Trade Review and Tips for Trading the British Pound

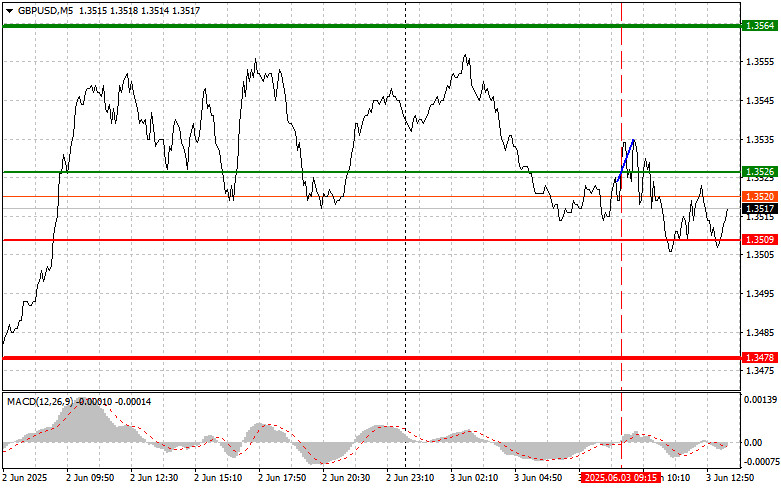

The price test at 1.3526 in the first half of the day occurred when the MACD indicator had just started to move upward from the zero mark, confirming a proper entry point for buying the pound. However, the pair did not achieve significant growth.

Only reports from the U.S. Bureau of Labor Statistics on job openings and labor turnover (JOLTS), and changes in factory orders exceeding expectations, can put pressure on the pair and lead to a fall in the British pound. Investors, trying to predict the next moves of the Federal Reserve, carefully analyze every published indicator, looking for hints of possible monetary policy adjustments. The JOLTS reports, reflecting labor market dynamics, and factory orders data, indicating industrial sector activity, will surely not go unnoticed by traders. Above-forecast figures in these reports could spark a surge of optimism, strengthen the U.S. dollar, and trigger a sell-off in risk assets.

It's also important not to overlook speeches by Austan D. Goolsbee and Lorie K. Logan, members of the Federal Open Market Committee (FOMC). Historically, FOMC representatives' speeches significantly impact market sentiment, provided they touch on monetary policy. Their remarks are carefully analyzed for hidden hints about potential interest rate adjustments, quantitative easing programs, or other instruments used by the Fed to regulate the economy.

As for the intraday strategy, I will rely mainly on the execution of scenarios #1 and #2.

Buy Signal

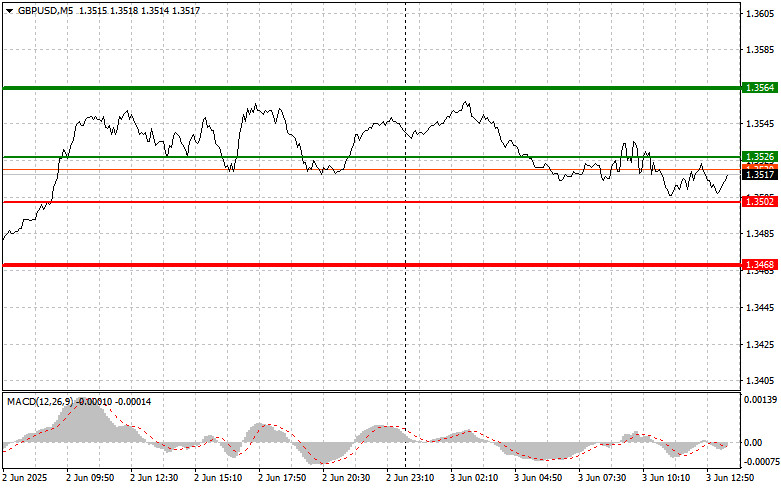

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3526 (green line on the chart), targeting growth to the 1.3564 level (thicker green line on the chart). Around 1.3564, I plan to exit long positions and open short positions in the opposite direction (targeting a 30–35 point move downward). Pound growth today can be expected after weak U.S. data.Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3502 level while the MACD is in oversold territory. This will limit the pair's downward potential and lead to a market reversal upward. Growth toward the opposite levels of 1.3526 and 1.3564 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.3502 level (red line on the chart) is updated, which should lead to a quick drop in the pair. The key target for sellers will be the 1.3468 level, where I plan to exit short positions and immediately open long positions in the opposite direction (targeting a 20–25 point upward move). Sellers are unlikely to show significant strength today.Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning to fall from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3526 level while the MACD is in overbought territory. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.3502 and 1.3468 can be expected.

What's on the Chart:

- Thin green line – the entry price where you can buy the trading instrument;

- Thick green line – the estimated price where you can set Take Profit or manually lock in profits, as further growth above this level is unlikely;

- Thin red line – the entry price where you can sell the trading instrument;

- Thick red line – the estimated price where you can set Take Profit or manually lock in profits, as further decline below this level is unlikely;

- MACD Indicator – It's important to follow the overbought and oversold areas when entering the market.

Important Notes

Beginner Forex traders must be very cautious when making trading decisions. It is best to stay out of the market before the release of major fundamental reports to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not practice proper money management and trade with large volumes.

And remember, successful trading requires having a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for intraday traders.