Analysis of Wednesday's Trades

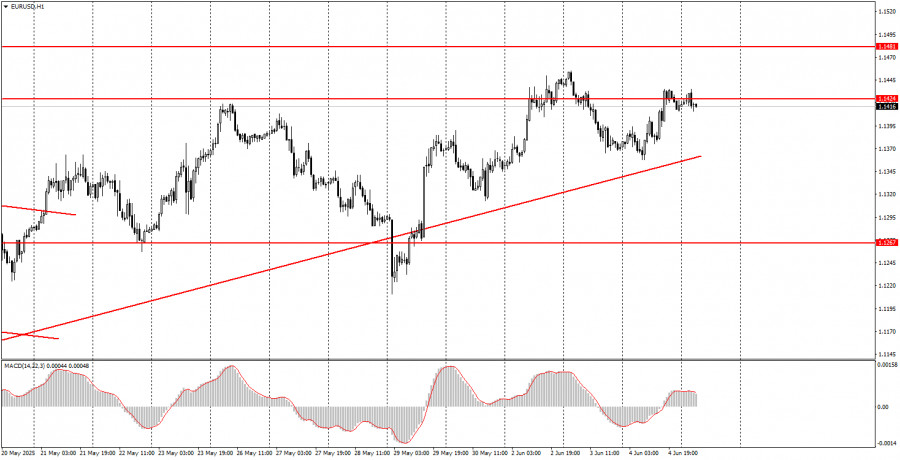

1H Chart of EUR/USD

On Wednesday, the EUR/USD currency pair traded with low volatility and an upward bias. We anticipated that the macroeconomic background would not significantly impact the pair's movements, but it turned out that almost all the published reports ended up supporting anything but the dollar. The Eurozone Services PMI for May came in at 49.7 points, higher than forecast. The US ISM Services PMI printed at 49.9 points, below expectations. The ADP report showed only 37,000 new jobs created versus the expected 115,000. Thus, given the market's persistent desire to dump the US dollar, the dollar's decline happened once again easily and effortlessly. Even if the US data had been stronger than forecast, we highly doubt the dollar would have been able to grow. The problem remains the same: the market doesn't want to buy the US currency under Donald Trump's current trade policy, which is expected to have devastating long-term effects on the economy.

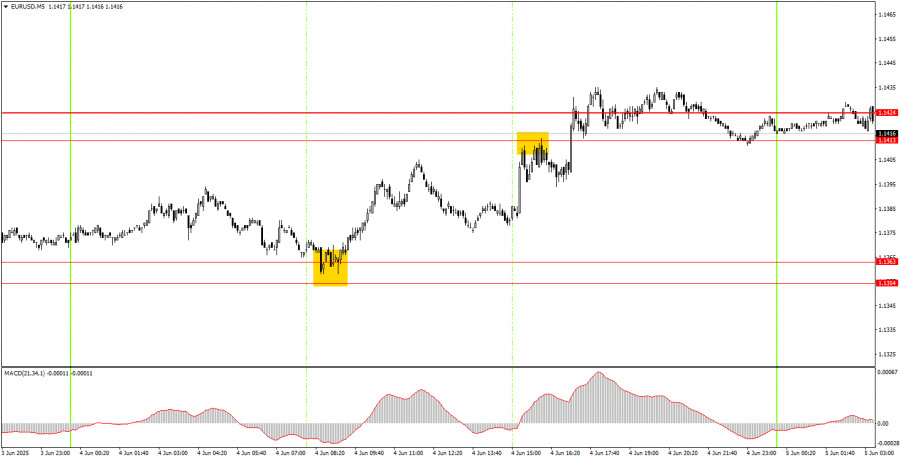

5M Chart of EUR/USD

On the 5-minute timeframe on Wednesday, a decent buy signal was formed around the 1.1354–1.1363 area. Novice traders could have opened long positions based on it. At the start of the US session, the price reached the nearest target zone of 1.1413–1.1424 and bounced from it. Thus, longs could have been closed with a profit, and shorts could have been opened. Unfortunately, the sell signal proved false, and concurrently, weak American reports were released. Consequently, prioritizing short positions was not feasible.

Trading Strategy for Thursday:

In the 1-hour timeframe, EUR/USD has breached the ascending trendline, but the overall uptrend that started during Trump's presidency remains intact. At this point, it's enough for the market that Trump is president for the dollar to keep falling. That's a solid reason for the market to flee the dollar without hesitation. If Trump continues to threaten, set ultimatums, and impose or raise tariffs, the market will have few alternatives. The failure to repeal Trump's tariffs and the stalled negotiations with China and the EU means the trade war situation has not improved.

On Thursday, EUR/USD can move in either direction since Trump's tariff hikes have already been priced in. The European Central Bank meeting will occur today, and its market reaction is impossible to predict.

On the 5-minute timeframe, consider the following levels: 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. On Thursday, the ECB will announce the results of its latest meeting. Since rates are expected to be cut again, in theory, the euro could weaken today. However, it's important to remember that the market still seems unwilling to buy the dollar.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.