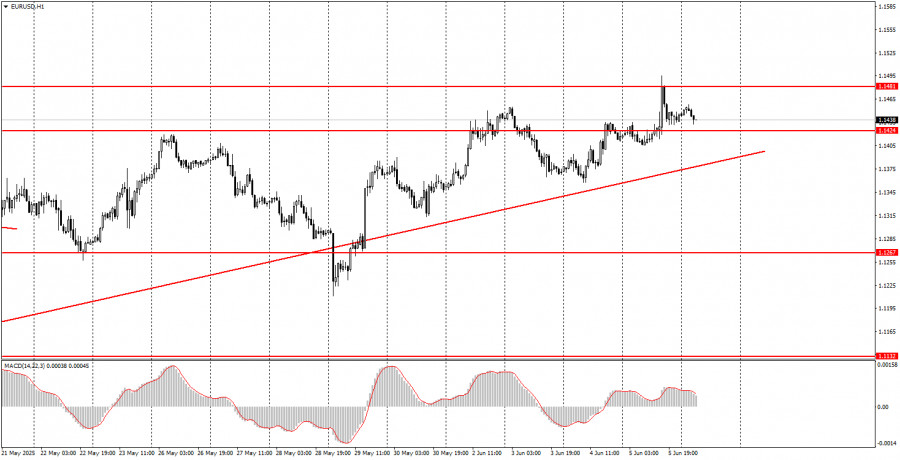

Thursday Trade Analysis:EUR/USD 1H Chart.

The EUR/USD currency pair continued its upward movement on Thursday, in line with the current trend. There were no reasons for a new "rally" of the European currency. The only major event on Thursday was the ECB meeting. It was right after this that the euro experienced quite a strong rise, although it eventually ended with a decline. However, the euro initially rose — once again without any cause or justification. The ECB decided to lower all three key rates for the eighth time, and Christine Lagarde did not give a single hint that the cycle of monetary policy easing was coming to an end. According to her, inflation has been defeated, economic growth rates won't decline due to Donald Trump's tariff policy, but at the same time, her statements implied that rates could continue to be lowered, as inflation could fall to an average of 1.6% in 2026, which is very low. In general, if the euro had fallen yesterday, it would have been logical and expected. But the euro rose again.

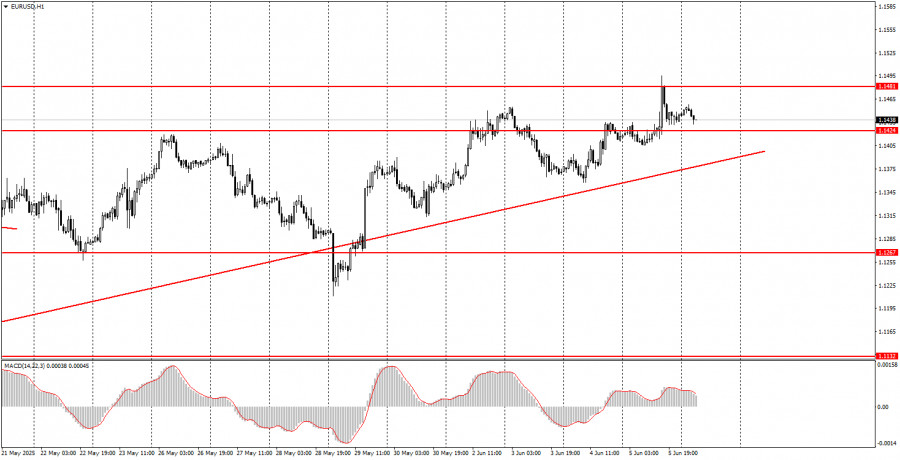

EUR/USD 5M Chart.

In the 5-minute time frame on Thursday, several trading signals were formed, but due to the ECB meeting, the price movements were either very weak or too volatile. Therefore, the first buy signal, which took about six hours to form, was hardly worth acting upon. The buy signal near the 1.1474–1.1481 level appeared after the price had already risen by about 70 points — and in the context of the ECB's dovish decision. The sell signal near the same area could be acted upon since the euro's decline was much more logical than its rise.

How to Trade on Friday:In the hourly time frame, the EUR/USD pair broke the ascending trendline; however, the upward trend that began during Donald Trump's presidency remains intact. Basically, for the USD to keep falling regularly, it's enough that Trump is the president. For the market, this is already a significant reason to flee from the dollar without looking back. If Trump continues to threaten, issue ultimatums, and introduce/increase tariffs, the market will have few alternatives. Trump's tariffs haven't been repealed, and negotiations with China and the EU are once again stalling, so the trade war situation has not improved.

On Friday, the EUR/USD pair can move in any direction, as the market mood will depend on U.S. macroeconomic statistics. If the data turns out weak, the market will gladly continue to sell off the dollar.

On the 5-minute time frame, consider the levels 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. On Friday, the EU will release reports on retail sales and Q1 GDP, but these data are not the most crucial. Much more attention will be paid to the U.S. NonFarm Payrolls and unemployment rate reports.

Main Rules of the Trading System:

- The signal's strength is determined by how quickly it forms (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more false signals form around the same level, further signals from that level should be ignored.

- In a flat market, any pair may produce many false signals or none at all. In any case, it's better to stop trading at the first signs of flat.

- Trading transactions are opened between the start of the European session and the middle of the American session, after which all positions should be closed manually.

- On the hourly time frame, it's preferable to trade MACD signals only with good volatility and a confirmed trend supported by a trendline or trend channel.

- If two levels are too close (5 to 20 points apart), treat them as a support or resistance area.

- After a 15-point move in the correct direction, set the Stop Loss to breakeven.

What's on the Charts:

- Support and resistance levels — target levels for opening buy or sell trades. You can set Take Profit near these levels.

- Red lines — channels or trendlines that show the current trend and the preferred trading direction.

- MACD (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used for generating signals.

- Important speeches and reports (always listed in the news calendar) can significantly influence currency pair movements. Therefore, during their release, trade with extreme caution or exit the market to avoid sharp reversals against the previous trend.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and money management are key to long-term success in trading.