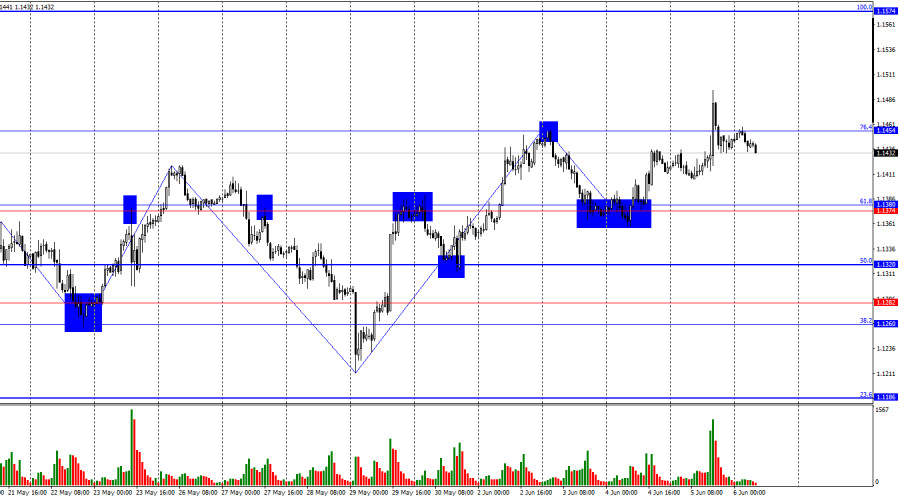

On Thursday, the EUR/USD pair continued its upward movement but made two rebounds from the 76.4% corrective level at 1.1454, suggesting a potential reversal in favor of the U.S. dollar and some decline toward the support zone at 1.1374–1.1380. A consolidation above 1.1454 would increase the likelihood of further growth toward the next Fibonacci correction level at 1.1574.

The wave situation on the hourly chart remains clear. The last completed downward wave did not break the previous low, while the last upward wave broke the previous high. Thus, the trend remains "bullish" for now. Recent news about a possible increase in tariffs on steel and aluminum has once again forced the bears to retreat.

The news background on Thursday offered certain opportunities for the bears, but they failed to take advantage. The ECB held another meeting in 2025, and almost unanimously decided to lower interest rates by 0.25%. This was the eighth decision to ease monetary policy. Thus, the bears had a chance to go on the offensive, but this time traders were dissatisfied with the tone of Christine Lagarde, who stated at the press conference that policy easing is likely complete or close to completion. Effectively, Lagarde did not "close the door" to future rate cuts but noted that inflation has returned to target levels and the current rate level is appropriate. Therefore, in the future, the regulator may decide on further easing, but it will depend on economic data. If the data reflects a decline in inflation below the target level, rates may be cut again. Traders likely expected 1–2 more rounds of easing, but this reason for the euro's rise looks more like an excuse. In fact, the market continues to sell off the U.S. dollar for quite understandable reasons, and the ECB meeting was merely a trigger for traders on Thursday.

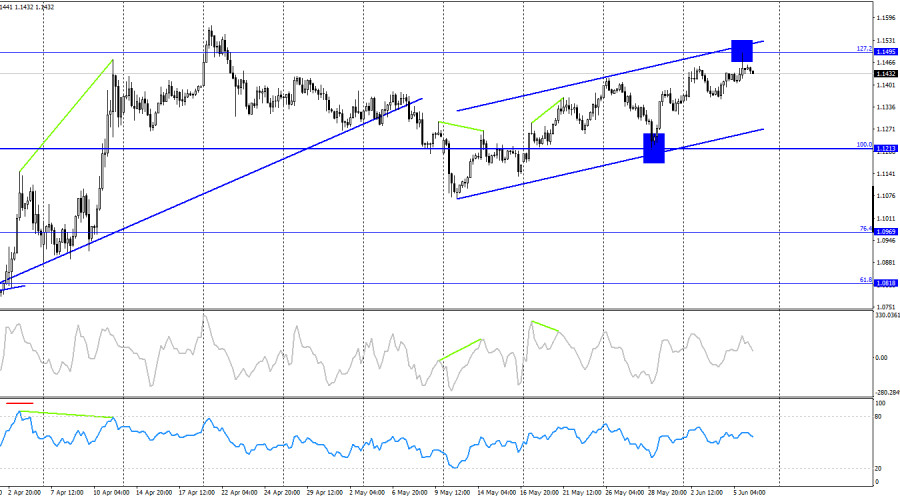

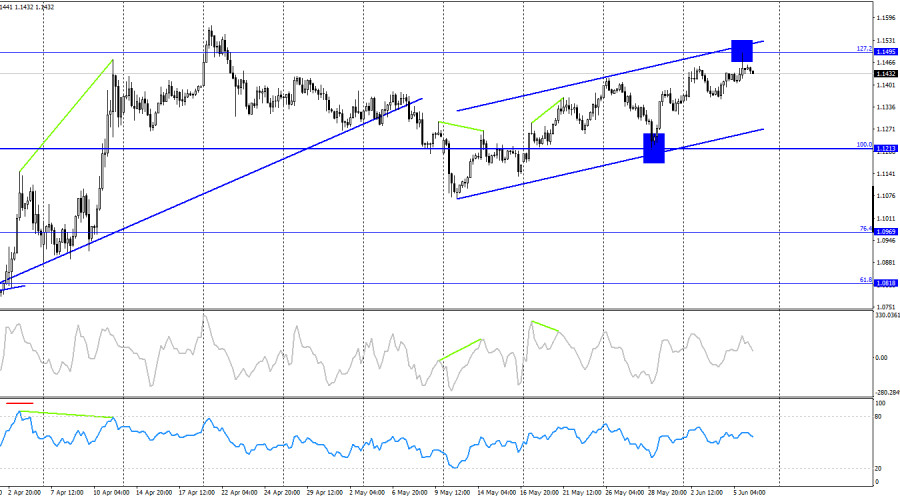

On the 4-hour chart, the pair rose toward the 127.2% Fibonacci corrective level at 1.1495. A rebound from this level would favor the U.S. dollar and some decline toward the 100.0% Fibonacci level at 1.1213. A consolidation above 1.1495 would increase the likelihood of continued growth toward the 161.8% Fibonacci level at 1.1851. No divergences are forming on any indicator. The trend channel still signals the continuation of the "bullish" trend.

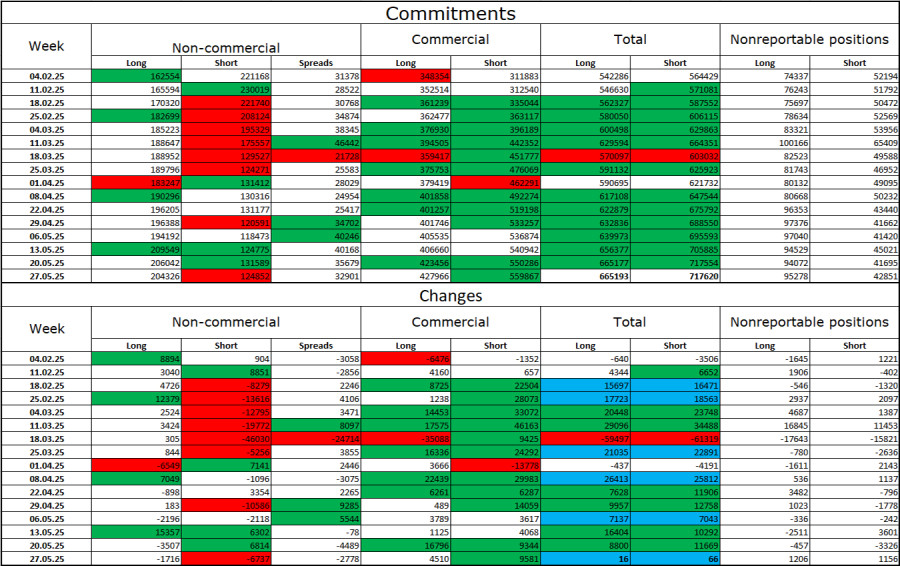

Commitments of Traders (COT) Report:

During the last reporting week, professional traders closed 1,716 long positions and 6,737 short positions. The sentiment of the "Non-commercial" group remains "bullish" thanks to Donald Trump. The total number of long positions held by speculators now stands at 204,000, while short positions stand at 124,000, and the gap (with rare exceptions) continues to widen. Thus, the euro remains in demand, while the dollar does not. The situation remains unchanged.

For seventeen consecutive weeks, large traders have been reducing their short positions and increasing their long positions. The difference in monetary policy approaches between the ECB and the Fed is skewed in favor of an expanding rate differential, which still supports the U.S. dollar, but Donald Trump's policies remain a stronger factor for traders, as they could lead to a recession in the U.S. economy and many other long-term structural issues.

News Calendar for the U.S. and the Eurozone:

- Eurozone – Germany Industrial Production Change (06:00 UTC)

- Eurozone – Retail Sales Change (09:00 UTC)

- Eurozone – GDP Change for Q1 (09:00 UTC)

- U.S. – Nonfarm Payrolls Change (12:30 UTC)

- U.S. – Unemployment Rate (12:30 UTC)

- U.S. – Average Hourly Earnings Change (12:30 UTC)

On June 6, the economic events calendar includes quite a few important entries. Particular attention will be paid to the U.S. labor market and unemployment reports. The influence of the news background on market sentiment could be strong on Friday.

EUR/USD Forecast and Trading Tips:

Sales of the pair were possible on a rebound from the 1.1454 level with targets at 1.1374–1.1380 and 1.1320. I recommended buying on a rebound from the 1.1320 level on the hourly chart with a target at 1.1374–1.1380. This target has been reached. New purchases are possible if the pair consolidates above the 1.1374–1.1380 zone with a target at 1.1454 or on a new rebound from the 1.1374–1.1380 zone.

Fibonacci grids are built between 1.1574–1.1066 on the hourly chart and 1.1214–1.0179 on the 4-hour chart.