Trade Review and Tips for Trading the Japanese Yen

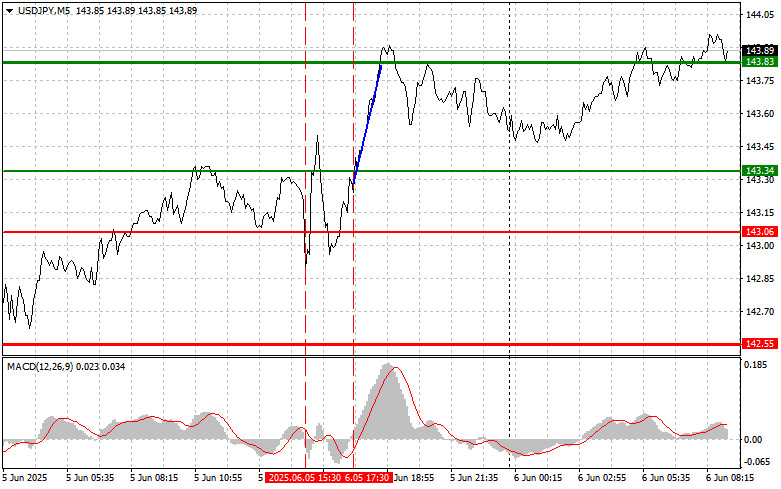

The price test at 143.34 coincided with the moment when the MACD indicator had just started moving up from the zero mark, confirming a correct entry point for buying the dollar. As a result, the pair rose to the target area around 143.83.

Despite all attempts by yen buyers to regain control of the market, the U.S. dollar demonstrated growth in the second half of the day, maintaining its chances for a more significant upward correction after today's U.S. labor market statistics.

Today's weak data on changes in Japanese household spending and the leading economic indicators index, which also came in below expectations, pressured the yen during Asian trading. The decline in consumer spending signals ongoing uncertainty among Japanese households about the future, restraining economic growth. The drop in the leading indicators index points to a possible deterioration in economic conditions in the coming months.

The negative data have increased speculation that the Bank of Japan may maintain its cautious monetary policy longer than previously expected. This, in turn, reduces the yen's attractiveness for investors seeking higher returns in other currencies. Japan's worsening economic outlook is unfolding against a backdrop of global uncertainty fueled by geopolitical tensions and recession risks in the U.S. Under these conditions, investors are shifting toward safer assets, which traditionally included the yen — though it is losing its haven status due to Japan's weak economic backdrop.

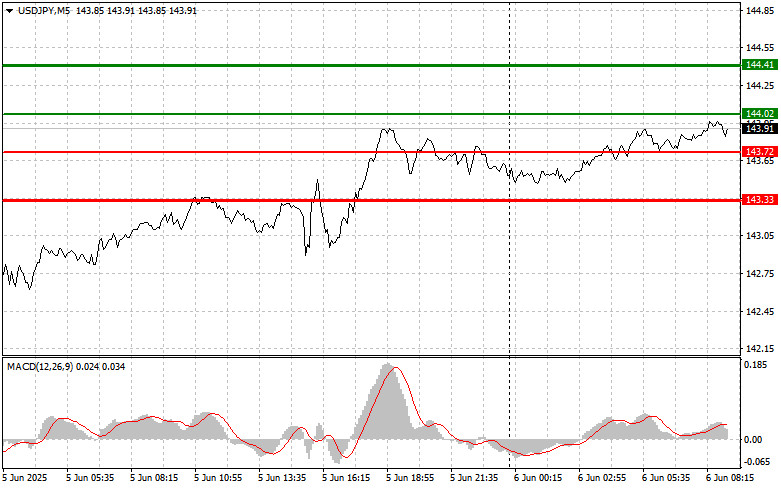

As for the intraday strategy, I will mainly rely on the implementation of Scenarios #1 and #2.

Buy Scenarios

Scenario #1: Today, I plan to buy USD/JPY upon reaching the entry point around 144.02 (green line on the chart) with a target at 144.41 (thicker green line on the chart). Around 144.41, I plan to exit long positions and open short positions in the opposite direction (targeting a movement of 30–35 points in the opposite direction). It is best to return to buying the pair during corrections and significant pullbacks. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of 143.72 while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and could trigger a reversal upward. A rise to the opposite levels of 144.02 and 144.41 can be expected.

Sell Scenarios

Scenario #1: Today, I plan to sell USD/JPY only after breaking below 143.72 (red line on the chart), which would likely lead to a rapid decline of the pair. The main target for sellers will be 143.33, where I plan to exit short positions and immediately consider buying in the opposite direction (aiming for a 20–25 point reversal). Selling pressure on the pair could return quickly today. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of 144.02 while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and could trigger a reversal downward. A decline to the opposite levels of 143.72 and 143.33 can be expected.

What's on the chart:

- Thin green line – the entry price for buying the trading instrument.

- Thick green line – the estimated price for setting a Take Profit or manually closing profits, as further growth above this level is unlikely.

- Thin red line – the entry price for selling the trading instrument.

- Thick red line – the estimated price for setting a Take Profit or manually closing profits, as further decline below this level is unlikely.

- MACD Indicator – it's important to use the overbought and oversold zones when entering the market.

Important: Beginner traders in the Forex market should make entry decisions very carefully. It's best to stay out of the market before major fundamental reports are released to avoid being caught in sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Spontaneous decision-making based on the current market situation is inherently a losing strategy for an intraday trader.