Analysis of Trades and Trading Tips for the Euro

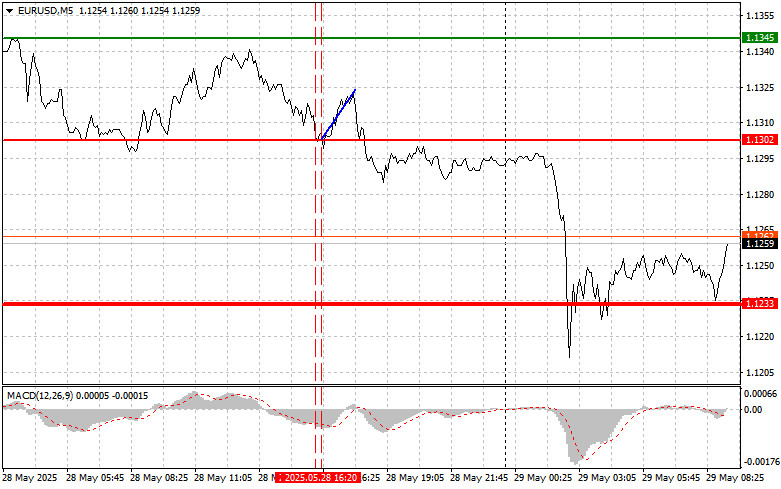

The first test of the 1.1302 price level in the second half of the day occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downside potential. For this reason, I did not sell the euro. The second test of 1.1302 occurred while the MACD was in the oversold area, which allowed Scenario #2 for buying to be realized and resulted in a 20-pip rise in the pair.

The news that the U.S. Federal Trade Court had annulled the global reciprocal tariffs introduced by Trump and ordered the administration to cease their application triggered a sharp drop in the euro and strengthened the U.S. dollar. Investors interpreted this decision as a sign of easing trade tensions and a return to a more predictable economic strategy. The court ruling followed lengthy legal proceedings. It is expected that the removal of tariffs will reduce the cost of imported goods and improve export opportunities. At the same time, lifting tariffs may also have negative consequences for American industries that were previously protected from foreign competition. A stronger dollar could also negatively impact U.S. exports by making them less price-competitive for foreign consumers.

With no significant economic data expected in the eurozone this morning, the EUR/USD pair may have an opportunity for a slight rebound. The absence of notable macroeconomic events during this period may offer traders a brief respite. It's possible that, in the absence of significant economic releases, the market will continue to focus on the tariff situation. Any comments from Trump regarding this issue could increase volatility and put additional pressure on the euro.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

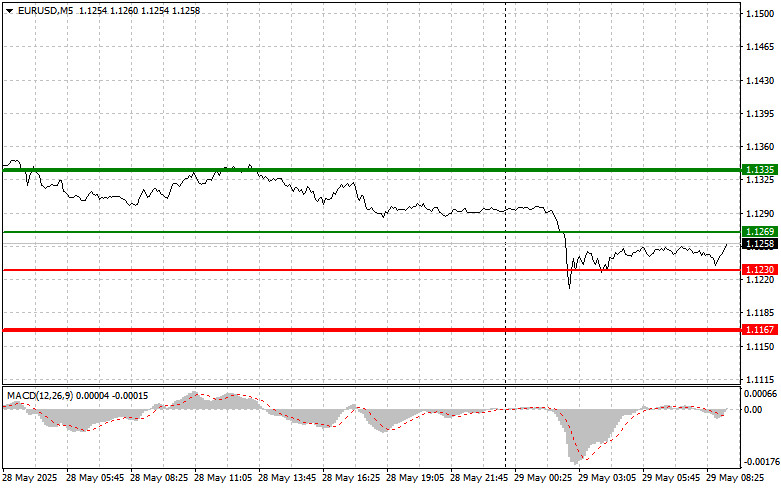

Scenario #1: Today, I plan to buy the euro upon reaching the 1.1269 area (green line on the chart) with a target of rising to 1.1335. At 1.1335, I plan to exit the market and sell the euro in the opposite direction, expecting a 30–35 pip move from the entry level. A euro rise should only be considered as part of a correction.

Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the euro today if the price level of 1.1230 is tested twice consecutively while the MACD is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. A rise toward the opposite levels of 1.1269 and 1.1335 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after it reaches the 1.1230 level (red line on the chart). The target will be 1.1167, where I plan to exit the market and buy immediately in the opposite direction (expecting a 20–25 pip move back from the level). Strong pressure on the pair may return at any moment today.

Important! Before selling, make sure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the euro today if the pair tests the 1.1269 level twice consecutively while the MACD is overbought area. This will limit the pair's upside potential and lead to a downward reversal. A decline toward the opposite levels of 1.1230 and 1.1167 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.