GBP/USD 5-Minute Analysis

On Tuesday, the GBP/USD currency pair traded very differently from the EUR/USD pair, which is rare. The British pound rose not only on Monday evening but throughout the night and most of Tuesday. What caused this divergence between the two major currencies? In our opinion, it's a technical issue. The euro encountered a key level at 1.1615, above which it would be difficult to appreciate further—at least without new shocking news from across the Atlantic. Formally, the pound also had such a level—1.3615. However, it had to cover more ground than the euro to reach and bounce off this level. Therefore, the British pound simply caught up with the euro.

The fundamental and macroeconomic background was nearly identical for both currency pairs. Andrew Bailey's speech offered no new information, neither did Jerome Powell's. Let's recall that the Bank of England and the Federal Reserve had their meetings just last week, so no new announcements could be expected so soon—it's simply too early. Now, both currency pairs must overcome the technical barriers holding back further growth. We believe it's only a matter of time.

In the hourly timeframe, the technical picture resembles a resumption of the 5-month trend, but the possibility of a sideways movement remains, as seen on the 4-hour chart. Therefore, everything now depends on the 1.3615 level.

On the 5-minute timeframe, a great buy signal was formed near the 1.3537 level yesterday, but it appeared during the Asian session. When the European session opened, the price had already moved 15 pips from the signal's formation point. Theoretically, a long trade could have been opened, but the entry point wasn't ideal. The pair continued to rise for most of the day and eventually reached the target level at 1.3637.

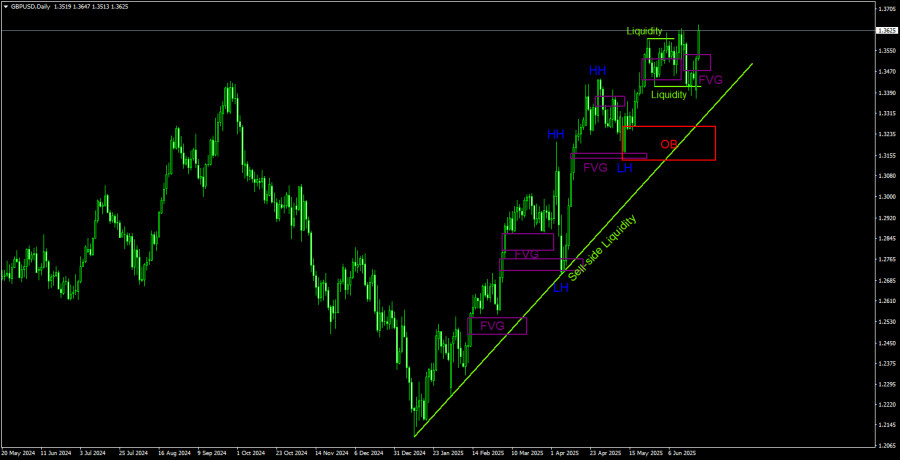

GBP/USD 1D Analysis – ICT

On the daily timeframe under the ICT system, we observe a strong upward trend that shows no signs of ending. The recent drop in the pair should not mislead traders; it was merely a liquidity grab before the next upward movement, and this is now quite clear. Therefore, the British pound may continue to rise—unless sideways movement on the 4-hour timeframe interferes. The "bearish" FVG was ignored on Tuesday and may now act as support for buyers, functioning as an IFVG. Thus, a return to this area, followed by a corresponding bounce, could signal the next upward move.

COT Report

COT reports for the British pound show that commercial traders' sentiment has fluctuated frequently in recent years. The red and blue lines, representing net positions of commercial and non-commercial traders, often intersect and usually hover near zero. They also remain close now, indicating an approximately equal number of long and short positions. However, over the past 18 months, the net position has been trending upward.

The dollar continues to weaken due to Donald Trump's policies, so the current interest of market makers in the pound isn't particularly relevant. If the global trade war begins to de-escalate, the U.S. dollar may have a chance to strengthen. According to the latest report on the British pound, the "Non-commercial" group opened 7,400 new long contracts and closed 9,000, resulting in a weekly net increase of 16,400 contracts—a notable shift.

The pound has risen sharply lately, but it's important to remember that the primary reason is Trump's policy agenda. Once that factor is neutralized, the dollar could start to gain again—but no one knows when that will happen. The dollar is still in the early stages of Trump's presidency. What further shocks await over the next four years?

GBP/USD 1-Hour Analysis

On the hourly timeframe, GBP/USD broke through the trendline but couldn't surpass the 1.3615 level. Thus, an upward trend has formed, but the chance of a sideways move remains on the 4-hour chart. A breakout above 1.3615, renewed escalation in the Middle East, or failed trade talks with China and the EU would make the U.S. dollar even less attractive to traders. We just need to wait for a breakout and consolidation above 1.3615. A bounce from the IFVG on the daily chart will also indicate a resumption of the upward movement.

Key Levels for Trading on June 25: 1.3125, 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537, 1.3615, 1.3741. Ichimoku Levels: Senkou Span B (1.3506) and Kijun-sen (1.3510) may also generate signals. A Stop Loss should be moved to breakeven once the price moves 20 pips in the desired direction. Ichimoku indicator lines may shift throughout the day, which should be considered when determining trade signals.

On Wednesday, no significant events are scheduled in the UK, while in the U.S., Powell is set to testify in Congress for a second time. As with the first appearance, we don't expect any new or significant information. However, the Middle East issue is far from over—especially after Tuesday's confusion.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.