every country. People always seek better living conditions. And America used to look very attractive. In the past.

Trump decided to correct this "oversight" and moved to deport all immigrants—both legal and illegal. He has no legal basis for such actions. He hasn't received approval from the U.S. Congress or individual state governors. Thus, Trump again made a unilateral decision that contradicts the U.S. Constitution.

Recall that a couple of weeks ago, twelve Democratic governors filed a lawsuit against Trump in the International Trade Court. Understandably, only Democrats did so, as Republicans fear that any dissenting word or disagreement with the president's stance will lead to resignation or at least serious problems. Trump threatens not only foreign nations but also Elon Musk, who invested hundreds of millions in his campaign. For Trump, Democrats are like a red flag to a bull.

California Governor Gavin Newsom has filed a new lawsuit against Trump. Newsom claims that Trump had no right to deploy the National Guard to disperse protests in Los Angeles. According to Newsom, the U.S. Department of Defense (which dispatched troops) was required to coordinate its actions with the state governor, which didn't happen. Newsom expressed confidence in winning the case and accused Trump of trying to federalize the National Guard—essentially, take control of it. Newsom added that he personally supports peaceful protesters, while Trump is imposing a totalitarian regime where dissent is met with repression. "Protest is the foundation of democracy. Right now, people must take to the streets and voice their opinion," said the California governor.

Recall that on June 6, mass raids by U.S. Immigration and Customs Enforcement began in Los Angeles, where more than 80% of the population are immigrants from Latin America. Trump ordered over 2,000 National Guard troops to suppress the protests.

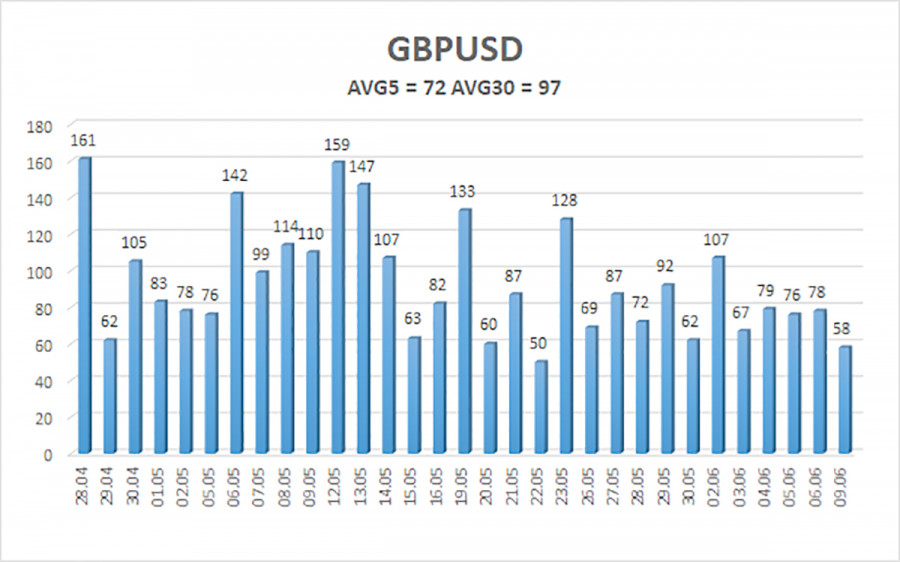

The average volatility for the GBP/USD pair over the last five trading days is 72 pips, which is classified as "moderate." Therefore, on Tuesday, June 10, we expect movement within the range bounded by 1.3491 and 1.3635. The long-term regression channel is pointed upward, which indicates a clear upward trend. The CCI indicator has not entered extreme zones recently.

Nearest Support Levels:

S1 – 1.3550

S2 – 1.3428

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3672

R2 – 1.3794

R3 – 1.3916

Trading Recommendations:

The GBP/USD pair maintains an upward trend and continues to rise. And there is plenty of news to support this movement. The de-escalation of the trade conflict began and ended quickly, but market aversion toward the dollar remains. Every new Trump decision or related event is perceived negatively by the market. Thus, long positions are possible with targets at 1.3635 and 1.3672 if the price is above the moving average. Consolidation below the moving average line allows for considering shorts with targets at 1.3491 and 1.3428, but who currently expects strong dollar growth? From time to time, the U.S. dollar may show minor corrections. Real signs of de-escalation in the global trade war are needed for sustained growth.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.